With the news that the California Attorney General is suing Uber and Lyft for misclassifying workers as independent contractors, it made us ask: have Uber and Lyft been treating drivers like independent contractors, or have we been treated like employees all along? Senior RSG contributor Jay Cradeur answers this question in light of the coronavirus pandemic and unemployment benefits debacle.

This debate continues to rage on. Are Uber and Lyft drivers employees or are they independent contractors?

Several states have passed laws that indicate rideshare drivers are employees. However, Uber and Lyft have ignored these laws and move forward, business as usual. Whether or not this strategy will prevail remains to be seen – currently, California is suing Uber and Lyft for misclassifying workers.

During this pandemic, both Uber and Lyft have made some policy changes that have definitely added fuel to the fire for Employee classification. This article will take a fresh look at this ongoing debate: are drivers employees or independent contractors?

Quick links:

- California sues Uber and Lyft for misclassifying workers

- The latest coronavirus updates here

- What it’s like to be an Uber driver during the pandemic

- Stay up to date on all the latest unemployment information here

Background on How We Got to Where We Are Now

Both Uber and Lyft engage drivers as independent contractors (ICs). When I started to drive back in December 2015, I was well aware that I was an IC.

To this day, new drivers are brought on as ICs. Over the nearly four and a half years since then, in my opinion, both Uber and Lyft have demonstrated by their policy changes that drivers are treated more like employees than ICs.

Attorney Mark Potter weighed in on this:

“California law is clear on this issue, Uber & Lyft drivers are employees and are entitled to much more money. We have found that our driver/clients are entitled to more than double what Uber/Lyft paid.

Uber/Lyft have gotten away with it because drivers have to pursue in private arbitration rather than Court. The Attorney General is not subject to an arbitration clause and will finally get a ruling that will settle the issue once and for all.

Drivers should hire an attorney who will seek all the money they have been underpaid for the past 4 years.”

See what you are entitled to with the Potter Handy Damage Calculator.

Unfortunately, Uber and Lyft can’t have it both ways. For example, if I were a true IC, Uber and Lyft would not be able to determine my pay structure. I would be able to charge what I determine to be my fair market value.

Instead, over the past many years, I have seen my pay cut on several occasions. The per-mile and the per-minute rates have been adjusted leaving me with lower and lower pay.

Gone are the bonuses that many drivers counted on for additional revenue. Surge and Prime Time have also been adjusted down, further decimating the earning power of drivers.

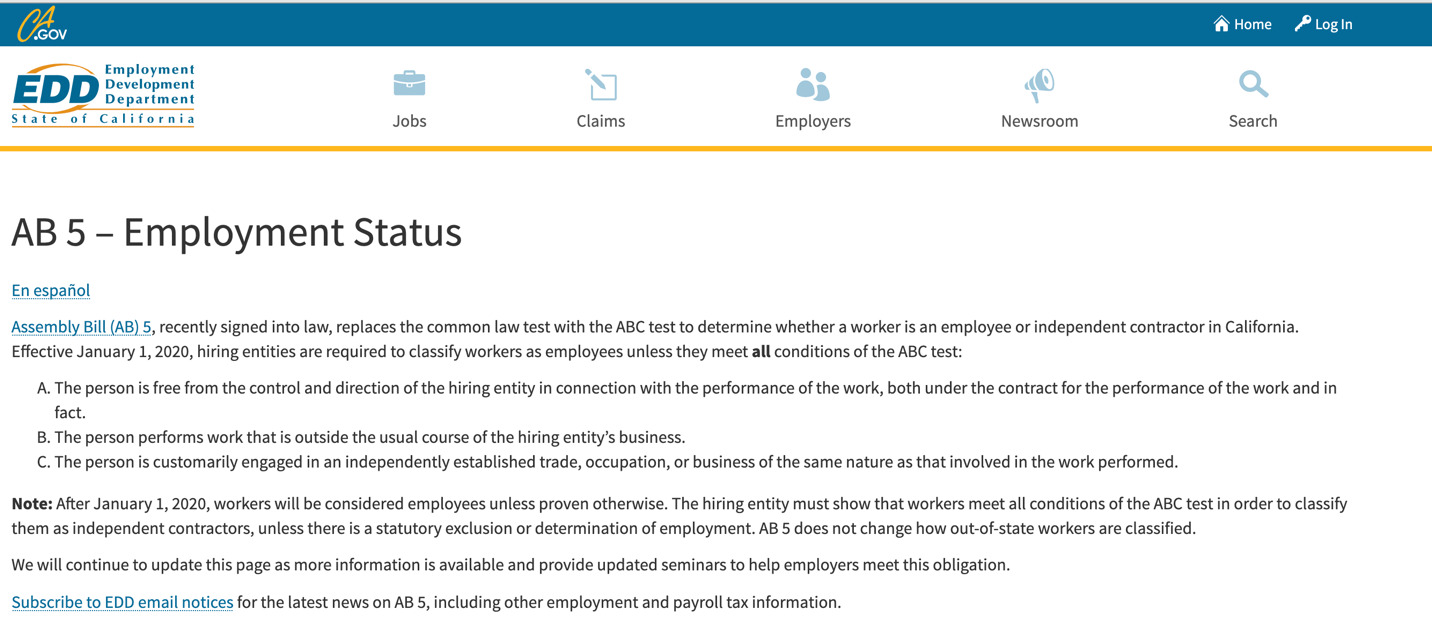

As a result of these rapidly declining conditions, many drivers have revolted. In much the way the labor movement began in 1794, drivers came together, and out of that movement we saw in California the passage of Assembly Bill 5 (AB5).

This law provides one must pass the ABC test in order to be considered an independent contractor:

AB5 says that:

AB5 says that:

- The worker is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact.

- The worker performs work that is outside the usual course of the hiring entity’s business.

- The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed.

As any rideshare driver can tell you, both A and B are impossible to pass. We are not free of the control of Uber and Lyft, and second, we perform the most essential of Uber and Lyft’s work, namely transporting people from point A to point B.

Regardless of the law, Uber and Lyft have continued to fight the law, ignore the law, and attempt to circumvent the law. What we now have is a situation that will most likely end up in court and be decided by a judge.

Why are Uber and Lyft so adamant about this? Money.

If all drivers are classified as employees, both companies would have to pay for things like unemployment benefits, overtime, vacation, medical benefits, and even sick pay. And this brings us up to our current situation.

How Would Uber and Lyft Drivers As Employees Handled COVID-19?

During the last three months, since the pandemic became apparent, Uber and Lyft drivers have struggled to receive unemployment benefits. Had the Coronavirus Aid Relief and Economic Security (CARES) Act not passed on March 27, rideshare drivers, gig workers, independent contractors would not have been entitled to any unemployment insurance (UI) benefits.

As it is, drivers have been strung out for months and are only now beginning to see some movement. States have been slow to adjust to ICs being added to the system.

If drivers were classified as employees, we would have been receiving money back in February, or whenever it was that you stopped driving. Both Uber and Lyft would have been contributing to the UI fund, and life would have been much simpler and abundant.

Instead, we are struggling, fighting tooth and nail to get our funds in our bank accounts.

If Drives Are Independent Contractors, Why Are Uber and Lyft Providing Sick Pay?

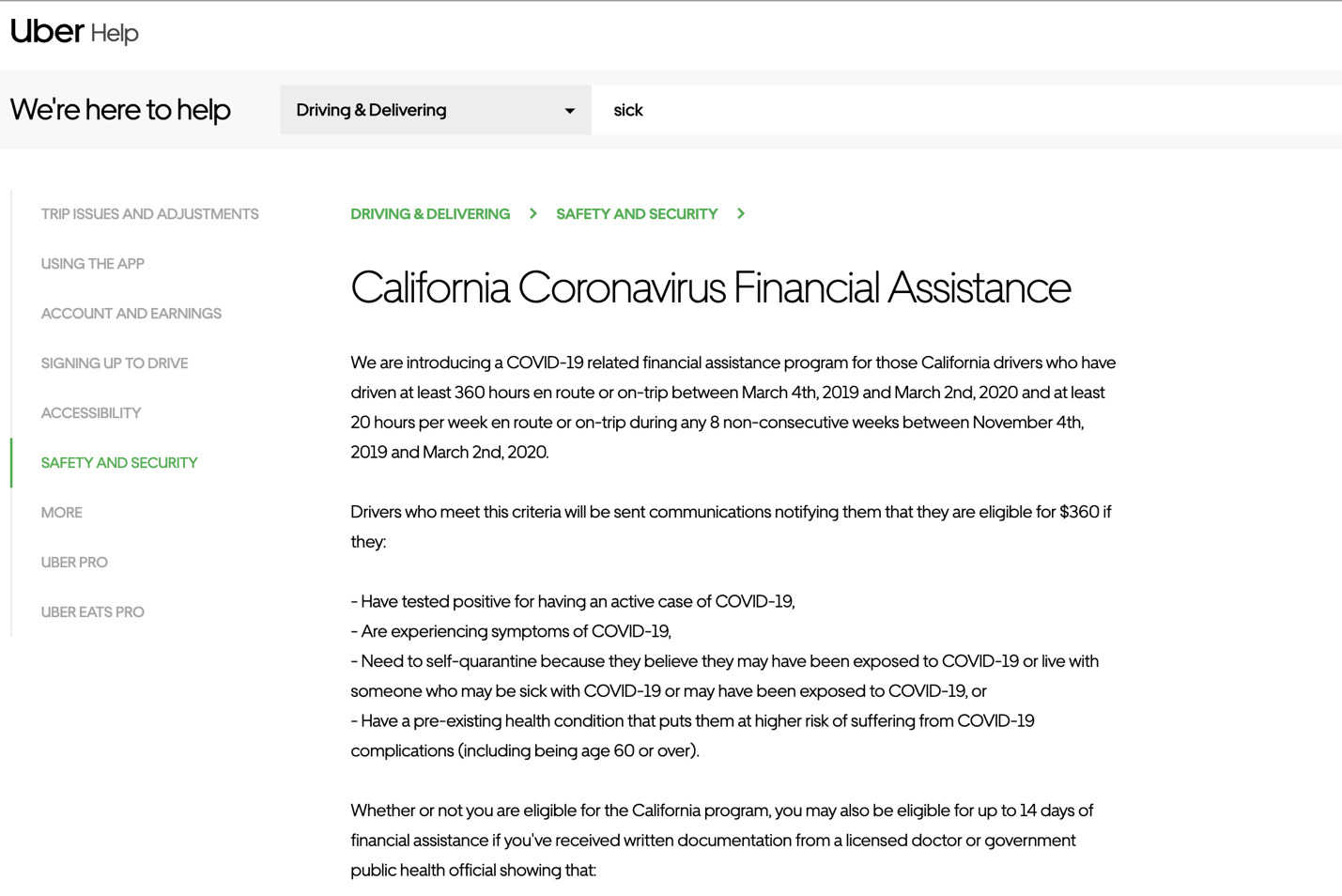

During our current pandemic, both Uber and Lyft have provided sick pay for drivers. That is odd, is it not? Even though it seems like the right thing to do.

Here are two companies that have vehemently opposed classifying drivers as employees, yet here they are offering sick pay for drivers.

Here is Uber’s policy:

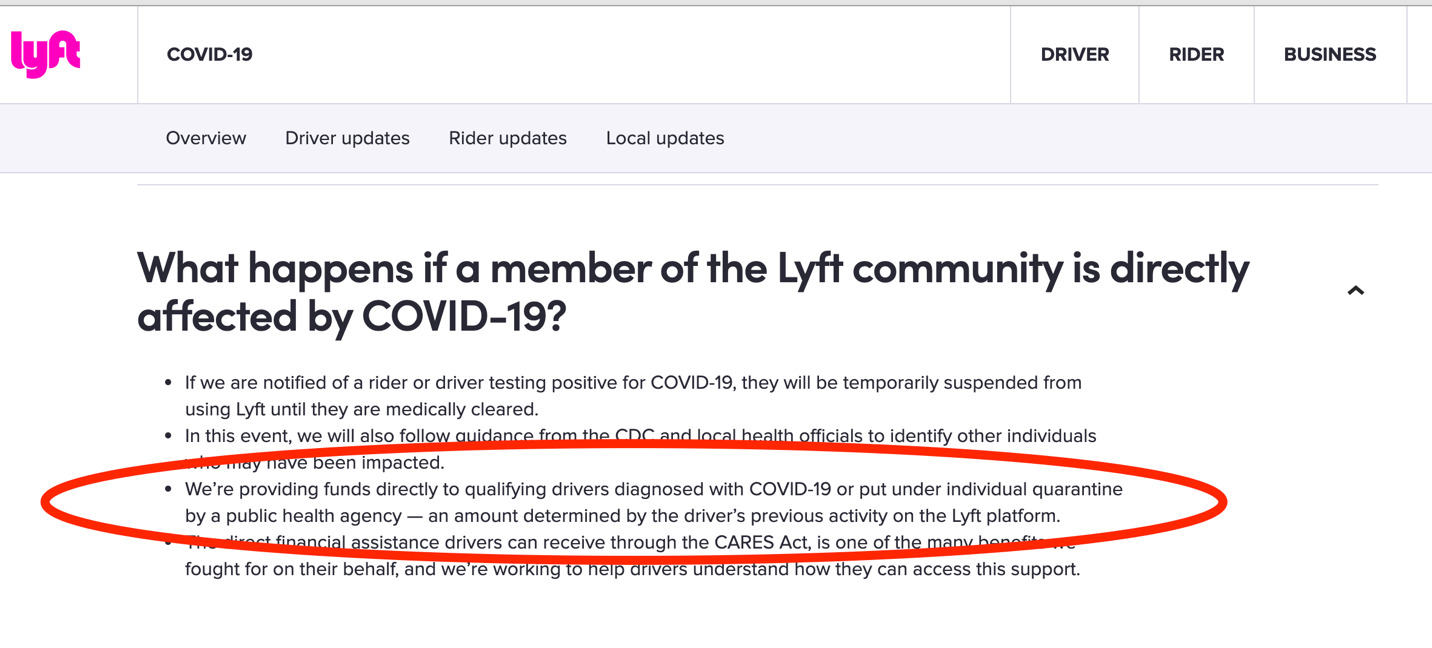

Lyft, on the other hand, is not nearly as transparent. When I did a search on Lyft’s website for “sick pay,” nothing came up. I had to search on their website to find this very noncommittal bullet point which does not have a link for more information.

Lyft, on the other hand, is not nearly as transparent. When I did a search on Lyft’s website for “sick pay,” nothing came up. I had to search on their website to find this very noncommittal bullet point which does not have a link for more information.

On the one hand, it would seem both companies are doing the right thing by offering some sick pay for their drivers who get sick or are in a high-risk category.

On the one hand, it would seem both companies are doing the right thing by offering some sick pay for their drivers who get sick or are in a high-risk category.

But I question their motives. Are they doing it because they want to help out their drivers? Or are they doing it because having a sick driver on the road infecting passengers would be a public relations nightmare?

It is better to pay some sick pay to get sick drivers off the road rather than risk a driver becoming newsworthy for infecting passengers. And for the drivers who stay on the road, both companies are now providing some cleaning supplies to keep cars as virus-free as possible.

Recently, Uber expanded its sick pay to include sick drivers as well as drivers with pre-existing conditions.

Regardless of the motive, Uber and Lyft’s behavior indicates that they see their drivers more as employees than as independent contractors.

A plumber is often used as an example of a true independent contractor. Would you ever consider contributing sick pay to your plumber? No. It makes no sense. However, that is exactly what Uber and Lyft have done for drivers.

If Drives Are Independent Contractors, Why Is Uber Requiring All Drivers To Wear Masks?

Here is yet another example of how Uber treats its drivers like employees and not independent contractors. True independent contractors could not be told how to do their job. Again, even if it’s the right thing to do.

Here, Uber is requiring drivers to wear the mask, or else not drive at all. Returning to the plumber example, could you ever tell your plumber which type of equipment to use or what kind of safety clothing to wear? No. But Uber can?

A lot of the new COVID-19 requirements and policies (masks, sick pay, etc) are rooted in the best practice guidelines from the CDC, but telling drivers what they have to do or have to wear seems a lot more like employees than independent contractors.

What’s Next?

This legal battle will continue. A majority of drivers want to remain independent contractors, but the pandemic has made others re-think that decision.

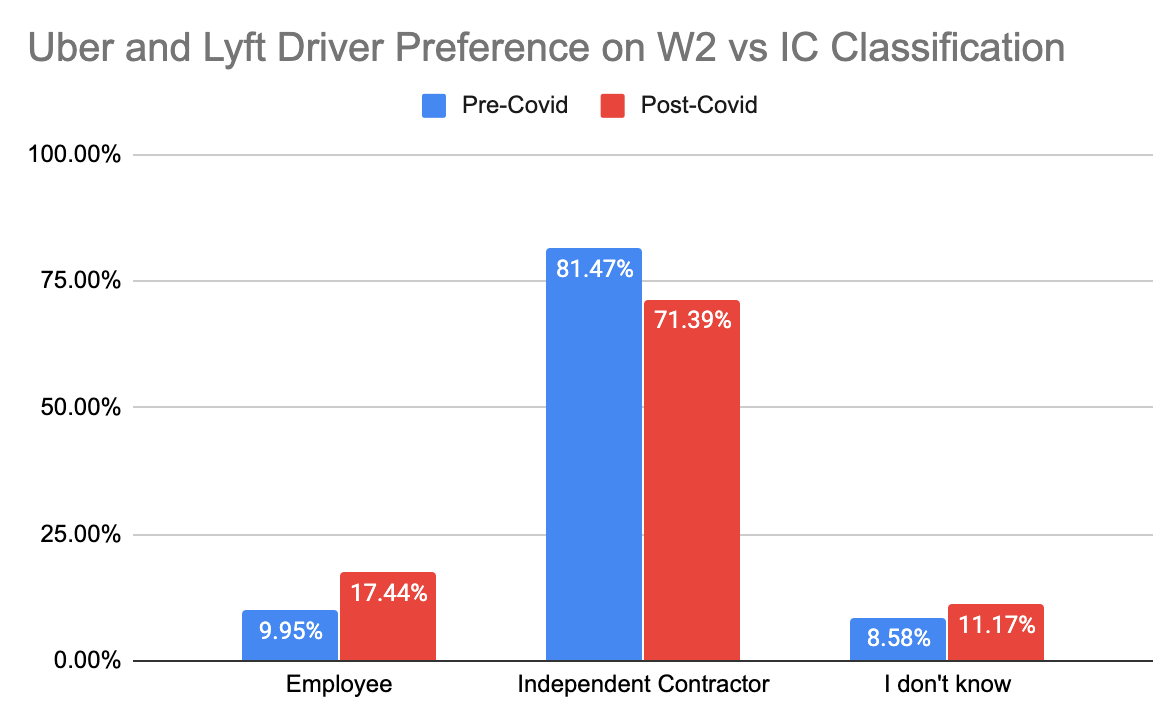

We recently (5/6/20-5/11/20) sent out a survey to our e-mail list of 80,000 drivers across the country and posted on social media asking for responses to a simple 9 question survey and received 734 responses. The goal of the survey was to determine how Uber and Lyft drivers felt about employee vs independent contractor status in the wake of the coronavirus pandemic – have drivers’ attitudes toward becoming employees vs. independent contractors changed?

It turns out that 71% of drivers surveyed still want to be independent contractors. Prior COVID-19, 81% of drivers stated they wanted to remain as independent contractors.

Although a minority of drivers, just 17%, would like to be designated as employees, this is a 75% jump from the 10% figure prior to Covid-19.

So even though a majority still prefer IC, the tide could be turning. For those that want their day in court, some drivers are filing suits against Uber and Lyft. You can count me in that category.

Other drivers don’t seem to care and will drive regardless of the situation. It is certainly an interesting situation, and Uber and Lyft’s sick pay policies would seem to have weakened their argument. Time will tell.

Do you think drivers should become employees or remain independent contractors? Do you wish you had some employee protections right now?

-Jay @ RSG

Resources:

- The latest coronavirus updates here

- What it’s like to be an Uber driver during the pandemic

- Stay up to date on all the latest unemployment information here