Harry here. Tax time is over but one thing I learned from all the questions I got is that drivers are still leaving a lot of money on the table when it comes to deductions. Today, RSG senior contributor Christian Perea details a recent night of driving and shows exactly how you can track your deductions and save on taxes using a new 100% free app called Stride Drive.

Seems like everybody these days wants to know how to make more money driving for Uber. But it turns out, one of the easiest ways to make more money without spending more time behind the wheel is to not donate half your paycheck to the government. Taxes may not be super sexy, but if you play the game right, you could owe close to nothing at tax time. In this post, I’m going to show you how using Stride Drive.

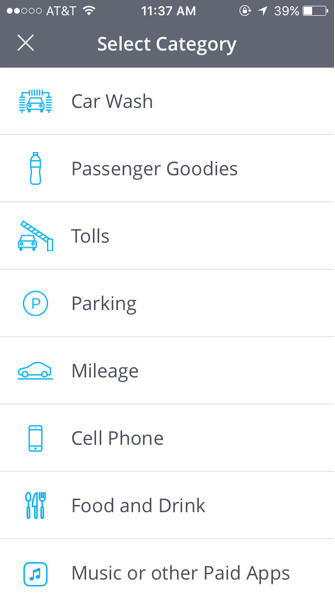

You might know some of this already, but stay with me. First off, pretty much anything you spend money on while on the clock is something you can write off – your mileage (this is the biggest one), water bottles and candy for passengers, tolls, parking, your cell phone, your meals, music apps … you get the idea. One little known fact about mileage tracking – not only can you count the miles while you have a passenger in your car, but you can count the miles between passengers too. That’s huge.

Many try and track all these things manually. They find themselves scribbling notes down in a notebook, on the backs of receipts, it gets messy. Others may solely rely on Uber but they will only provide your on-trip mileage at the end of the year. In in this piece, I’m going to talk about my experience using Stride Drive, a free app that simplifies all of this.

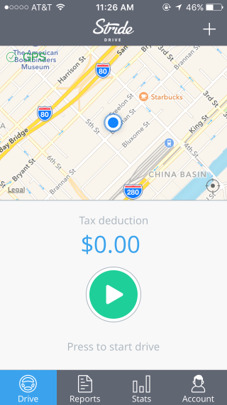

The Stride Drive app looks like this –

When you start working, just hit the big green start button and when you’re done driving for work, hit the button again and it will stop recording. (Note: if you run a personal errand while driving, you should stop tracking miles just for that segment). For every mile you log, the IRS lets you deduct $0.54, and the app does it all for you. This takes advantage of the fact that not only can you count the miles while you have a passenger in your car, but you can count the miles between passengers too.

They also have a screen where you can enter in most of your other expenses. We’ll get more into this later, but it looks like this:

You can also link your bank account to the app and all of your credit card charges will show up – then you can just select and categorize any expenses that are tax deductible. I like this feature, because you get reminders to review recent transactions, to make sure you’re not leaving any tax deductible expenses on the table. And no keeping track of paper receipts!

The company behind this app is called Stride Health (you might have heard of them). They provide a free tool to rideshare drivers to find affordable health coverage which is also great (I got my plan through them a year ago).

Going out for the night in San Francisco with Stride Drive

Before I left my house, I hit the mileage record button on the Stride Drive app. I had to get some driving supplies and then I drove to the Best Buy in the Mission district of San Francisco and flipped on the Uber app at 5:55 pm.

First Ride 6:05 – 6:15 pm: UberX, 1.94 miles, 10 mins, $7.97

Note: I begin recording miles as soon as I login to the Uber app and continue from pickup through drop-off. After I drop-off I keep the app running in the background while I wait for my next pickup.

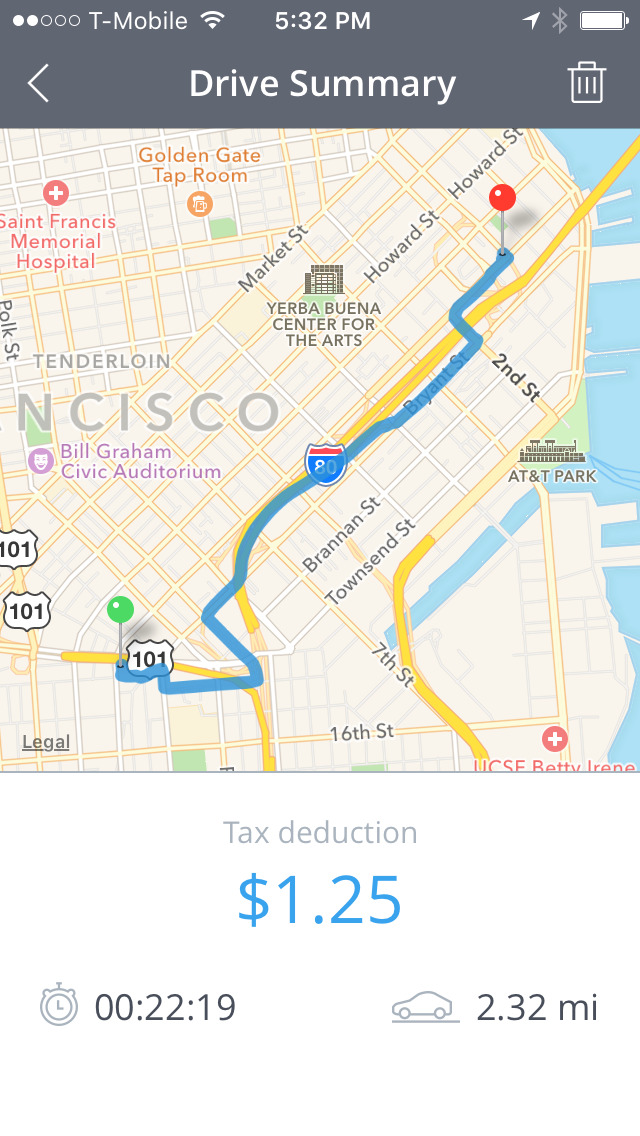

6:24 – 6:38: UberPool, 1.55 miles, 14 mins, $8.69

This person was ready curbside at 2nd and Howard. Nice quiet young female professional. She made a joke about how she didn’t want to walk up the hill. I told her that people not willing to walk up hills have paid off a few of my credit cards.

6:48 – 6:56: UberX, 1.28 miles, 8 minutes, $3.90

7:05 – 7:13: UberX, 1.1 miles, 8 minutes, $3.75

I drive a lady who told me she spent $9,800 on SoulCycle classes last year. Wanna guess where I drove her to?

7:15 – 7:27: UberX, 1.71 miles, 12 minutes, $4.95

A man spends 12 minutes staring at his phone. I drive like Ricky Bobby.

7:42 – 7:57: UberPool, 2.8 miles, 15 minutes, $5.90

8:00 – 8:21: UberX, 5.3 miles, 21 minutes, $9.52

Give a ride to two Kiwi girls who are playing hide and seek when I try to pick them up.

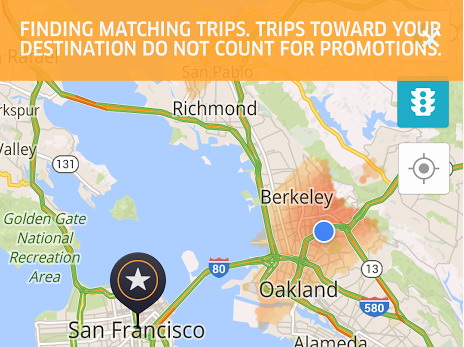

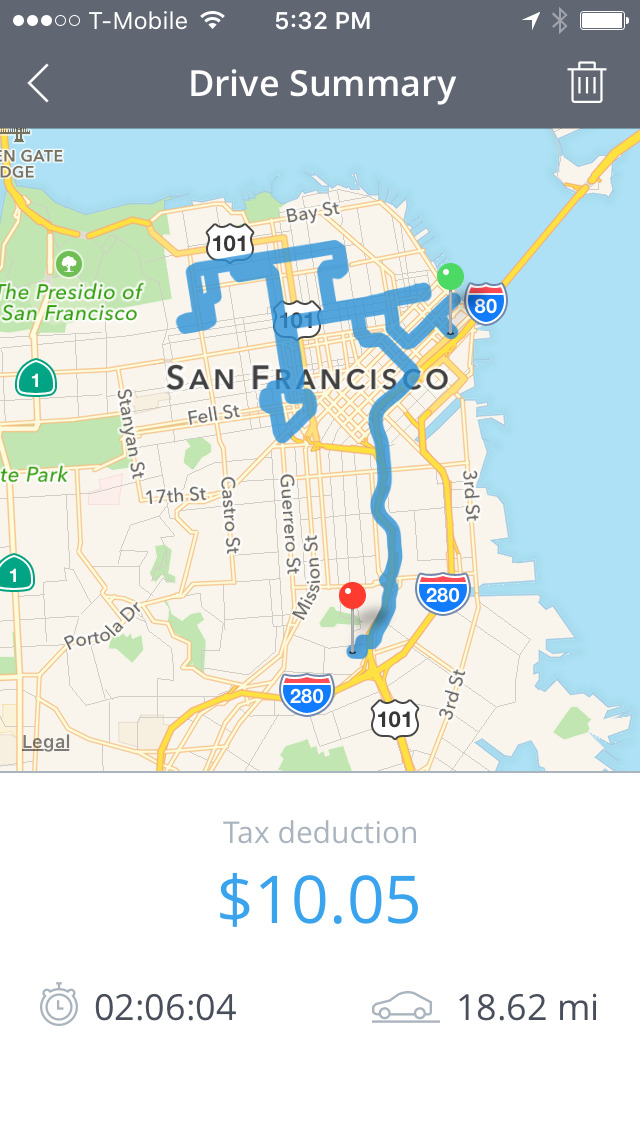

All the places I drove in 2 hours!

8:30: I Take A Break and Review My Progress

At this point, I had been driving for 2.5 hours and had been consistently busy with almost back-to-back rides. BUT there had been no surge AT ALL.

I checked the Uber app to see how much I had made so far. Only $41.53. I then checked Stride Drive to see how many miles I had driven to make that money. Results were 20.94 miles for $41.53 from seven rides. They had all been pretty easy, but $16.61 an hour isn’t all that much in SF. That being said, utilization was pretty efficient as I had a passenger in my car for 1 hour and 28 minutes of the 2 hours 30 minutes I was logged in. Fortunately, I would be able to deduct $11.30 of that $41.53 since I had the mileage recorded via Stride Drive.

I get out of the car and do some stretches and lunges to prevent my legs and back from tightening up. I log in again at 8:45 pm.

8:47 – 9:07: 20 mins, 5.86 miles, $9.93

I get a ride from Bernal Heights to Tacolicious in North Beach. 3 girls talk about how all guys named “Chad” are bros.

Next Ride: I Make A Tough Judgement Call

The next ride I got was an UberPool. It was starting to surge heavily and this one (of course) wasn’t on surge. I went in initially thinking I could make it quick and get back as it peaked at the ball game.

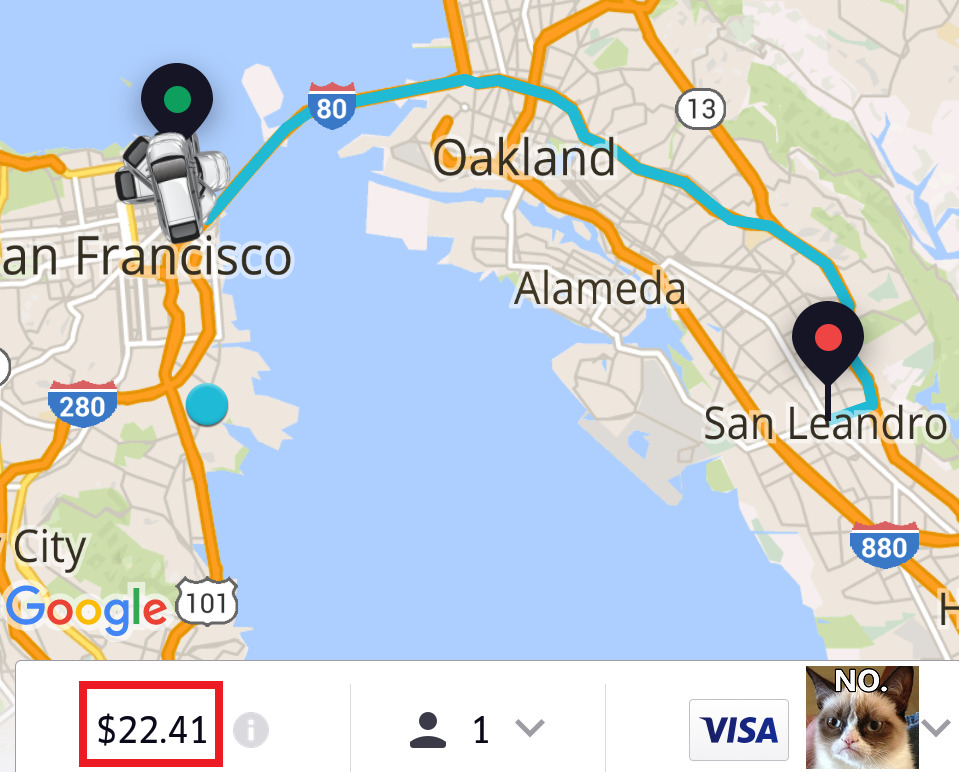

I arrive. She gets in the back seat. I swipe to begin the trip. San Leandro! UberPool to San Leandro only pays between $20 and $30 after Uber takes their cut. It would involve an hour to get there and back, while dropping me in a place where the rates are $0.85/mile! It makes no sense for anybody to do this ride unless their car is free. I politely asked her to request another Uber since “I had a place to be in an hour and couldn’t leave the city” which wasn’t a lie. The place I needed to be was in San Francisco.

9:22 – 9:50: 1.6X, 20.2 miles, 28 minutes, $41.76

Turns out I made a good call because the next ride I got was on a 1.6x surge. I picked up a professional in the financial district who went to happy hour. This ride was also going to be long, but since it was on some surge I figured it would be worth it, but just barely. I get all the way out to Orinda and drop her off.

I check Stride Drive to find I racked up $16.05 in mileage deductions to get out there and will do the same getting back. I only get taxed on about $10 worth of that ride, but obviously it’s better to get a paid ride back to the city if I can.

10:16 – 10:25: UberX, 4.49 miles, 9 minutes, $4.95

I set my destination filter and get a ride right away. I drive a nice couple home from trivia night at the local pub. East Bay rates are really terrible (.85/mile) so I make it a point to get back to the city ASAP.

Decision Point: Should I Chase This Surge?

What did I do? I know from experience that surge in East Bay tends to be pretty volatile. It comes fast, hits heavy, and leaves quickly like a cyclone. $0.85/mile it’s a pretty big gamble, since I need to get 2.0x to really make it worth it. I decide to keep destination filter on and return to SF.

Back In SF

11:02 – 11:12: Lyft, 3 miles, about 10 minutes, $6.33

I flip over to Lyft for a quick ride.

11:14 – 11:30: Lyft, Around 4 miles, 16 minutes, $11.30

Couple on a date.

11:41: Dinner time

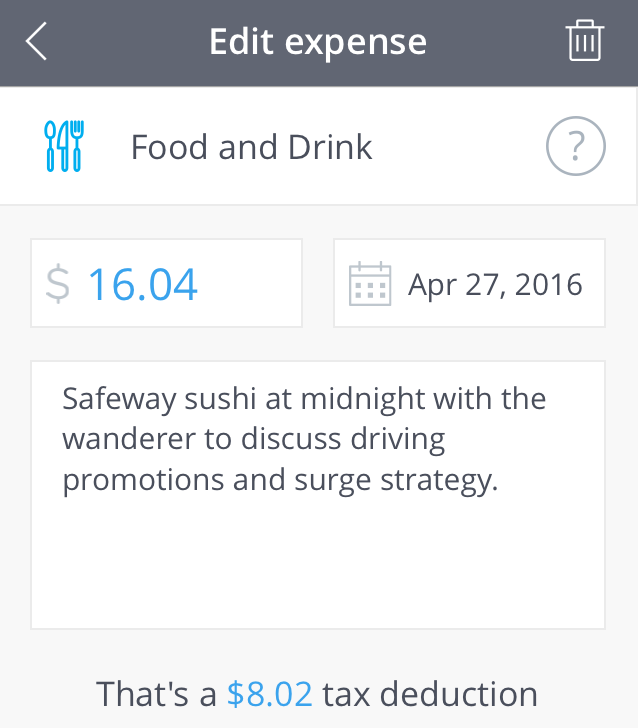

I start feeling hungry and decide to stop for some Safeway sushi with another driver for a meaningful business discussion about our night on the road. Yet another opportunity to write off an expense. Bingo.

I ended my night by setting my destination filter on Lyft to my house and recording it via Stride Drive in order to maximize the mileage I could deduct. When I got home, I had driven 97 miles for the night in a little under six hours and netted $115.80, spending 4 hours and 30 minutes online with Uber and 20 minutes online with Lyft. I had spent about another hour taking breaks, and I made it home around midnight.

My Nightly Numbers

When it came to net earnings I had made $98.17 on Uber and $17.63 on Lyft for a total of $115.80. When you divide that by the 5.5 hours I spent working, the hourly total came out to $21.05/hr net. This doesn’t include expenses like gas, tires, and depreciation on my vehicle, or taxes.

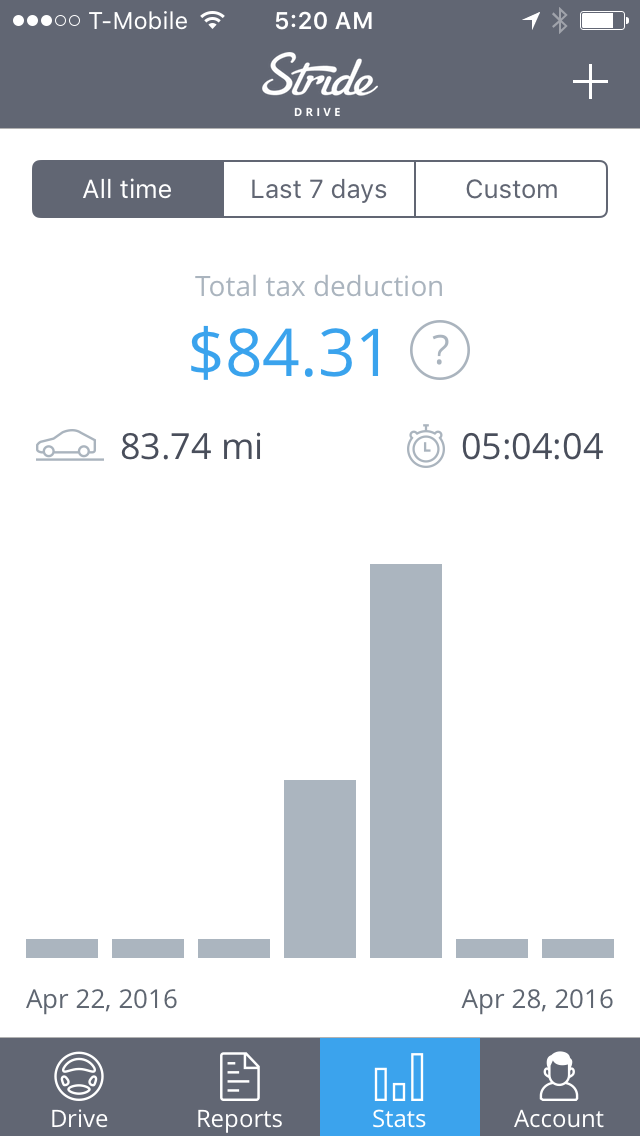

Total Money Saved on Taxes Using Drive

Taking a look at my Stride Drive app, at the end of the night I managed to log 94.85 miles as business miles for a $51.22 deduction. I also recorded the $25.07 I spent on driving supplies at the beginning of the day as well as 50% of the $16.04 that I spent on dinner. This all added up to $84.31 in deductions that will offset my income, which translated into a total of $31.49 of taxable income.

Had I only used what Uber gave me as miles to deduct via ride miles, it would have instead been 53.24 miles for a $28.75 mileage deduction and a taxable income of $87.05 throughout the night. That means I got 293% more tax deductions by recording my mileage and deductions with Stride Drive. Awesome (and crucial for my business)!

Much of that came from remembering to deduct my driving supplies and meal expense. Lesson learned: you should always be on the lookout for incidental deductions – these are items that you would have spent money on anyways. Things like meals are a great example since you have to eat every day/night, so you might as well take a deduction for the money you’re spending on your food.

Also, since I recorded all of my mileage between passengers I was able to compare total mileage tracked on Stride to miles where I had a passenger in the car to find that throughout the night I had a passenger in the car for 53.24 of the 94.85 miles I drove that night, a utilization rate of 56.13%.

My Take

It was great to get back on the road, even though the money wasn’t a home run the night I drove. But now that I drive part-time instead of full-time, there is a lot less stress. I was slightly disappointed with $115.80, and may have done a little better on Lyft that night, since there was more Prime Time and less driver saturation.

Still, I’m super happy about the fact that Stride Drive kept me from owing barely anything on taxes. Give Stride Drive a spin so you can instantly start keeping more of your rideshare income. You can download the app for free by clicking here. This is an awesome new product and it’s also 100% free so if you’re not tracking your mileage & expenses yet, this is a great option.

Drivers, what do you use to track your mileage and what do you think about my earnings on this random Tuesday night in San Francisco?

-Christian @ RSG