If you’re looking for the best rideshare insurance, we’ve made it easy to learn about the options in your state on the page below.

After you sign up for a gig job like Uber, make sure to get several rideshare insurance quotes from the agents below.

This is especially important if you drive for one of the best food delivery services, too, as insurance requirements are different for couriers vs drivers.

There are still a few states that don’t have rideshare-friendly options, but we keep this page updated as new options are added every week, so be sure to check back frequently!

The Best Rideshare Insurance for Rideshare Drivers By State

This post will continue to be updated with insurance information for each of the markets, but if you have conflicting info or would like to add to this page, please leave a comment below.

Additionally, if you have an agent that you’d like to personally recommend, don’t hesitate to reach out to me with their contact info.

Select Your State:

Use the drop-down menu above to jump to your state.

If you’re just learning about rideshare insurance and not sure why you need it, it’s because, as a rideshare driver, you need to be especially mindful of the risks and insurance limits in your state.

There are many states where there isn’t an officially recognized rideshare insurance policy and although you may still be covered by Uber or Lyft, your personal insurer may drop you for being a rideshare driver.

You don’t want your income stream cut off before rent is due next month!

Updated for 2024: Yes, you will want delivery insurance for your food delivery driving! Find our top recommended delivery insurance agents.

Why Delivery, Uber, and Lyft Drivers Need Rideshare Insurance

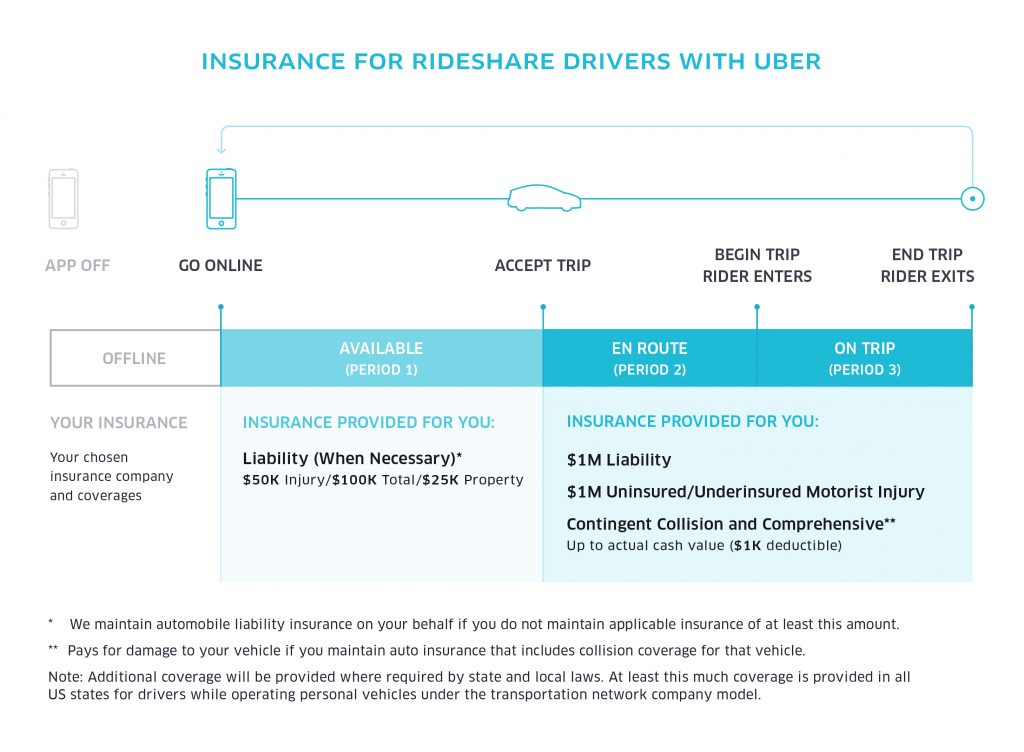

Uber and Lyft only cover rideshare drivers during Periods 2 and 3. Period 2 starts once you accept a ride request and are en route to your passenger, and Period 3 starts once your passenger gets into your car.

However, when you’re online and waiting for a request during Period 1, you have no collision coverage from Uber or Lyft and much lower liability limits.

This means as a rideshare driver, you’re most at risk during Period 1 since you won’t get any collision coverage from rideshare companies, and your personal insurer likely won’t cover you during this time either.

Getting a rideshare insurance quote and rideshare insurance solves this gap by covering drivers during Period 1, and additionally, they won’t drop you for being a rideshare driver. Some policies will even cover you during Periods 2 and 3 so you won’t be subject to Uber’s $1,000 collision deductible and Lyft’s $2,500 collision deductible.

Rideshare insurance really should be part of Uber driver requirements and Lyft driver requirements.

Finally, you will also want insurance even if you only plan on driving for food delivery services (not Uber or Lyft).

You may be able to deduct your rideshare insurance from your tax bill. Use the Stride Tax App to maximize your deductions and keep more of your income.

Related:

What is Uber and Lyft Insurance?

I’ve covered this issue extensively, so if you want to brush up on the current state of insurance for rideshare, here are some of the best rideshare insurance resources for you to review:

- Podcast: Everything You Need to Know About Rideshare Insurance

- What Do Drivers Need to Know About Rideshare Insurance?

- Explore all of our insurance articles

Rideshare Insurance vs. Commercial Insurance

Insurance Options for Delivery App Drivers

With the rising popularity of on-demand food and package delivery services, it’s no surprise that there’s a huge demand for new drivers.

Companies like Uber Eats, DoorDash, Instacart, and Amazon Flex are constantly looking for new workers to come on board and deliver for them.

But which one of these food delivery companies offers insurance for drivers? You can find the full list of delivery insurance options, but we’ve also broken it down for you below:

- DoorDash – provides a $1 million contingent liability policy during the “Delivery Service Period [which] begins when a Dasher accepts a delivery request on the DoorDash App until the order is marked as delivered, unassigned, or canceled”

- Uber Eats – Uber Eats provides similar coverage to couriers as it does to drivers, “$1 million of liability coverage per incident. Uber holds a commercial insurance policy with $1 million of coverage per incident. Drivers’ liability to third parties is covered from the moment a driver accepts the request to deliver meals or goods to the time the delivery is complete.”

- Instacart: Instacart currently does not offer any kind of vehicle insurance to their full-service shoppers or drivers. You will definitely want to add on an insurance policy for delivery if you choose to drive for Instacart.

- Amazon Flex – offers an Amazon Flex Auto Policy that “includes auto liability coverage of $1,000,000, uninsured motorist/under-insured motorist coverage, and contingent comprehensive and collision coverage (passengers are not covered).”

What if my area doesn’t have any rideshare insurance options?

Over the past year, almost all of the major carriers have begun offering rideshare insurance policies for drivers. This is great news since we no longer need to worry about being dropped by our insurance company if we insure with a rideshare-friendly insurance company. This is why it pays to get multiple rideshare insurance quotes!

But changing insurance is obviously not a simple matter since many of us have policies across our homes, other cars, etc. My hope is that one day all major carriers will offer rideshare-friendly policies but until then, drivers will have to either switch insurers or assume the risk of going without a rideshare-friendly policy.

Rideshare Insurance Companies: Rideshare Insurance Cost

Rideshare insurance is widely available these days and even some of the most well-known insurance providers are offering competitive coverage levels for drivers. Here’s what some of the top 4 big names in the industry offer.

Allstate Rideshare Insurance

Allstate offers a rideshare endorsement to your regular auto insurance policy which will help cover your vehicle while you’re rideshare driving. Allstate’s rideshare endorsement helps close the infamous Period 1 coverage gap when Uber and Lyft’s insurance won’t cover you if you get into an accident when the app is on and you’re waiting for a trip.

However, Allstate’s endorsement won’t cover you during Periods 2 and 3 when Uber and Lyft’s insurance would cover you. With this policy, you’d also get deductible gap coverage so if you did need to file a claim through Uber or Lyft, Allstate would reimburse you for a portion of that deductible, so that it matches the deductible on your personal policy. For example, if you have to pay Lyft’s high deductible of $2,500 and your Allstate insurance deductible is only $500, you’d get reimbursed the difference.

Adding a rideshare endorsement to an existing policy can only cost you an extra $10 – $20 per month.

State Farm

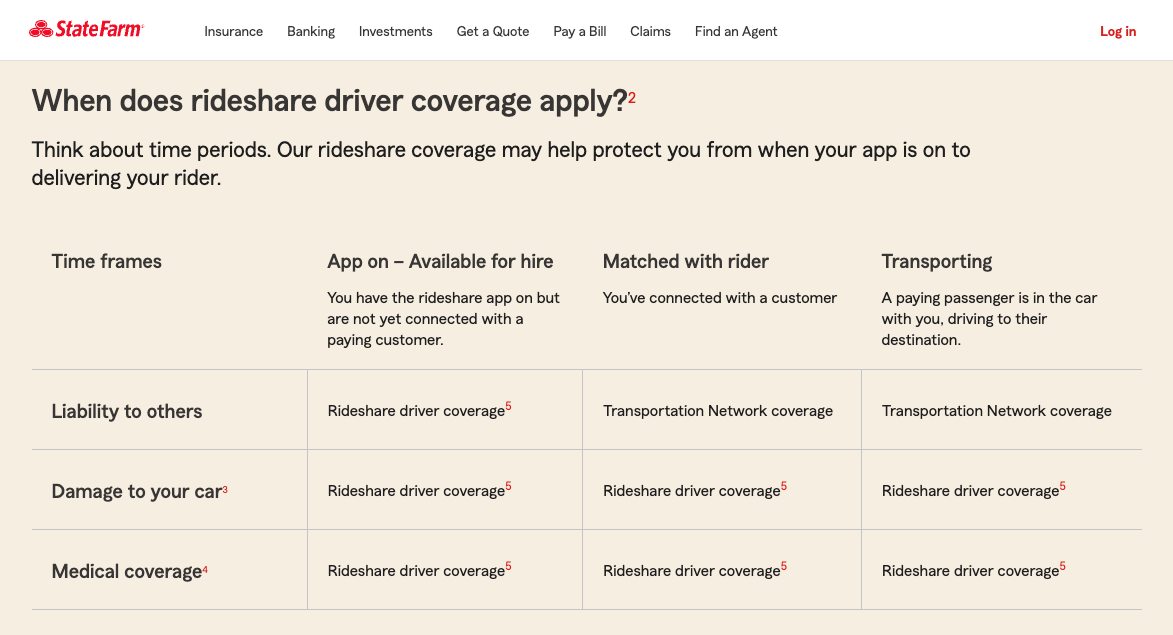

State Farm is another company that offers ‘gap coverage’ for rideshare drivers that extends to your personal policy to include Period 1 coverage. In fact, State Farm’s rideshare insurance can provide you with some amount of coverage during all 3 periods for rideshare drivers.

According to State Farm reps, adding a rideshare coverage endorsement “typically adds about 15–20 percent to your current premium.”

Here’s how State Farm rideshare insurance works:

Farmers

Farmers was one of the first insurers to offer rideshare endorsements. Like many other companies, they offer ‘gap coverage’ for rideshare drivers which can be added to a standard personal policy. While Farmer’s rideshare insurance is not a commercial policy, it does extend coverage through Period 1 so you’re completely covered when rideshare driving.

You can expect to pay about 25% more for your Farmers policy with a rideshare endorsement, but you won’t have to worry about getting dropped for driving for companies like Uber or Lyft.

USAA Rideshare Insurance

USAA offers rideshare insurance as an add-on option to an existing USAA auto policy. Because of this setup, the total cost will be only slightly more than a regular policy – and USAA policies themselves are some of the most affordable policies anywhere, making it an extremely good deal.

One of our readers reported that USAA’s rideshare addendum cost them an extra $16 per month. For some drivers, it’s as low as $6. Another reader and Uber driver reported that her total 6-month cost to insure a 2015 Nissan Sentra through USAA came to just $385 – including the rideshare add-on. You’d be hard-pressed to find a cheaper policy anywhere.

USAA has a pretty good reputation as an insurer, and although its rideshare coverage isn’t the most thorough, it does offer what’s known as “gap coverage” or “period one coverage.”

As you know, insurance costs vary by company vastly. They also vary based on the services you want to be included in them and also on your own driving record. The best advice is to shop around. Find all of the options available in your area and choose the insurance company that works best for you.

After doing some shopping around in California, I found that there was a range of $113 to $205 a month for rideshare insurance, which is in line with what I’ve found for most other drivers.

If you have a better driving record or you live in an area that is cheaper to insure, you may be on the lower end. But for a lot of drivers, the average quote may come in at around $150/month.

One thing to keep in mind is what all is covered by each insurance company. For instance, in my research for the price range, there were companies that offered coverage for all three periods instead of just period one, so you can fully process your claim through them instead of going through the TNC.

On the other hand, if you have Allstate and get into an accident during period 2 or 3, Allstate will pay part of Uber’s $2500 deductible (or Lyft’s $2,500 deductible, etc) to make it match the deductible on your policy.

What are deductibles and why do auto insurance companies charge them?

Your deductible is the out-of-pocket portion of damages paid by you, the policyholder. What? It’s insurance!

Why should you have to pay for any of it? The reason insurance companies charge a deductible is to discourage very small claims that would drive up administrative expenses. In exchange for having to pay a deductible in the event of a mishap, the policyholder gets a reduced premium (the amount you pay to get the coverage) depending on how large that deductible is.

In most cases, consumers pay something like $250-2000 dollars.

Which companies can help you avoid high deductibles?

Allstate and State Farm are your best bets to avoid high deductibles as an Uber or Lyft driver.

Allstate’s program helps pay the difference between the deductible you have with them, and what you would owe in periods 2 and 3.

For example: If you have a $500 deductible on your policy with Allstate, Allstate could pay the difference if you have an accident in periods 2 and 3 to Uber and Lyft, in this case, $500 to Uber and $2,000 to Lyft.

State Farm’s rideshare endorsement is more extensive than most other options since they extend their coverage limits during periods 1, 2, and 3. This means that your personal deductible will be in effect any time you are behind the wheel, even when you are driving for Uber or Lyft.

Also, if you have other coverages such as medical, towing, and rental car coverage, those will also be in effect even when driving for Uber and Lyft.

Shopping around and knowing what you want while comparing what each company offers is the best way to go about finding the right rideshare insurance for you.

Other Insurance Companies that Offer Rideshare Insurance:

- Erie Insurance

- Liberty Mutual

- Mercury

- Quoteasy/Bristol West

For more information, take a look at this video on which companies offer rideshare insurance:

How to Buy Rideshare Insurance

It’s crucial to work with an insurance agent familiar with rideshare driving (and delivery, if you want to drive for delivery).

That’s why here at The Rideshare Guy, we interview every rideshare insurance agent before we add them to our list of agents – there’s nothing worse than buying insurance from an agent that ends up not covering you because your agent doesn’t understand Uber or Lyft!

Here’s what you need to know before buying rideshare insurance:

- Will you be adding other policies, like homeowners or renters, to your auto policy? If so, that could save you money.

- Reach out to all the insurance agents in your state (check out our by-state resources below). Compare rates and options.

- Decide what you must have when it comes to coverage.

- Understand any gaps in your policy or any benefits that distinguish companies from each other.

- Make sure to tell your agent you’re a rideshare driver – let them know RSG sent you!

What Happens If You Get Into an Accident While Driving for Uber, Lyft, or a Delivery App?

This is a very common question among rideshare drivers, unfortunately, given how much we are all on the road. Here are some tips:

If You Are At Fault

This means that you and your insurance company bear the brunt of the financial responsibility. Here are the different pieces of the insurance policy and what they apply to:

- Liability – This part of your policy will cover damage to other cars, property, and people that were involved in the accident. Any injured persons that were in your car that are not direct family members are covered by liability as well. There is no deductible for any liability claims.

- Collision – This part of your policy covers damages to your own vehicle. There is usually a deductible associated with collision insurance and varies from policy to policy.

- Medical – This is one of the most misunderstood parts of insurance. Medical insurance covers yourself and anyone else in your car for medical expenses prior to the assignment of fault.

If the Other Driver is At Fault

This is certainly a better situation than the first example, but this is where most people get confused. Coverages are used differently.

- Liability – Not used here since you were not at fault.

- Collision – This coverage is used temporarily until your insurance coverage can get payment from the other insurance company. With most insurance companies, you will be subject to a deductible until the other insurance company pays.

- Uninsured/Underinsured – This coverage is to protect you and your passengers should you get into an accident with an uninsured driver. This coverage will pay out in the case the other person is at fault but does not have insurance.

- Medical – This covers you and your passengers until the other insurance company pays.

If the other driver is at fault, your insurance company should pay for the damages (mostly) and has a legal right and responsibility to collect from the insurance company of the at-fault party. This is a valuable service that insurance companies perform if you allow them to if the damages are higher than your collision deductible, and/or if there are injuries.

And if you need to, you can contact a Uber car accident lawyer here.

What Happens If I Get Into an Accident Driving for Uber or Lyft with a Rental Car?

Bryant Greening of Legal Rideshare encourages drivers to move swiftly and avoid keeping the rented vehicle in their possession for an extended time after an accident.

“It does get pretty complicated with rentals, as it’s tough to know who to call. Generally, you want to get the car out of your hands as quickly as possible to avoid being charged the rental fee.It may be best to go directly to the facility/dealership where you picked up the car. You should be able to return the car, or get instructions on how to do so.If you need to make an insurance claim, contact the at-fault driver’s insurance company and explain that you need repairs based on an accident their insured caused. Being a rental car, this is the last option.”

What About Uber’s Driver Injury Protection Program?

Uber announced a 5 cent per mile pay increase in order to fund Driver Injury Protection insurance. Uber announced they are doing this in partnership with Aon as a program for drivers to sign up for injury protection and pay into a fund OR simply collect an extra $0.05/mile. That’s obviously not a huge pay increase, but every little bit counts.

Specifically, benefits include:

- Disability Payments: earnings replacement to a maximum of $500/week.

- Medical Expenses: medical expenses to a maximum of $1,000,000 with no deductible or co pay.

- Survivor Benefits: to a maximum of $150,000 for your family.

Basically, If an Uber driver is injured or hurt on the job, they will have their medical expenses covered with an earnings reimbursement of up to $500/week depending on their previous driver pay history. According to an Uber spokesman, this will include up to $1,000,000 in protection.

This type of insurance can be valuable for a full-time driver who spends between 40 and 60 hours a week on the road because driving is inherently a dangerous job. The more time one spends on the road, the more likely they are to get into an accident or experience a situation where their back gives out while lugging Larry’s luggage at the airport.

Fleet Owner Insurance

Are you a fleet owner? If so, your rideshare insurance needs are different from individual rideshare drivers.

If you’re looking for fleet insurance coverage, we recommend Ed Walker, our resident insurance expert and Vice President at Shared Economy & Mobility. You can find him on LinkedIn here.

The Best Rideshare Insurance for Rideshare Drivers By State

This post will continue to be updated with insurance information for each of the markets, but if you have conflicting info or would like to add it to this page, please leave a comment below. Additionally, if you have an agent that you’d like to personally recommend, don’t hesitate to reach out to me with their contact info.

Select Your State:

Use the drop-down menu above to jump to your state.

Alabama Rideshare Insurance

Alabama drivers have several rideshare insurance options to choose from: USAA, Progressive, State Farm, and Farmers. Make sure to get several rideshare insurance quotes so you can get the best price and coverage.

With Farmers’ policy addition, you get coverage during period 1 (app on, but no passenger) and you won’t be dropped for telling them you’re a rideshare driver.

State Farm

State Farm’s rideshare endorsement is more extensive than most other options since they extend their coverage limits during period 1, 2, and 3. This means that your personal deductible will be in effect any time you are behind the wheel, even when you are driving for Uber or Lyft. Also, if you have other coverages such as medical, towing, and rental car coverage, those will also be in effect even when driving for Uber and Lyft.

Arizona Rideshare Insurance

Arizona drivers have six rideshare insurance options to choose from: Allstate, USAA, State Farm, Progressive, Mercury, American Family Insurance, and Farmers. With Farmers’ policy addition, you get coverage during period 1 (app on, but no passenger) and you won’t be dropped for telling them you’re a rideshare driver.

State Farm

State Farm’s rideshare endorsement is more extensive than most other options since they extend their coverage limits during period 1, 2, and 3. This means that your personal deductible will be in effect any time you are behind the wheel… even when you are driving for Uber or Lyft. Also, if you have other coverages such as medical, towing, and rental car coverage, those will also be in effect even when driving for Uber and Lyft. Contact Courtny Tyler at 520-568-5588.

Voom

Learn More:

Allstate

Allstate’s rideshare coverage is unique – it provides coverage for your personal insurance, and during period 1. Allstate’s rideshare coverage also helps fill the gap that arises when a customer’s personal auto policy liability coverage limits are greater than what’s provided by Uber and Lyft during period 1, 2, and 3. The coverage also protects drivers against the high deductibles that ridesharing companies have for their coverage.

Arkansas Rideshare Insurance

Farmers Insurance was the first to offer a rideshare-friendly policy in the state. With their policy addition, you get coverage during period 1 (app on, but no passenger) and you won’t be dropped for telling them you’re a rideshare driver. State Farm, USAA, and Progressive are also available in Arkansas.

California Rideshare Insurance

In rideshare’s largest state, there are a bunch of options for drivers. Farmers were first to market with a rideshare policy in California and now others have followed suit. We have highlighted the major players below. Others offering rideshare coverage are Allstate, Esurance, USAA, State Farm, Mercury, and MetLife.

State Farm

State Farm started offering rideshare-friendly policies on 3/21/16. State Farm’s rideshare endorsement is more extensive than most other options since they extend their coverage limits during period 1, 2, and 3. This means that your personal deductible will be in effect any time you are behind the wheel…even when you are driving for Uber or Lyft. Also, if you have other coverages such as medical, towing, and rental car coverage, those will also be in effect even when driving for Uber and Lyft.

State Farm Recommended Agent in CA

Allstate

Allstate’s rideshare coverage is unique – it provides coverage for your personal insurance, and during period 1. Allstate’s rideshare coverage also helps fill the gap that arises when a customer’s personal auto policy liability coverage limits are greater than what’s provided by Uber and Lyft during period 1, 2, and 3. The coverage also protects drivers against the high deductibles that ridesharing companies have for their coverage.

Allstate also offers commercial auto policies.

Allstate Recommended Agent in CA

- Doug Eisold – 858-271-7900

Farmers

Farmers offers a rideshare-friendly policy add-on which extends your coverage during period 1 (app on, but no passenger). You won’t be dropped for telling them you’re a rideshare driver; however, you will be reliant on Uber or Lyft’s insurance policies during periods 2 and 3.

Mercury

Mercury first opened their doors in 1962. Dedicated managers and enthusiastic employees work hand-in-hand with their network of independent agents. Mercury offers full coverage during period 1 and was named by Forbes as one of ‘America’s Most Trustworthy Companies’, earning a place among “America’s 50 Most Trustworthy Financial Companies’.

Colorado Rideshare Insurance

As of Jan. 15th, 2015, Colorado passed a bill that requires primary insurance during Period 1. Uber provides primary insurance during this period in order to satisfy the requirements but not every insurance company will endorse rideshare drivers. Currently, Allstate, American Family, Farmers, MetLife, Progressive, Safeco, State Farm, USAA, and VOOM all offer rideshare-friendly policies

Farmers

Farmers Insurance was the first to offer a rideshare-friendly policy in the state. With their policy addition, you get coverage during period 1 (app on, but no passenger) and you won’t be dropped for telling them you’re a rideshare driver. Contact Jolene Johnson at 303-768-8130 (Englewood, CO)

Did you know Farmers also offers delivery insurance? Contact Jolene Johnson at the number above if you’re interested in getting delivery insurance, which is a regular auto policy with a commercial endorsement for food delivery. It works just like a rideshare endorsement!

Voom

Learn More:

State Farm

State Farm’s rideshare endorsement is more extensive than most other options since they extend their coverage limits during period 1, 2 and 3. This means that your personal deductible will be in effect any time you are behind the wheel…even when you are driving for Uber or Lyft. Also, if you have other coverages such as medical, towing and rental car coverage, those will also be in affect even when driving for Uber and Lyft.

Connecticut Rideshare Insurance

GEICO is now offering rideshare “hybrid” policies. Also, Liberty Mutual offers a policy where they won’t cancel a policy holder just for being a rideshare driver. Allstate, State Farm, and USAA also offer rideshare insurance.

State Farm

State Farm’s rideshare endorsement is more extensive than most other options since they extend their coverage limits during periods 1, 2, and 3. This means that your personal deductible will be in effect any time you are behind the wheel…even when you are driving for Uber or Lyft. Also, if you have other coverages such as medical, towing, and rental car coverage, those will also be in effect even when driving for Uber and Lyft.

Recommend Agents in CT

Brian Busam – 860-289-2227

Delaware Rideshare Insurance

Allstate, USAA, Liberty Mutual, and State Farm all offer rideshare insurance in Delaware.

Liberty Mutual

Whether you are with Lyft, Uber, Doordash, Instacart, Turo, or any Transportation Network Company, Liberty Mutual is an excellent option. They recently rolled out their rideshare rider and it is excellent!

Liberty will cover your rideshare vehicle during Period 1 for a hassle-free experience. Liberty will not drop coverage for participating in any Transportation Network Companies either. Furthermore, get extra discounts on already competitively priced policies by bundling all of your auto, home, or renters insurance needs. Pile on the coverage and receive extraordinary discounts. Liberty Mutual only charges the Period 1 rider for the vehicle being used for rideshare, but they will discount other vehicles to offset pricing.

Give Yaniv “Jay” Natanov a call for a quote today at 240-309-6001 or email him at Yaniv.natanov@prudential.com.

D.C. (District of Columbia) Rideshare Insurance

Washington DC rideshare drivers have several options to choose from: Allstate, Liberty Mutual, State Farm, USAA and Erie Insurance.

State Farm

State Farm’s rideshare endorsement is more extensive than most other options since they extend their coverage limits during periods 1, 2, and 3. This means that your personal deductible will be in effect any time you are behind the wheel, even when you are driving for Uber or Lyft. Also, if you have other coverages such as medical, towing, and rental car coverage, those will also be in effect even when driving for Uber and Lyft.

Erie Insurance

Erie has been around for 90 years. They are currently rated A+ (Superior) by A.M. Best. According to the J.D. Power 2015 U.S. Insurance Shopping Study, Erie Insurance ranks highest in customer satisfaction. This is the third year in a row that Erie has achieved this award.

Liberty Mutual

Whether you are with Lyft, Uber, Doordash, Instacart, Turo, or any Transportation Network Company, Liberty Mutual is an excellent option. They recently rolled out their rideshare rider and it is excellent!

Liberty will cover your rideshare vehicle during Period 1 for a hassle free experience. Liberty will not drop coverage for participating in any Transportation Network Companies either. Furthermore, get extra discounts on already competitively priced policies by bundling all of your auto, home, or renters insurance needs. Pile on the coverage and receive extraordinary discounts. Liberty Mutual only charges the Period 1 rider for the vehicle being used for rideshare, but they will discount other vehicles to offset pricing.

Give Yaniv “Jay” Natanov a call for a quote today at 240-309-6001 or email him at Yaniv.natanov@prudential.com.

Florida Rideshare Insurance

Florida has a few rideshare insurance options: State Farm, Foremost, a subsidiary of Farmers, Prime Insurance, Progressive, Infinity, and USAA.

Quoteasy / Bristol West

Quoteasy is a broker that specializes in rideshare insurance and delivery insurance and currently offers Infinity Insurance, Mercury Insurance, Windhaven, and Foremost Insurance.

State Farm Insurance

State Farm’s rideshare endorsement is more extensive than most other options since they extend their coverage limits during periods 1, 2, and 3. This means that your personal deductible will be in effect any time you are behind the wheel, even when you are driving for Uber or Lyft. Also, if you have other coverages such as medical, towing, and rental car coverage, those will also be in effect even when driving for Uber and Lyft.

Contact State Farm agent Chris Tighe here.

Georgia Rideshare Insurance

Georgia Rideshare Insurance: Georgia drivers now have many options to choose from, including Allstate, American Family, Farmers, Mercury, Progressive, State Farm, USAA, Alfa Insurance Corporation (period one) and Ethio-American.

State Farm

State Farm’s rideshare endorsement is more extensive than most other options since they extend their coverage limits during periods 1, 2, and 3. This means that your personal deductible will be in effect any time you are behind the wheel, even when you are driving for Uber or Lyft. Also, if you have other coverages such as medical, towing, and rental car coverage, those will also be in effect even when driving for Uber and Lyft.

Hawaii Rideshare Insurance

Hawaii rideshare drivers currently only have Allstate as an option. If there are other insurance providers in Hawaii, please contact me to let me know.

Idaho Rideshare Insurance

Idaho rideshare drivers have several options to choose from: American Family, Progressive, USAA, State Farm, and Farmers. I recommend getting multiple quotes to find out which one best suits your needs.

State Farm

State Farm’s rideshare endorsement is more extensive than most other options since they extend their coverage limits during periods 1, 2, and 3. This means that your personal deductible will be in effect any time you are behind the wheel, even when you are driving for Uber or Lyft. Also, if you have other coverages such as medical, towing, and rental car coverage, those will also be in effect even when driving for Uber and Lyft.

Illinois Rideshare Insurance

Illinois has a big selection of rideshare-friendly auto insurance options. We have included agents that we recommend because they understand the unique needs of rideshare drivers and how to set up the policies correctly with each of these companies for rideshare drivers. Along with the Farmers, Erie, Travelers, Progressive, and USAA options listed below; Allstate, American Family Insurance, Safeco, Mercury, MetLife, and State Farm offer rideshare policies in Illinois as well.

State Farm

State Farm’s rideshare endorsement is more extensive than most other options since they extend their coverage limits during periods 1, 2, and 3. This means that your personal deductible will be in effect any time you are behind the wheel, even when you are driving for Uber or Lyft. Also, if you have other coverages such as medical, towing, and rental car coverage, those will also be in effect even when driving for Uber and Lyft.

Need an Uber Accident Attorney?

Head to our Uber Accident Lawyer Marketplace, where we’ve got more info about how to handle rideshare insurance after an accident.

Recommended Lyft and Uber Accident Attorney in IL

Contact Bryant Greening at (312) 767-2222. He is an attorney at LegalRideshare. LegalRideshare is the only law firm in the United States entirely dedicated to Uber/Lyft accident and injury claims. LegalRideshare fights to recover costs of medical bills, lost wages, and pain and suffering for injured Uber/Lyft drivers.

Indiana Rideshare Insurance

Indiana has a few rideshare options, including Allstate, American Family Insurance, Farmers, Progressive, Safeco, State Farm, and USAA.

GEICO also offers commercial auto policies.

State Farm

State Farm’s rideshare endorsement is more extensive than most other options since they extend their coverage limits during periods 1, 2, and 3. This means that your personal deductible will be in effect any time you are behind the wheel, even when you are driving for Uber or Lyft. Also, if you have other coverages such as medical, towing, and rental car coverage, those will also be in effect even when driving for Uber and Lyft.

Iowa Rideshare Insurance

Iowans currently have several choices for rideshare insurance: Allstate, Farmers, American Family Insurance, Progressive, State Farm, and USAA. We recommend getting quotes from all three to find out which one best suits your needs.

USAA

USAA is a well-known financial services company that exclusively serves the military community and their families since 1922. As part of their auto insurance products, USAA now offers a rideshare endorsement that covers Period 1 (app on, but no passenger), and you won’t be dropped for letting them know you are a rideshare driver.

Kansas Rideshare Insurance

Farmers Insurance was the first to offer a rideshare-friendly policy in Kansas. With their policy addition, you get coverage during period 1 (app on, but no passenger), and you won’t be dropped for telling them you’re a rideshare driver. Now Kansas has more options: Allstate, American Family, State Farm, and USAA.

GEICO also offers commercial auto policies

USAA

USAA is a well-known financial services company that exclusively serves the military community and their families since 1922. As part of their auto insurance products, USAA now offers a rideshare endorsement that covers Period 1 (app on, but no passenger), and you won’t be dropped for letting them know you are a rideshare driver.

Kentucky Rideshare Insurance

Drivers in Kentucky can choose from Allstate, Progressive, USAA, State Farm, or Erie; we recommend getting quotes from all to find out which one best suits your needs.

USAA

USAA is a well-known financial services company that exclusively serves the military community and their families since 1922. As part of their auto insurance products, USAA now offers a rideshare endorsement that covers Period 1 (app on, but no passenger), and you won’t be dropped for letting them know you are a rideshare driver.

Louisiana Rideshare Insurance

Drivers in Louisiana have a few different options. Allstate offers a policy geared towards rideshare drivers, and USAA, Progressive, and State Farm are also offering policies now.

USAA

USAA is a well-known financial services company that exclusively serves the military community and their families since 1922. As part of their auto insurance products, USAA now offers a rideshare endorsement that covers Period 1 (app on, but no passenger), and you won’t be dropped for letting them know you are a rideshare driver.

Maine Rideshare Insurance

Drivers in Maine have only a handful of options. USAA, Progressive, and State Farm both offer rideshare insurance policies to Maine drivers.

Maryland Rideshare Insurance

Drivers in Maryland have a few options for rideshare insurance, including Allstate, Erie, Farmers, Liberty Mutual, State Farm, and USAA. We recommend getting quotes from all these companies to find out which one best suits your needs.

State Farm

State Farm’s rideshare endorsement is more extensive than most other options since they extend their coverage limits during periods 1, 2, and 3. This means that your personal deductible will be in effect any time you are behind the wheel, even when you are driving for Uber or Lyft. Also, if you have other coverages such as medical, towing, and rental car coverage, those will also be in effect even when driving for Uber and Lyft.

Erie Insurance

Erie has been around for 90 years. They are currently rated A+ (Superior) by A.M. Best. According to the J.D. Power 2015 U.S. Insurance Shopping Study, Erie Insurance ranks highest in customer satisfaction. This is the third year in a row that Erie has achieved this award.

Liberty Mutual

Whether you are with Lyft, Uber, Doordash, Instacart, Turo, or any Transportation Network Company, Liberty Mutual is an excellent option. They recently rolled out their rideshare rider and it is excellent!

Liberty will cover your rideshare vehicle during Period 1 for a hassle free experience. Liberty will not drop coverage for participating in any Transportation Network Companies either. Furthermore, get extra discounts on already competitively priced policies by bundling all of your auto, home, or renters insurance needs. Pile on the coverage and receive extraordinary discounts. Liberty Mutual only charges the Period 1 rider for the vehicle being used for rideshare, but they will discount other vehicles to offset pricing.

Give Yaniv “Jay” Natanov a call for a quote today at 240-309-6001 or email him at Yaniv.natanov@prudential.com.

Massachusetts Rideshare Insurance

Despite Boston being one of the rideshare’s top markets, insurance companies have been fairly slow to adapt to all the new demands. Following recent legislative changes, Allstate, MAPFRE, Progressive, and USAA now offer rideshare-friendly policies in Massachusetts. Liberty Mutual is also an option.

Liberty Mutual

Whether you are with Lyft, Uber, Doordash, Instacart, Turo, or any Transportation Network Company, Liberty Mutual is an excellent option. They recently rolled out their rideshare rider and it is excellent!

Liberty will cover your rideshare vehicle during Period 1 for a hassle-free experience. Liberty will not drop coverage for participating in any Transportation Network Companies either. Furthermore, get extra discounts on already competitively priced policies by bundling all of your auto, home, or renters insurance needs. Pile on the coverage and receive extraordinary discounts. Liberty Mutual only charges the Period 1 rider for the vehicle being used for rideshare, but they will discount other vehicles to offset pricing.

Give Yaniv “Jay” Natanov a call for a quote today at 240-309-6001 or email him at Yaniv.natanov@prudential.com.

USAA

USAA is a well-known financial services company that exclusively serves the military community and their families since 1922. As part of their auto insurance products, USAA now offers a rideshare endorsement that covers Period 1 (app on, but no passenger), and you won’t be dropped for letting them know you are a rideshare driver.

Michigan Rideshare Insurance

Farmers was the first company to offer rideshare-friendly insurance in Michigan. Farmers has rideshare-friendly policy add-ons that extend your coverage during period 1 (app on, but no passenger). You won’t be dropped for telling them you’re a rideshare driver; however, you will be reliant on Uber or Lyft’s insurance policies during periods 2 and 3. State Farm and Progressive also offer insurance.

Minnesota Rideshare Insurance

Drivers in Minnesota have a few options for rideshare insurance, including Allstate, American Family, Farmers, Progressive, State Farm, and USAA. We recommend getting quotes from all these companies to find out which one best suits your needs.

Farmers

Farmers Insurance was the first to offer a rideshare-friendly policy in the state. With their policy addition, you get coverage during period 1 (app on, but no passenger), and you won’t be dropped for telling them you’re a rideshare driver.

Mississippi

Mississippi drivers currently have a few choices for rideshare insurance: USAA, Progressive, and State Farm.

State Farm

State Farm’s rideshare endorsement is more extensive than most other options since they extend their coverage limits during periods 1, 2, and 3. This means that your personal deductible will be in effect any time you are behind the wheel, even when you are driving for Uber or Lyft. Also, if you have other coverages such as medical, towing, and rental car coverage, those will also be in effect even when driving for Uber and Lyft.

Missouri

Missouri rideshare drivers now have several insurance options available: Allstate, American Family, Progressive, State Farm, and USAA.

GEICO also offers commercial auto policies.

State Farm

State Farm’s rideshare endorsement is more extensive than most other options since they extend their coverage limits during periods 1, 2, and 3. This means that your personal deductible will be in effect any time you are behind the wheel, even when you are driving for Uber or Lyft. Also, if you have other coverages such as medical, towing, and rental car coverage, those will also be in effect even when driving for Uber and Lyft.

USAA

USAA is a well-known financial services company that exclusively serves the military community and their families since 1922. As part of their auto insurance products, USAA now offers a rideshare endorsement that covers Period 1 (app on, but no passenger), and you won’t be dropped for letting them know you are a rideshare driver.

Montana Rideshare Insurance

Farmers recently added Montana to its growing list of states where they now offer rideshare-friendly policies. Progressive and State Farm’s rideshare policies are also available in Montana.

Farmers

Farmers Insurance was the first to offer a rideshare-friendly policy in the state. With their policy addition, you get coverage during period 1 (app on, but no passenger), and you won’t be dropped for telling them you’re a rideshare driver.

Nebraska Rideshare Insurance

Nebraska has an assortment of rideshare insurance options, including Farmers, American Family Insurance, Progressive, State Farm, and USAA. We recommend getting quotes from all of these companies to see which policy best suits your needs.

USAA

USAA is a well-known financial services company that exclusively serves the military community and their families since 1922. As part of their auto insurance products, USAA now offers a rideshare endorsement that covers Period 1 (app on, but no passenger), and you won’t be dropped for letting them know you are a rideshare driver.

Nevada Rideshare Insurance

Farmers was the first company to offer rideshare insurance in Nevada. State Farm, Allstate, American Family Insurance, USAA, and Mercury now offer policies in the state as well.

State Farm

State Farm’s rideshare endorsement is more extensive than most other options since they extend their coverage limits during periods 1, 2, and 3. This means that your personal deductible will be in effect any time you are behind the wheel, even when you are driving for Uber or Lyft. Also, if you have other coverages such as medical, towing, and rental car coverage, those will also be in effect even when driving for Uber and Lyft.

New Hampshire Rideshare Insurance

New Hampshire drivers now have several options to choose from: GEICO, Liberty Mutual, USAA, Progressive, and State Farm.

USAA

USAA is a well-known financial services company that exclusively serves the military community and their families since 1922. As part of their auto insurance products, USAA now offers a rideshare endorsement that covers Period 1 (app on, but no passenger), and you won’t be dropped for letting them know you are a rideshare driver.

New Jersey Rideshare Insurance

New Jersey rideshare drivers have several insurance options to choose from: Allstate, Farmers, New Jersey Manufacturers Insurance Company, Mercury, State Farm, and USAA.

State Farm

State Farm’s rideshare endorsement extends your coverage limits during periods 1, 2, and 3. This means that your personal deductible will be in effect any time you are behind the wheel, no matter which TNC you’re driving for or which period you’re in. If you have other coverages such as medical, towing, and rental car coverage, these too will be in effect while you’re driving for Uber, Lyft, or others.

New Mexico Rideshare Insurance

New Mexico drivers can select between Farmers, Progressive, and State Farm. We recommend getting quotes from all of these companies to find out which policy best suits your needs.

New York Rideshare Insurance

New York City is one of the largest transportation markets in the world but it’s also unique since it’s the only UberX market that requires drivers to get TLC insurance instead of regular rideshare or personal insurance. So if you’re driving for Uber, Lyft, Gett, or Juno, you’ll want to look into commercial insurance from a trusted New York commercial insurance broker. Note that commercial insurance is only required for New York City.

Outside of NYC, commercial insurance is not required but you will still want to get rideshare insurance. Currently, there are only two companies that provide rideshare insurance in New York State, Allstate and Mercury.

Recommended Commercial Insurance Brokers in NYC:

Pearland Brokerage

Contact Pearland Brokerage Inc at 718-361-0033 or Help@PearlandNY.com (email preferred)

Allstate

Allstate’s new rideshare coverage is unique. While it provides coverage during period 1, Allstate’s rideshare coverage also helps fill the gap that arises when a customer’s personal auto policy liability coverage limits are greater than what’s provided by Uber and Lyft during periods 1, 2, and 3. The coverage also protects drivers against the high deductibles that ridesharing companies have for their coverage.

North Carolina Rideshare Insurance

NC drivers have a couple of options for rideshare insurance: Allstate, Liberty Mutual, USAA, Progressive, and NCUberInsurance.com. We recommend getting quotes from all of them to find out which policy best suits your needs.

North Dakota Rideshare Insurance

North Dakota currently hanew s several options available for rideshare drivers: American Family Insurance, GEICO, Progressive, State Farm, and USAA. We recommend getting quotes from all three to find out which policy best suits your needs.

USAA

USAA is a well-known financial services company that exclusively serves the military community and their families since 1922. As part of their auto insurance products, USAA now offers a rideshare endorsement that covers Period 1 (app on, but no passenger), and you won’t be dropped for letting them know you are a rideshare driver.

Ohio Rideshare Insurance

Farmers recently added Ohio to its growing list of states where they now offer rideshare-friendly policies. USAA offers “rideshare gap” coverage. Allstate, Erie, American Family Insurance, Progressive, USAA, and State Farm offer rideshare insurance options in OH as well.

Ohio’s Rideshare Insurance Expert: Contact Brad Sussman at 844-200-4800

Erie Insurance

Erie has been around for 90 years. They are currently rated A+ (Superior) by A.M. Best. According to the J.D. Power 2015 U.S. Insurance Shopping Study, Erie Insurance ranks highest in customer satisfaction. Erie is one of the first insurance companies in Pennsylvania to offer ridesharing coverage directly on a personal auto policy and covers for periods 1,2 and 3. The personal auto policy options keep the premiums reasonable and allow drivers to retain the multi-policy discounts if their home or other cars are insured with Erie too.

Oklahoma Rideshare Insurance

Oklahoma drivers can pick between Progressive, Safeco, Allstate, Farmers, Mercury, State Farm, and USAA for their rideshare insurance policy. We recommend getting quotes from all of these companies to make sure you’re getting a policy that fits your needs.

Oregon Rideshare Insurance

Oregon drivers can now choose among American Family Insurance, Farmers, State Farm, and USAA for their rideshare insurance policy. We recommend getting quotes from all of these companies to make sure you’re getting a policy that fits your needs.

State Farm

State Farm’s rideshare endorsement extends your coverage limits during periods 1, 2, and 3. This means that your personal deductible will be in effect any time you are behind the wheel, no matter which TNC you’re driving for or which period you’re in. If you have other coverages such as medical, towing, and rental car coverage, these too will be in effect while you’re driving for Uber, Lyft, or others.

Pennsylvania Rideshare Insurance

Pennsylvania now has a few options for drivers, including Erie, Progressive, State Farm, and Liberty Mutual.

Erie Insurance

Erie has been around for 90 years. They are currently rated A+ (Superior) by A.M. Best. According to the J.D. Power 2015 U.S. Insurance Shopping Study, Erie Insurance ranks highest in customer satisfaction. Erie is one of the first insurance companies in Pennsylvania to offer ridesharing coverage directly on a personal auto policy and covers for periods 1,2 and 3. The personal auto policy options keep the premiums reasonable and allow drivers to retain the multi-policy discounts if their home or other cars are insured with Erie too. Contact Mike Gehman at (215) 804-5072 or email mike@innovativeig.com

Liberty Mutual

Whether you are with Lyft, Uber, Doordash, Instacart, Turo, or any Transportation Network Company, Liberty Mutual is an excellent option. They recently rolled out their rideshare rider and it is excellent!

Liberty will cover your rideshare vehicle during Period 1 for a hassle-free experience. Liberty will not drop coverage for participating in any Transportation Network Companies either. Furthermore, get extra discounts on already competitively priced policies by bundling all of your auto, home, or renters insurance needs. Pile on the coverage and receive extraordinary discounts. Liberty Mutual only charges the Period 1 rider for the vehicle being used for rideshare, but they will discount other vehicles to offset pricing.

Give Yaniv “Jay” Natanov a call for a quote today at 240-309-6001 or email him at Yaniv.natanov@prudential.com.

Rhode Island Rideshare Insurance

Drivers in Rhode Island can now get rideshare-approved coverage through USAA, Erie Insurance and Progressive have also begun offering rideshare insurance in Rhode Island.

South Carolina Rideshare Insurance

South Carolina rideshare drivers can select between Allstate, and State Farm, for their insurance policies.

South Dakota Rideshare Insurance

South Dakota Rideshare Insurance: South Dakota drivers have options, American Family Insurance, USAA, and Progressive. American Family offers rideshare endorsements that extend your personal policy to include the infamous “period one” gap (app on, no pings). During periods two and three, you’ll still be reliant on the coverage provided by Uber/Lyft – but you can rest easy knowing that you won’t be dropped from your policy for being a rideshare driver.

Tennessee Rideshare Insurance

Drivers in Tennessee now have more options for rideshare-friendly insurance, including Allstate, Erie, Farmers, Progressive, Safeco, State Farm, and USAA.

Voom

Learn More:

State Farm

State Farm’s rideshare endorsement is more extensive than most other options since they extend their coverage limits during periods 1, 2, and 3. This means that your personal deductible will be in effect any time you are behind the wheel, even when you are driving for Uber or Lyft. Also, if you have other coverages such as medical, towing, and rental car coverage, those will also be in effect even when driving for Uber and Lyft.

Allstate

Allstate’s new rideshare coverage is unique. While it provides coverage during period 1, Allstate’s rideshare coverage also helps fill the gap that arises when a customer’s personal auto policy liability coverage limits are greater than what’s provided by Uber and Lyft during periods 1, 2, and 3. The coverage also protects drivers against the high deductibles that ridesharing companies have for their coverage.

Texas Rideshare Insurance

Texas is one of the rideshare’s top markets, and there are now multiple options for drivers in the Lone Star state: Allstate, Farmers, Mercury, State Farm, Liberty Mutual, Progressive, USAA, MetLife, and Progressive. If you can, take advantage of the wide selection, and get a quote from all of them. That way, you’ll be sure to get the best policy for your needs.

State Farm

State Farm’s rideshare endorsement is more extensive than most other options since they extend their coverage limits during periods 1, 2, and 3. This means that your personal deductible will be in effect any time you are behind the wheel, even when you are driving for Uber or Lyft. Also, if you have other coverages such as medical, towing, and rental car coverage, those will also be in effect even when driving for Uber and Lyft.

Utah Rideshare Insurance

Farmers Insurance, American Family, State Farm, USAA and Allstate offer rideshare-friendly policies in Utah.

Vermont Rideshare Insurance

Vermont drivers now have State Farm and USAA as options for rideshare coverage. Stay tuned for more options.

Virginia Rideshare Insurance

Virginia drivers can now choose between Allstate, Progressive, State Farm, and Erie insurance. We recommend getting quotes from all of these companies to make sure you’re getting a policy that fits your needs.

State Farm

State Farm’s rideshare endorsement is more extensive than most other options since they extend their coverage limits during periods 1, 2, and 3. This means that your personal deductible will be in effect any time you are behind the wheel, even when you are driving for Uber or Lyft. Also, if you have other coverages such as medical, towing, and rental car coverage, those will also be in effect even when driving for Uber and Lyft.

Erie Insurance

Erie has been around for 90 years. They are currently rated A+ (Superior) by A.M. Best. According to the J.D. Power 2015 U.S. Insurance Shopping Study, Erie Insurance ranks highest in customer satisfaction. This is the third year in a row that Erie has achieved this award.

Liberty Mutual

Whether you are with Lyft, Uber, Doordash, Instacart, Turo, or any Transportation Network Company, Liberty Mutual is an excellent option. They recently rolled out their rideshare rider and it is excellent!

Liberty will cover your rideshare vehicle during Period 1 for a hassle-free experience. Liberty will not drop coverage for participating in any Transportation Network Companies either. Furthermore, get extra discounts on already competitively priced policies by bundling all of your auto, home, or renters insurance needs. Pile on the coverage and receive extraordinary discounts. Liberty Mutual only charges the Period 1 rider for the vehicle being used for rideshare, but they will discount other vehicles to offset pricing.

Give Yaniv “Jay” Natanov a call for a quote today at 240-309-6001 or email him at Yaniv.natanov@prudential.com.

Washington State Rideshare Insurance

Washington drivers can now choose between Allstate, American Family Insurance, Safeco, State Farm, USAA, and MetLife. We recommend getting quotes from all of these companies to make sure you’re getting a policy that fits your needs.

Allstate

Allstate’s Ride for Hire product is now available in Washington. During Period 1, Allstate Ride for Hire can help fill some of the coverage gaps between the TNC commercial policy coverage and your existing Allstate auto policy. During Period 2, Allstate Ride for Hire provides deductible gap coverage to help reduce your out-of-pocket expenses.

Allstate Recommend Agent in Washington State

Teri Bangart Insurance

- Learn More about Teri at Allstate.com

- Call: 360-753-6357

- Email: TBangart@allstate.com

- Quick Quote: Get a quick quote from Teri at Allstate using the QR Code below!

USAA

USAA is a well-known financial services company that exclusively serves the military community and their families since 1922. As part of their auto insurance products, USAA now offers a rideshare endorsement that covers Period 1 (app on, but no passenger), and you won’t be dropped for letting them know you are a rideshare driver.

West Virginia Rideshare Insurance

West Virginia Rideshare Insurance: Allstate, State Farm, Progressive, and USAA offer rideshare insurance in West Virginia.

State Farm

State Farm’s rideshare endorsement extends your coverage limits during periods 1, 2, and 3. This means that your personal deductible will be in effect any time you are behind the wheel, no matter which TNC you’re driving for, or which period you’re in. If you have other coverages such as medical, towing, and rental car coverage, these too will be in effect while you’re driving for Uber, Lyft, or others.

Wisconsin Rideshare Insurance

Wisconsin offers several rideshare insurance options, including Allstate, American Family, Erie, Farmers, USAA, Progressive, Safeco, and State Farm. We recommend getting quotes from all these companies to find out which policy best suits your needs.

Wyoming Rideshare Insurance

Progressive, USAA, and State Farm are the only companies offering rideshare insurance in Wyoming. Stay tuned for more options.

State Farm

State Farm’s rideshare endorsement is more extensive than most other options since they extend their coverage limits during periods 1, 2, and 3. This means that your personal deductible will be in effect any time you are behind the wheel, even when you are driving for Uber or Lyft. Also, if you have other coverages such as medical, towing, and rental car coverage, those will also be in effect even when driving for Uber and Lyft.

Canada Rideshare Insurance

Canada Rideshare Insurance: The same period one coverage gap will apply to most Canadian drivers without a specific rideshare-friendly insurance policy. Currently, Aviva/Intact Insurance is the only company we’re aware of that offers rideshare insurance in Canada.

Need an Uber Accident Attorney?

Chat with a Lawyer and read our Uber Accident Lawyer page to learn how to handle rideshare insurance after an accident.

Please leave a comment below if there’s a company we left out in your state.