Another state has joined the ranks in suing Uber and Lyft to classify rideshare drivers as employees instead of independent contractors. You know all about California and AB5, but today the focus is on Massachusetts.

Massachusetts Attorney General Maura Healey said in a video announcement of the lawsuit: “Uber and Lyft set the rates. They alone set the rules. Drivers are employees.”

“It’s time for Massachusetts to stand up for our values, our laws, and our workers,” Healey continued. So we’ll see Uber and Lyft in court.”

ANNOUNCING: We are suing @Uber and @Lyft for misclassifying their drivers.

Billion-dollar businesses don’t get to pick and choose which laws they follow. Tune in for our live press conference at 11AM here: https://t.co/ONVUH6HNBr pic.twitter.com/Xlm7tv82Yn

— Maura Healey (@MassAGO) July 14, 2020

We want to know what you think! Given what you’ve seen of COVID and unemployment benefits, would you rather be an employee or remain an independent contractor? Take our new survey here!

Why Is Massachusetts Announcing a Lawsuit Now?

The COVID-19 pandemic helped open the eyes of lawmakers to the fact that gig workers are without benefits and protections that regular employees are guaranteed by law. This helped spur Massachusetts leaders to force companies like Uber and Lyft to reclassify their drivers as employees and afford them these benefits.

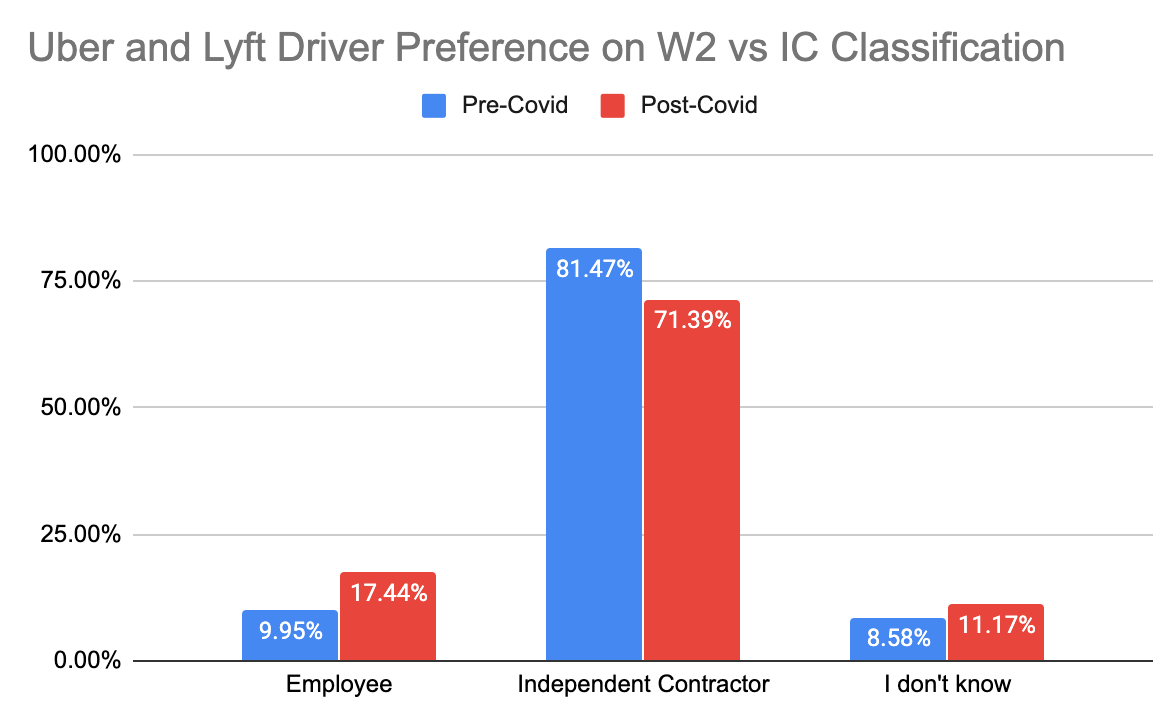

A few months ago (5/6/20-5/11/20) we sent out a survey to our e-mail list of 80,000 drivers across the country and posted on social media asking for responses to a simple 9-question survey and received 734 responses.

The goal of the survey was to determine how Uber and Lyft drivers felt about employee vs independent contractor status in the wake of the coronavirus pandemic – have drivers’ attitudes toward becoming employees vs. independent contractors changed?

It turns out that 71% of drivers surveyed still want to be independent contractors. Prior to COVID-19, 81% of drivers stated they wanted to remain independent contractors.

No matter how you look at the info, most drivers would rather be independent contractors than employees.

In that vein, with the current state of the world in reference to the pandemic, drivers might be fearing what Uber and Lyft could do during times like these if they were employees instead of independent contractors. In recent news, Uber and Lyft have been laying off employees at alarming rates.

In that vein, with the current state of the world in reference to the pandemic, drivers might be fearing what Uber and Lyft could do during times like these if they were employees instead of independent contractors. In recent news, Uber and Lyft have been laying off employees at alarming rates.

This kind of reclassification would affect the almost 200,000 drivers in Massachusetts. Now, as COVID shows no signs of abating and unemployment benefits are so rocky for independent contractors, would drivers want to be considered employees?

At the Rideshare Guy, we’ve done polls before to see what drivers think. Let’s see what you’re thinking now by taking an updated poll in light of Massachusetts taking a stand.

What Does This Mean for Drivers?

It’s reasonable to assume that Uber and Lyft will fight this lawsuit, tooth and nail. They have shown this based on the ballot measure (Protect App-Based Drivers and Services) that is set to be on the November ballot in California. This measure is meant to be a new law in place of AB5 with specific language for rideshare drivers and other gig delivery workers.

If they are looking for a fight, they’ll have to gear up for a big one. New York and Illinois are also looking into similar legislation.

Some might argue that drivers knew what they were getting into when they signed on to drive for Uber and Lyft as independent contractors. They were well aware they would be in charge of finding their own health insurance and that paid time off and sick leave were not factored into it.

If you want to take time off from driving, you just don’t go on the app that day. Many also argue that rideshare driving is meant to be a part-time gig and not meant to be considered a full-time job or a career.

Granted, with the pandemic raging through the country, I’m sure more than one driver has taken advantage of the Pandemic Unemployment Assistance (PUA) and have enjoyed being treated like an employee in that respect without having to pay into unemployment from their earnings with Uber and Lyft. But, of course, that is unprecedented and will likely not happen again in our lifetimes.

Of course, there is an argument for drivers being employees as well. We don’t get to set our own rates (with the recent exception of California). We are at the mercy of Uber and Lyft deciding if we’re allowed to drive; they can deactivate us for basically any reason—or no reason at all. These things make it feel like we’re being treated like employees instead of independent contractors without the benefits that go with the classification.

Where do you fall in the independent contractor versus employee argument? Share with us your reasons below and don’t forget to take our survey!

-Paula @ RSG