One of the things a lot of new rideshare drivers overlook when they’re just getting started is taxes. Rideshare driver taxes might seem scary, but they’re actually pretty simple. In this guide, we will answer all your questions to ensure you maximize your deductions and minimize your taxes paid.

We will be updating this article throughout the 2024 tax season, so make sure to bookmark this and save it as you go through your taxes this year!

Now, let’s get started and see how to file your taxes as a rideshare driver.

How to File Taxes as a Rideshare Driver

Knowing how to file taxes as a rideshare driver is important because you’ll complete more than the standard 1040. You’ll need Schedule C to report your self-employment income and Schedule SE to determine the self-employment taxes owed.

Understand Self-Employment Taxes

Self-employment tax differs from regular income tax. It covers your contribution to Medicare and Social Security. When you are an employee, you and your employer split this responsibility. However, when you’re a rideshare driver (independent contractor), you are responsible for the entire amount, 15.3% of your taxable income (12.4% goes to Social Security and 2.9% to Medicare).

However, self-employment income only applies to your net earnings or profit. This is your earnings after any expenses.

Learn How 1099 Forms Work

As a rideshare driver, you won’t receive a W-2 from Uber or Lyft because you work as an independent contractor.

Instead, you’ll receive two types of 1099 forms.

- 1099-K: This form details all money collected from rides you provided. This includes the commissions the rideshare company earned, so it’s not the total income you must report. You’ll also receive a summary of the income you received from that amount that you’ll use on Schedule C to report your self-employment income.

- 1099-NEC: This form reports any payments from anything other than driving, such as bonuses, guaranteed payments, or money earned from referrals.

Currently, the tax law only requires companies to issue a 1099-K if you earned more than the $20,000 threshold, but the IRS requires you to report any income earned, regardless of whether you receive a 1099-K. Keeping track of your income yourself is vital to ensure you report it properly.

Keep Track of Your Expenses

A key factor in filing rideshare driver taxes is keeping track of your expenses. Since you’re responsible for all expenses and aspects of running your business, you may be eligible to deduct some of your expenses. This reduces your taxable income and the amount you owe in taxes.

Your largest expenses usually involve your car since it’s how you make money as a rideshare driver.

There are two ways to deduct car expenses:

- Actual expenses: You can deduct the actual expenses paid for your car, including gas, maintenance, repairs, and insurance. You may also include depreciation or lease payments if you lease the vehicle.

- Standard deduction: If you’d rather take a standard deduction versus tracking and proving every dollar spent on your vehicle through the year, you can deduct 67 cents per mile in 2024. But be sure you track your mileage driven specifically for your rideshare business.

Other expenses you may incur that you can deduct include:

- Tolls

- Parking fees

- Snacks or water for passengers

- Cellphone expenses (only those that were for your business)

You must have proper documentation to prove the expenses to be eligible for these deductions, including receipts and mileage logs. It’s best to use a mileage tracking app to ensure you capture the right mileage and don’t miss any deductible expenses.

Pay Taxes Throughout the Year

We live in a pay-as-you-earn country, but as an independent contractor, you don’t have an employer withholding taxes and paying them on your behalf, so it’s your responsibility.

Generally, if you owe more than $1,000 in taxes, you must make quarterly tax payments. These are estimated tax payments that get worked out when you file your taxes for the year. If you don’t make estimated payments and owe over $1,000, you may face IRS penalties on top of your taxes owed.

To estimate your taxes, you should pay 100% of your previous year’s tax liability or 90% of your estimated current year’s tax liability. You can estimate your annual earnings by looking at your average weekly earnings and multiplying it out over the year.

If you wait to pay taxes quarterly, here are the dates you must pay:

- April 15: Covers January 1 – March 31

- June 15: Covers April 1 – May 31

- September 15: Covers June 1 – August 31

- January 15: Covers Sept 1 – Dec 31

File Your Taxes

The final step is to file your taxes. Even if you paid estimated taxes throughout the year, you must file your official tax return by April 15, or the tax deadline for the current year.

To file your taxes, you’ll need all the documentation from above, including:

- 1099-K, 1099-NEC

- Proof of any estimated taxes paid

- Receipts and mileage logs for tax deductions

- Government-issued ID and Social Security number

You can file your taxes yourself, use tax software such as TurboTax, or hire a tax professional to do them for you.

How to Find Your Rideshare Tax Information

You can typically find your tax documents on your rideshare platform, whether you drive for Uber or Lyft. You can access your 1099-K and 1099-NECs if applicable.

Any other documents, such as deductions for specific expenses, should be either handwritten, on a spreadsheet, or tracked in a mileage tracking app that also tracks your expenses.

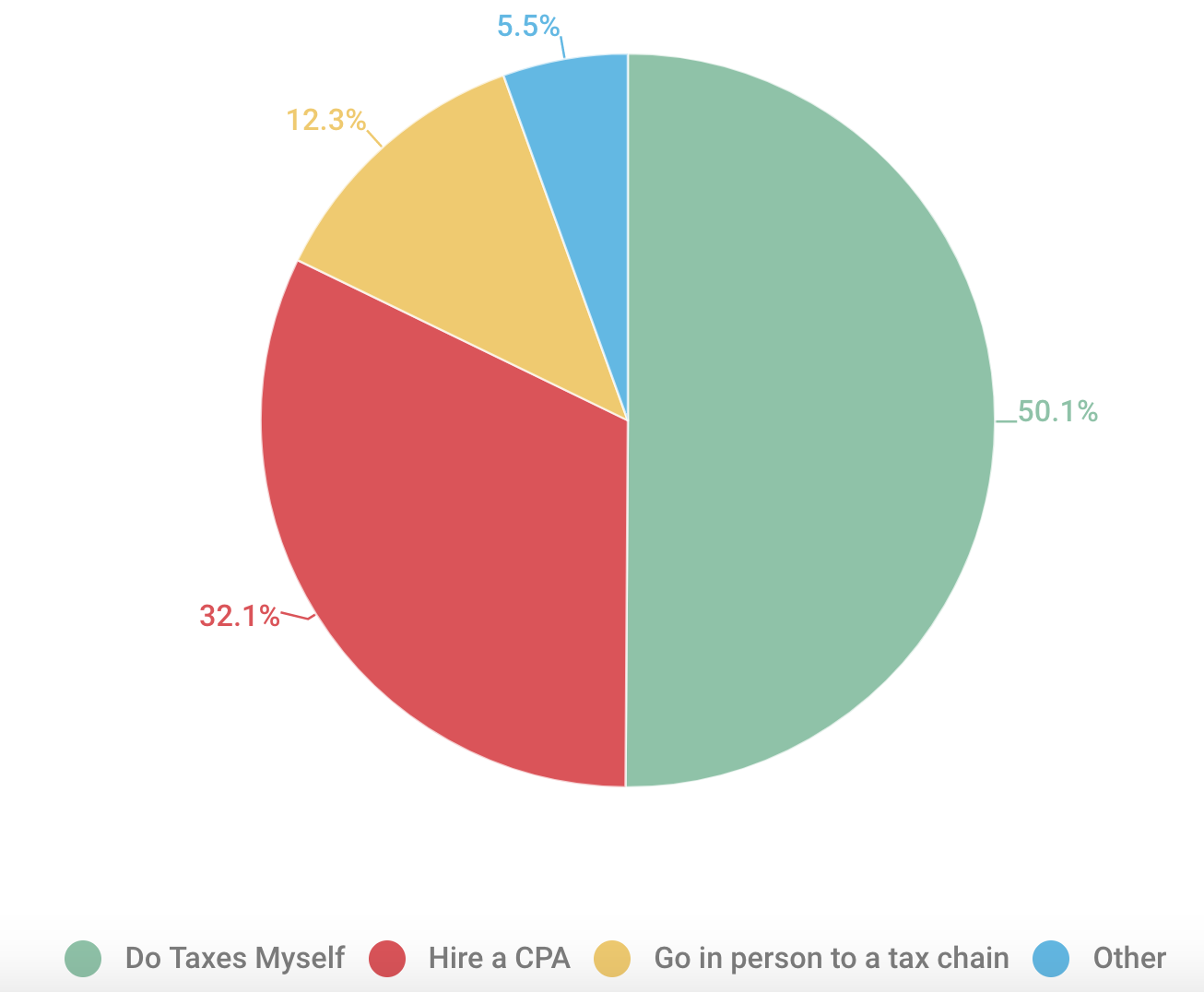

How Do Most Drivers File Their Taxes?

If you’re wondering what your fellow drivers do when they file their taxes, here are the responses from a survey I sent:

Filing Your Own Taxes

Thanks to the simple processes of e-filing, filing your own taxes is now easier than ever. There are many affordable programs to help walk you through the process step-by-step, and many options also provide professional support and assistance from real CPAs.

Two of the most popular DIY tax filing software programs are H&R Block and TurboTax.

Hiring a Rideshare CPA

Hiring a CPA (certified public accountant) to file your taxes is one of the safest routes to take because accountants know the tax code, and some might even specialize in what you are looking for.

For example, if you are a contractor, hiring a CPA to help you manage your tax documents and file each year is a safe move, especially if you have a very complex situation that requires an expert’s attention.

How much does a CPA cost?

Generally, using a CPA to file your taxes can run you anywhere from $250 to $400, depending on your situation, so it’s one of the more expensive options. The benefit of having a CPA is knowing that you can go back to the same person year after year, and they’ll keep track of all your information. You can ask questions whenever you want and receive reminders to make quarterly estimated tax payments.

When determining the right CPA, you want to work with someone familiar with and specializing in taxes for rideshare drivers. It’s best to work with someone who knows the tax code well and is up-to-date on all the deductions drivers can take and how to file for them correctly. You can also request references and ask plenty of questions to ensure you’re making the right choice.

Finding the Right CPA

Some important questions to ask your rideshare CPA include:

- What does your service include, and what are your fees?

- How do you bill for your services?

- What is the best way to communicate with you? Do you prefer communication online, by email, in person, or by other means?

- What specific documents do I need to send you to get my estimates and file taxes by the deadline?

- Can you send me regular reminders of when quarterly estimates are due?

- Can you represent me if I get audited by the IRS?

- Do you have references?

Best Tax Software for Rideshare Drivers

1. TurboTax

TurboTax is one of the most popular tax filing programs. They offer a ‘Self Employment’ tax filing program and a wealth of information and tools like their Tax Bracket Calculator, Self Employed Expense Estimator, and a tool to import mileage and expenses tracked in Quickbooks Self Employed.

TurboTax guarantees their calculations are accurate, and if you get audited by the IRS, TurboTax will provide free guidance from a professional and pay any IRS fees, so there’s very little risk on your end.

Uber partners with TurboTax, offering rideshare drivers discounts on TurboTax Self-Employed products. Otherwise, the price is $89 to file or $169 to use Turbo Tax Self Employed Live.

Get started with TurboTax using our referral link here.

2. H&R Block

H&R Block has tax filing offices nationwide, but you can probably spend less by filing taxes online or downloading their software program. As a rideshare driver, you’ll want to use their Premium Online tax filing service for $60 or Premium & Business service for $71.20. Both options include filing one state tax return, too.

Just like TurboTax, H&R Block offers a maximum refund guarantee and a 100% accuracy guarantee. They also provide free audit guidance and support.

Get started with H&R Block using our referral link here!

3. FreeTaxUSA

FreeTaxUSA is an IRS-approved e-file provider and a top-rated tax-filing software program. As their name suggests, you can file advanced and simple returns for free, not including state fees.

As a rideshare driver, you’d be looking at their free advanced tax filing service. Here is a snapshot of all the situations that qualify.

You can import data from prior tax returns done with TurboTax, H&R Block, and Tax Act, and their system will check for over 350 different tax credits and deductions that you may qualify for. Since FreeTaxUSA doesn’t charge for advanced tax returns for contractors, you probably ask yourself, ‘what’s the catch?’

While they don’t charge for Federal returns and also offer a 100% accuracy guarantee, the company charges $14.99 for state returns and other additional services they sell. For example, you can pay an additional $7.99 for priority support, audit assistance, and amended returns.

Get started with FreeTaxUSA here.

4. Tax Act

Tax Act offers self-employed tax filing services for $69.99 online. You can easily import things like income, expenses, depreciation, and more while receiving step-by-step guidance for a maximum refund.

While Tax Act says you can complete your federal return in just minutes after importing all your information, they offer year-round tax support and planning and 7 years of access to a digital copy of your return.

Like TurboTax and H&R Block, Tax Act offers multiple tools and resources to make the tax filing process smoother and more understandable.

Get started with Tax Act here!

5. Liberty Tax

Liberty Tax has their own tax filing online service that is affordable for freelancers and contractors. The best package for rideshare drivers is the Premium service for $85.95.

The Premium package is for anyone with self-employment income, business deductions, unreported tips, or other complex tax issues.

Liberty Tax offers all the standard accuracy guarantees, support, and audit guidance, along with the ability to send your tax return to a local office for a free double-check. They have an advanced software system that is great for someone who’s been e-filing on their own for a year or two.

One thing I really appreciate about their system is the safeguards they put in place to warn you if you input information that could trigger an audit so you can understand more about how that works.

Get started with Liberty Tax here.

Frequently Asked Questions

Completing your rideshare driver taxes can seem overwhelming, but plenty of support is available today. Here are some common questions rideshare drivers have about filing taxes.

How do I file for taxes if I drove for multiple companies?

If you drove for Uber and Lyft, you can combine your total income reported on the 1099s you receive (or your own documentation) on Line 1 of your Schedule C. Be sure you have accurate records from both companies regarding income earned and expenses paid to ensure you pay what you owe, but also get the appropriate deductions.

Why is the amount on my 1099-K from Uber higher than what I earned last year?

The 1099-K you receive from Uber includes all fees customers paid for any drives you accepted. This is your gross income, but Uber sends a tax summary showing the exact amount of the direct deposits you received, which is what you’ll claim.

Why didn’t Uber or Lyft send me a 1099? How can I do my taxes without a 1099?

Current tax law only requires companies to send 1099s if you earn over $20,000 in the tax year. They may not send one if you don’t, but that doesn’t mean you don’t claim your income. Be sure to keep track of your income and expenses yourself to ensure you properly file your taxes.

Can I take the standard mileage deduction if I rent a car to drive for Uber and Lyft?

You cannot take the standard mileage deduction on vehicles you rent for rideshare. Instead, you can deduct the actual expenses paid to rent the vehicle and any other expenses you incur.

What can I do if I forgot to track my mileage?

If you forgot to track your mileage, you can come up with an estimate of what you think you drove, along with a written explanation of how you came up with that number.