Taxes as a rideshare and delivery driver can be headache-inducing for many: how many times should you file taxes? Once a year or quarterly? If you wish you could just outsource the whole thing, you’re in luck! Below, RSG contributor Tyler Philbrook outlines how 1-800Accountant can help you set up your business, do your taxes and more.

Imagine the very first ride you ever did. You were probably super nervous! Most rideshare drivers had never been behind the wheel as a taxi driver, so shuttling around a stranger was pretty out of the ordinary.

I remember worrying about: should I talk? Should I play music? What kind of music?

Many of us still remember how we felt that first day of rideshare driving – but little did we know, something even more confusing was around the corner… taxes!

Come tax time, we may have been so confused, frustrated, and just didn’t know what to do. For many of us, when everything was said and done, we felt we paid way more in taxes than we should have — and we probably did!!

In fact, The Motley Fool estimates Americans made a “$464 billion tax mistake” in 2018 – in the form of tax refunds. While getting a large chunk of money back once a year can feel great, it’s actually you overpaying your taxes and giving the government a free loan.

With the right accountant, you can better estimate how much you’ll actually owe – and neither pay too much nor too little!

There is an easier way – it’s 1-800Accountant.

This article was sponsored by 1-800Accountant and, as always, opinions are our own.

Quick summary:

- 1-800Accountant can help drivers save money, especially at tax time

- Getting started with 1-800Accountant is free

- 1-800Accountant offers more than just tax help – they can help with bookkeeping, business formation and more

Take a look at how 1-800Accountant works at our video below:

Getting Started with 1-800Accountant

Starting a business as a sole proprietorship is easy, as it’s basically what most of us did when we started rideshare driving. You drive, get paid by Uber, Lyft or another gig company, do your rideshare taxes, and keep going.

Creating an LLC, or S Corp can feel very scary, and to be honest, it’s not necessarily for everyone. However, there are instances where it’s the smarter choice and, if you’ve looked at it and decided it’s the right thing for you, 1-800Accountant can get it done.

Not only do they help you set up your LLC, but you’ll also get complimentary tax consultation, Tax ID, savings consultation, phone and email support, exclusive partner savings, business bank account, and more.

Put simply, they take something that may be difficult or overwhelming to you, break it down, and walk you through it.

Working With 1-800Accountant

What does working with 1-800Accountant look like?

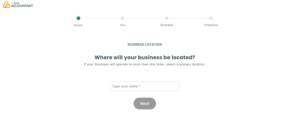

When you visit 1-800Accountant.com, just click on the “Start a business” button, and then answer the questions so they can pick the best option for you.

First, choose what state you live in.

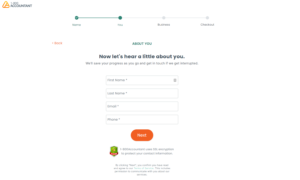

Next, provide your basic information.

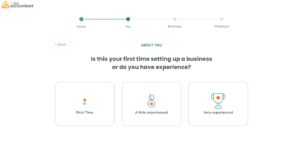

After that, tell them if you are experienced in setting up businesses, are a little experienced, or this is the very first time you’ve ever done so.

Next, they want to know how much you think this business will bring you. Is this going to be a side hustle, your new full time gig, or the next big thing?

After that, tell them when you anticipate starting the business. If you have already taken your first ride, then you have already started your own business. If you are looking into this before you start, and want to have the extra protection from forming an LLC before doing so, you’ll choose “starting now (or soon)”.

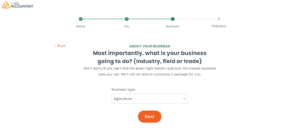

Next, determine what your business will be. The two options that I think work for rideshare drivers are “Transportation”, though that really more works for things like big trucks, and “other” because there aren’t other good options specifically for rideshare drivers.

Maybe in the future ones will be added, but for now those are both good options.

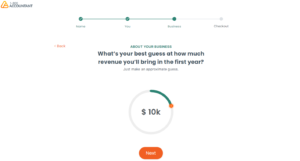

After that, answer the big question of how much you anticipate making in your first year.

Most rideshare drivers drive part time, and make less than $20,000 a year. I have tried $10,000, all the way up to $150,000 and the suggestions at the end are the same, so whatever you anticipate making in the next year, input that to get the most accurate recommendations.

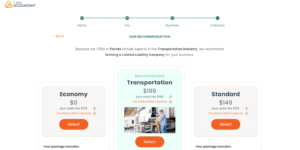

Next, you’ll get a look at the different option plans and the one 1-800Accountant recommends. Obviously, the first one most people are going to look at is the “free” one, and honestly, it does come with a lot and is a solid choice.

However, if you’re going through all the trouble to set up a business, make sure you do it right, and spend a little bit more money to sleep better at night knowing that you picked the best option for you.

Ready to get started? You can get started with 1-800Accountant using our link here!

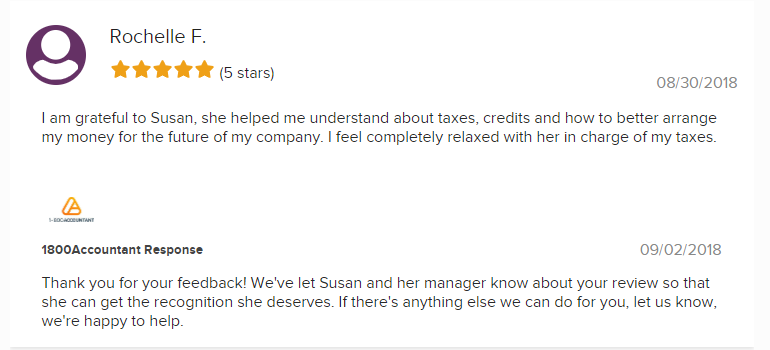

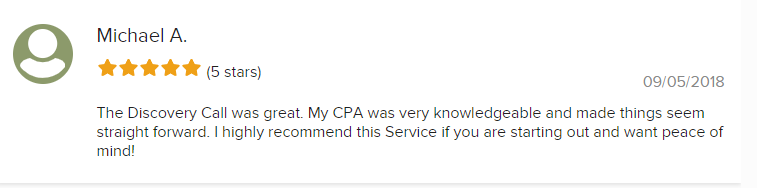

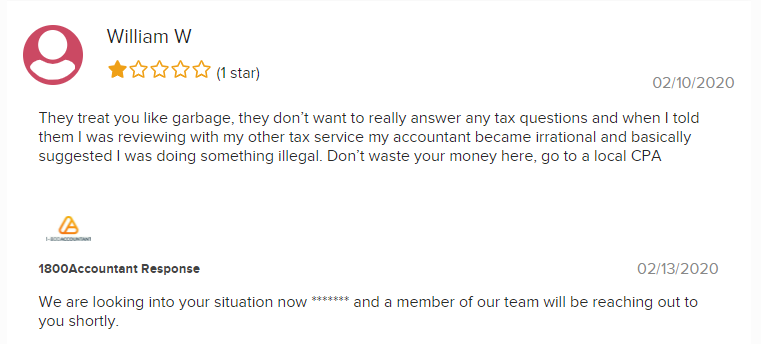

1-800Accountant Reviews

With all companies, even the best companies, you have good reviews and negative reviews. Looking online 1-800Accountant is no different.

To 1-800Accountant’s credit, with the negative reviews, they typically responded and tried to make it right. But as we all know, there is no pleasing everyone all the time.

Conclusion

Whether you have been driving for years, or are just thinking about getting started, the most important thing is to make as much money and keep your expenses as low as possible.

How can 1-800Accountant help you? There are three main ways rideshare and delivery drivers will benefit from 1-800Accountant, including:

- Starting a business based on your unique circumstances (one size fits all advice doesn’t work for everyone!)

- Business taxes – let’s face it, rideshare and delivery driving is a business! Why not save more at tax time by working with a professional?

- Bookkeeping – horrible at managing your expenses? Let 1-800Accountant do it for you! This is best for drivers who have multiple income streams.

Get started with 1-800Accountant here!

Have you ever used an accountant for your business? Let us know!

-Tyler @ RSG