Investing in the stock market may seem like a good idea, but many first-time investors find the process daunting, or if they are interested, feel like they don’t have enough money to get started. Fortunately, micro-investing platforms like Acorns have changed all that, and with just a few taps on your smartphone, your journey into the investing world can begin.

Get started with Acorns here!What is Acorns?

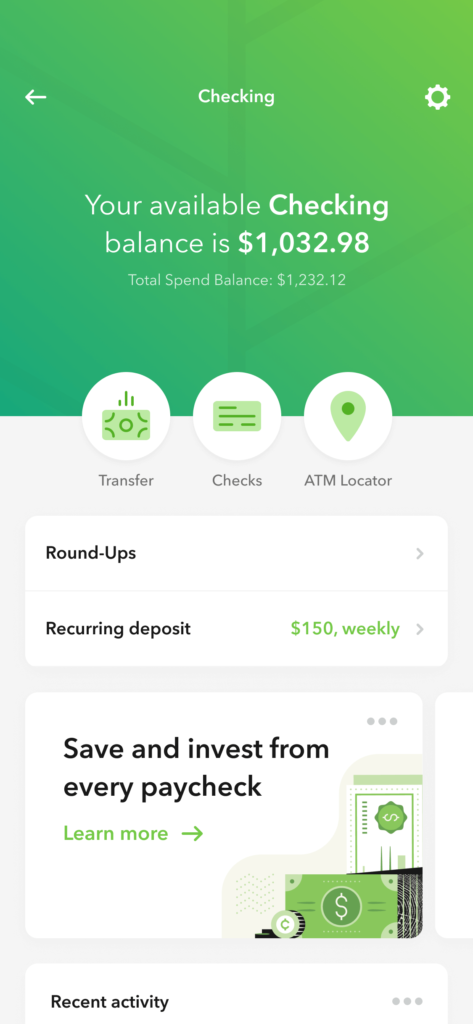

Acorns is a micro-investing platform, specifically designed for novice investors with little to no investing experience. Unlike some investor platforms, the app allows users to make small investments (there is no minimum investment required) whenever they can, and they can increase their savings by using Round-Ups every time they make a purchase with their debit card or through their checking account.

For example, if you were to make an $11.95 purchase on your debit card, Acorns automatically rounds the total up to $12, then deposits $.05 into your account as the Round-Up.

Where is Acorns available?

Acorns is only available to residents in the United States. They make exceptions for armed forces personnel that maintain a US address but are currently stationed overseas.

What are Acorns Costs and Fees?

Acorns provides users with two different price plans to choose from: personal and family.

What Are Acorns Benefits and Features

The biggest benefit of using Acorns is that the entire savings process is automatic, so you don’t have to think about it. Every time you make a purchase with your debit card or linked account, you’re adding to your investment through their Round-Up feature.

In addition, Acorns partners with 350+ other businesses that reward you with cashback savings every time you make a purchase.

How Does Acorns Work?

Acorns rounds up the amount of every purchase you make. This money is then used to buy fractional shares of ETFs (Exchange-Traded Funds), which are a combination of securities all contained within one fund.

ETFs are similar to mutual funds, except they are traded on an exchange the same way stocks are. ETFs can contain different investments, including stocks, bonds, and other types of holdings.

When you sign up for Acorns, you are asked to choose from one of five investment portfolio options. These choices range in risk levels from safer options such as slow growth (Conservative), which provides profits over a longer period of time, to a faster growth (Aggressive), which yields profits more quickly but at a higher risk.

You can also choose between options, such as “moderately conservative” or “moderately aggressive.”

Pros & Cons of Acorns

There’s a lot we like about Acorns and a few things we don’t. Since the Round-Up occurs automatically when you make a purchase, there’s nothing for you to think about or remember. It makes investing painless and easy.

Since everything is done on autopilot, you can also select a set amount to go into your account each day to add to your savings, and we like that if you purchase many items online, you can add to your investment with partnership rewards as well.

We don’t like that, while $3 or $5 in fees doesn’t sound like much, if you are only maintaining a small balance in your account, this fee can take a pretty sizable bite out of your investment. It’s also important to remember that a bad day in the stock market could cause you to lose money rather than make it.

Pros:

- $0 minimum deposit to open an account

- Invests your spare change from everyday purchases

- You can get cash back from participating retailers

- Provides educational articles and videos to learn about investing

Cons:

- High monthly fee on small balances

- Limited investment options to choose from

FAQs About Acorns

Can you lose money with Acorns?

Yes. Acorns portfolios can rise and fall, depending on how the stock market performs. Acorns does try to minimize the amount of risk investors can experience, but it is possible to lose money while investing with Acorns.

Is Acorns Better Than WeBull or Robinhood?

Comparing Acorns to Robinhood and WeBull is like comparing apples to oranges and more oranges. Acorns provides managed portfolios for investors, while Robinhood and WeBull are trading platforms that allow members to buy and sell individual stocks.

To determine which one is better for your investment needs will depend on whether you prefer to have someone else monitor your investments for you, or if you prefer to do it yourself.

Why Do I have to Give Acorns my SSN Number?

Like most financial institutions, Acorns follows The Patriot Act, which requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. In addition, Acorns needs your social security number so that they can issue you a tax reporting form at the end of each year.

Is Acorns Worth It?

If you’re new to investing and prefer to ‘set it and forget it’ instead of watching over your investments yourself, you may find Acorns well worth it, despite the monthly fee. If you don’t shop with your debit card much and choose only sporadically to invest money into the account, however, you could find that the monthly fees are eating up most of your profits.

While we think Acorns is a good way to start investing, it is important to note that this type of investing can carry risk. You should still do your due diligence to ensure you understand the risk before you invest.

Get started with Acorns here!Do you use a micro-investing app? Let us know about your experience in the comment section below.

-Kate @ RSG

Related articles:

- Acorns Review

- Current Review

- Axos Bank Review

- Ally Bank Review

- M1 Finance Review

- Chime Bank Review

- Coin App Review

- Coinbase Review

- OneUnited Bank Review

- LendingClub Review

- Starling Bank Review

- Best Stock Buying Apps

- Webull Stock App Review

- Robinhood Stock App Review

- M1 Finance Stock App Review

- Best Gig Jobs

- Varo Bank Review

- Step Review

- Tapestri App Review

- Yotta Bank Review

- PrizePool Review

- Receipt Hog Review

- Novo Review