Rideshare driving and other gig working opportunities are flexible, but they also pose some challenges as well. One of those challenges is often knowing when to drive and how to maximize your earnings.

Since you have so much more control over your jobs, it makes sense that many gig workers want to make the most of their time on the platforms they work and not leave any money on the table.

Solo is an app that helps drivers and gig workers uncover the secret element they need to ensure success on their platforms: data.

What Is Solo?

Solo is an app for rideshare drivers and gig workers that uses data and analysis in a powerful way to help improve driver performance and maximize earnings.

Their mobile app makes running your business-of-one easy by seamlessly managing your income, expenses, work-related miles, and taxes, and—in major metro areas—their smart schedule will show you the best hours to work with predictions they back through their Pay Guarantee program!

This Seattle start-up began with one goal in mind: to empower solopreneurs by providing the necessary data needed to help them earn more money in less time.

Solo uses a worker-first mentality after talking to thousands of workers and finding out that they find the unpredictability of gig work apps frustrating and a little scary.

It’s no secret that app workers have it harder when it comes to finding the proper resources to do their jobs efficiently.

Solo gathers various data points that you generate when you’re driving for Uber or Lyft, picking up for DoorDash, or doing any other app job. Then, Solo analyzes that data and provides actionable insights for you to start using immediately to become more efficient.

In 2020, co-founders Bryce Bennett and Keith Ng founded Solo. In 2021, the company received $5.3 million in seed fundraising dollars.

“When working with Uber, we got to see some of the key challenges app workers face which is knowing how to optimize their time,” said Keith Ng. “Everyone has an income goal and with Solo we’re trying to bring that same level of income confidence as someone with a W2 job.”

Other supporters include Fuse, Ascend, and our very own Harry Campbell from The Rideshare Guy.

Solo App Features

Drivers and gig workers receive quite a few things when they sign up for Solo.

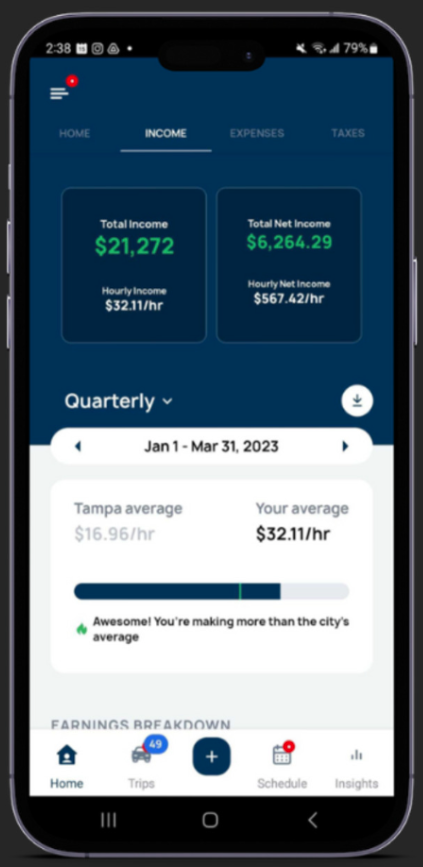

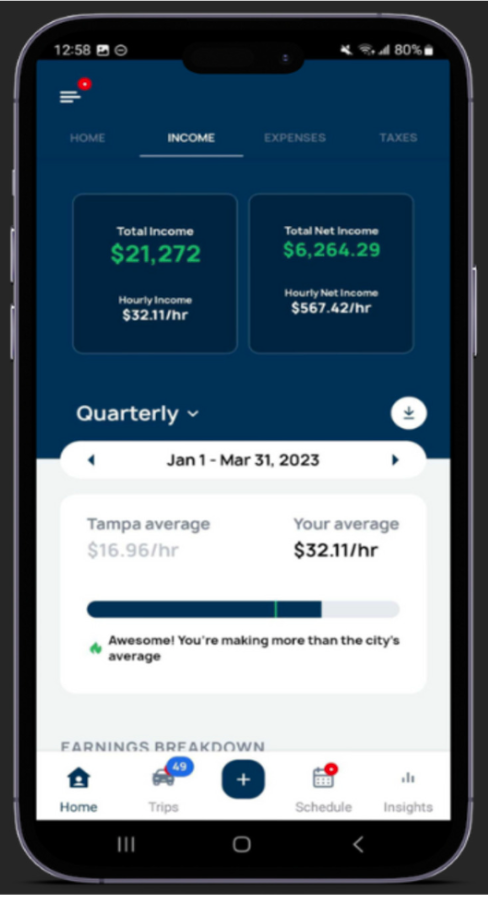

- Automatically Track Your Income

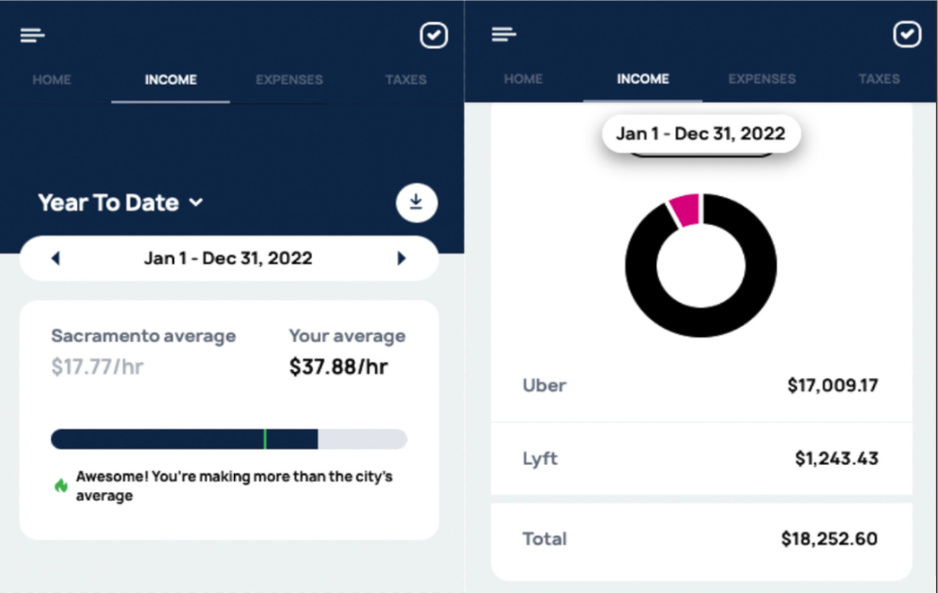

First, Solo helps you automatically track your income across gig platforms in one dashboard. Tracking income across multiple jobs is challenging but important, and Solo definitely takes the stress out of tracking and managing it all.

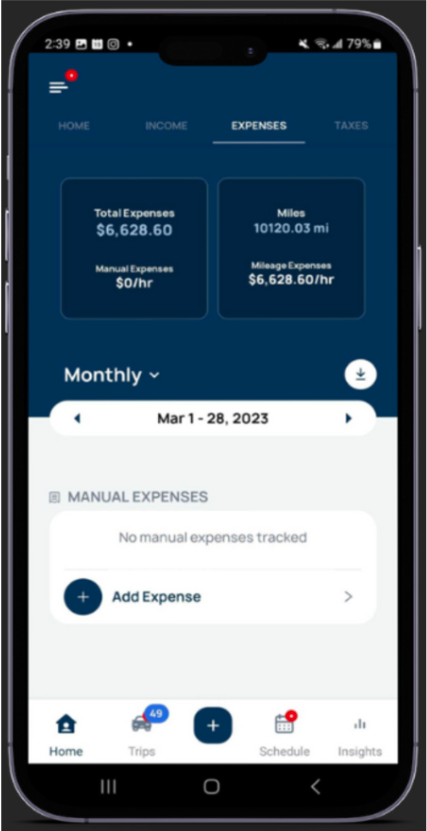

- Track Your Expenses

You can make maximizing your tax deductions easy by tracking your business expenses with Solo. You can take unlimited photos of receipts when you track expenses in the Solo app, so you never miss a deduction.

- Track Your Mileage

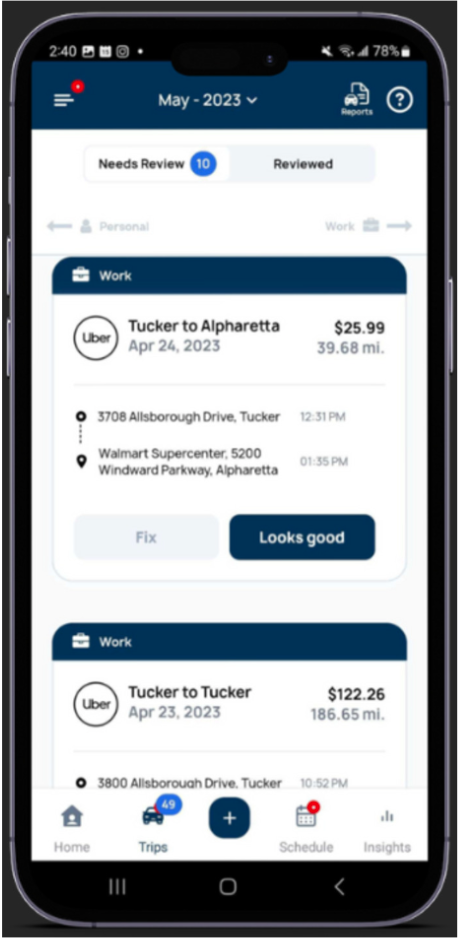

Solo’s “Trips” feature for mileage tracking is easy and seamless to use. Solo’s smart features automatically track your deductible miles by detecting when you are driving so there’s no need to manually log each start or end of a trip.

Solo knows when you’re working, so it will automatically classify your gig work trips when you link your work accounts with them.

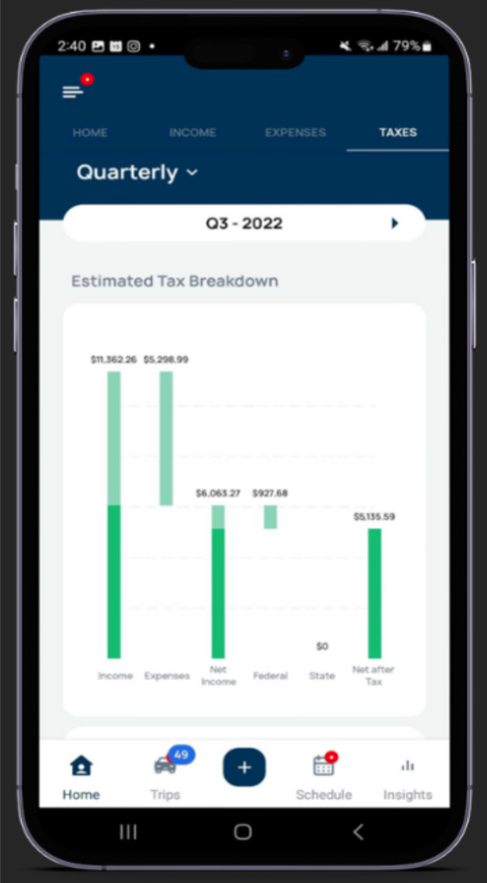

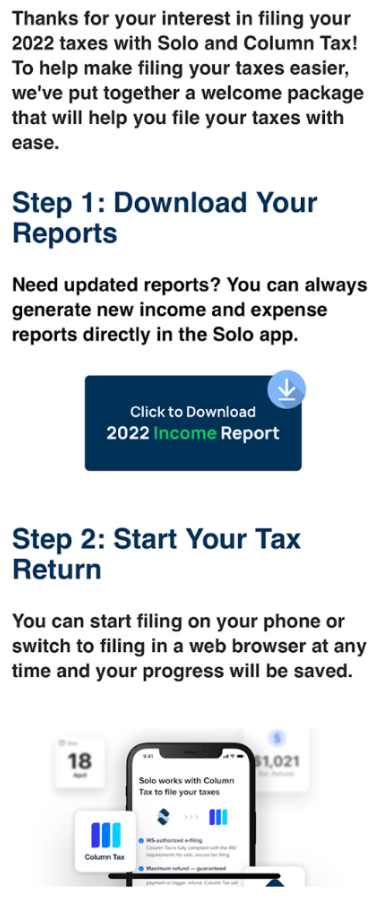

- Project and File Your Taxes

Worrying about paying your taxes is at the top of all gig workers’ minds starting January of each year. Solo makes it easy to file your taxes and plan ahead for tax season year round. Solo uses your tracked income and expenses to give you a real-time view of your federal and state income taxes so there are no surprises.

Solo also allows you to file your federal and state taxes directly through the app. In 2024, Solo Pro or Pro Plus subscribers can file for FREE while Basic subscribers can file for a flat fee of $30 and never any upsells. If you aren’t ready to subscribe to Solo but still want to use their tax filing feature, you can still file for $50 and no upsells.

- RideshareGuy Senior Contributor Jay Cradeur reviewed the feature earlier this year.

- Smart Schedule

Solo optimizes your work schedule by using community earnings data for your city to help you know when, where, and what job you should work across various gig platforms. These hourly pay predictions are ideal since most drivers are signed up with more than one app. It even breaks down income prospects by base rate, tips, bonuses, and incentives. Solo sees that workers who have 3 or more jobs earn up to 40% more per hour when they use the Smart Schedule feature.

Solo’s Smart Schedule is available in over 100 metro areas and counting —head to their website to learn more and see what cities these features are available in. As Solo grows, this option will roll out to more cities.

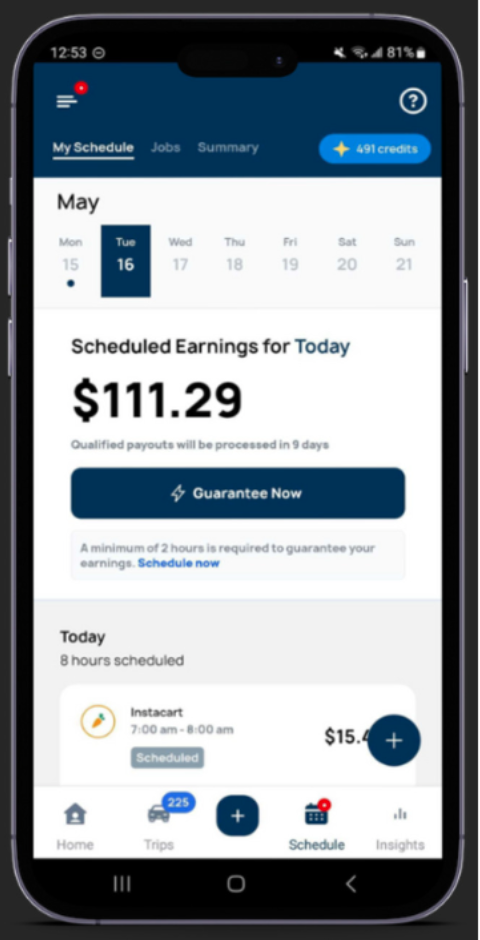

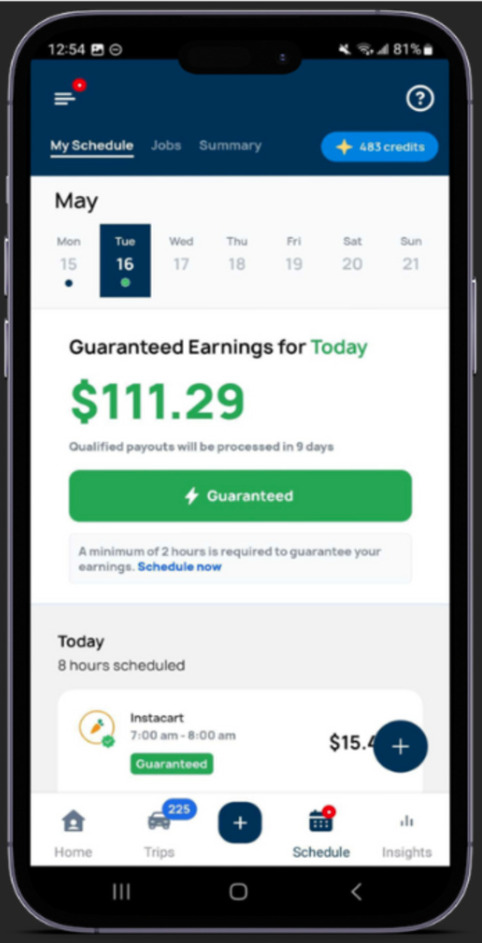

- Solo’s Pay Guarantee Program

Using the Smart Schedule (mentioned above), Solo also offers a daily income floor in 100 major metropolitan areas across the country. After you craft your ideal work schedule, you can use credits to guarantee the hourly rates shown in the app with their Pay Guarantee program.

If you work the hours you guaranteed in the Solo app, and end up earning less than their prediction, Solo will pay you the difference — that’s how confident they are in their algorithm! Guaranteed hours are reviewed daily for your work activities from two days prior. To date, Solo has guaranteed rideshare and gig app workers over $14 million.

Related:

- Market Insights

Solo helps you become an expert of your market by sharing market level insights about where you work. With the Airports + Events, drivers can easily pinpoint high demand rider areas to keep you moving and earning. You can also find new jobs that are available in your area and what the average earnings are. Plus, with Solo’s Leaderboard, you can check out how your earnings rank against other Solopreneurs.

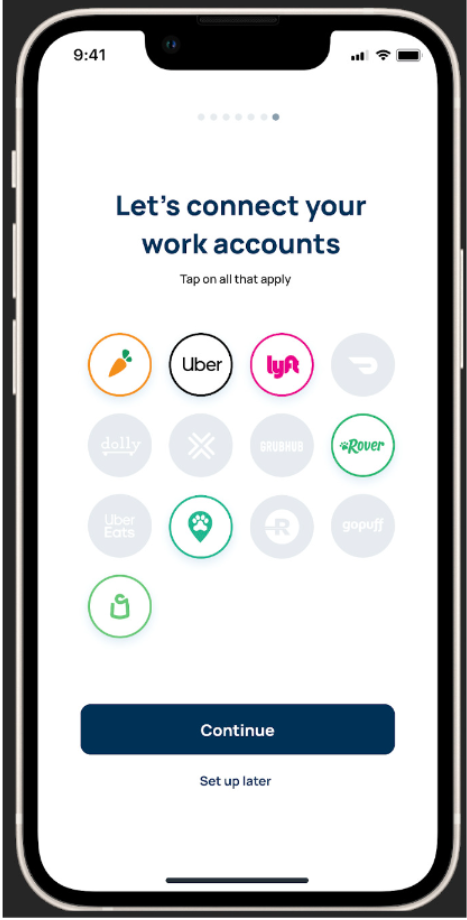

How To Get Started With Solo

Solo offers a risk free 7-day trial before you decide which subscription package is right for you. You can get started easily by downloading the Solo app from the Apple or Google Play store and securely linking your active app-based platforms.

Solo integrates with many apps like Uber, Lyft, GrubHub, Instacart, GoPuff, and more.

From there, you can start tracking important data in real-time and using it to your advantage.

Solo helps track and optimize your income and keep track of expenses, which will also help you prepare for taxes.

You can compare your hourly earnings with what others are making doing similar work.

What People Are Saying About Solo

Solo’s website claims workers make 20% more than other solopreneurs using the same gig apps. That’s a pretty big deal, but we always like to see what other workers are saying about the app.

I haven’t run across that many drivers using the app, however, the ones who did generally liked their experience. One driver commented that the Pay Guarantee feature was tricky for them since Solo only tracks your ‘active hours’ when you’re accepting trips.

Solo cleared this up by confirming that in order to qualify for their Pay Guarantee program, you need to complete at least one job per hour within a day. Jobs are defined as trips, deliveries, orders, and other activities depending on your app.

Here’s what other workers are saying about the app:

“I use it and it’s awesome! They already launched their pay guarantee in Seattle and it’s live in Miami now too. The guaranteed pay thing is legit and it’s almost like free insurance since you know that you will get paid what they predict. You just have to make sure you allow the app to track your miles while you work to qualify but this is helpful for tax write offs.” – Reddit User

“Solo is an amazing App if you gig drive. I’ve had it for a while now but never really used it until a couple days ago. Why I didn’t take advantage of it then is beyond me! I drive full time for 3 different platforms and this app is going to be a lifesaver. Documented mileage, tax info, weekly planner. Guaranteed pay! I’m so excited! P.S. Sailing and the Solo team really do a great job showing care, sharing information and making sure everyone feels welcome!” – Google App store review

Is Solo Safe To Use?

There are so many apps out there these days, and it seems like most of them want your data.

Digital security has always been important to me and I like to know what people are doing with my information.

When speaking with the co-founders of Solo, I gained a clear understanding of how Solo works in this sense and the security measures the app takes.

The app doesn’t store your credentials and also has 2-factor authentication. Solo uses Plaid-level security and anonymizes your gig work data to produce community-driven insights.

For instance, you may want to know the best times to drive for Uber in your city. Solo analyzes and aggregates data anonymously from other users to produce these results to benefit everyone. So think of it as a small business assistant working in your best interest.

Coming up with all these insights manually would be a full-time job in itself so I fully appreciate the level of transparency Solo takes in terms of safety and security.

Takeaways For Drivers

Rideshare driving assistant apps are becoming increasingly popular these days and with good reason.

As a driver or gig worker, you’re an independent contractor and should have access to data such as your mileage, the best times of day to drive, which apps to use during the day, and more.

Solo makes it easy to aggregate this data all in one place and use it to maximize your time on the road and boost earnings. Solo is also one of the only apps that allow workers to do this easily.

Solo would be a great option for anyone driving for multiple apps, delivering items, and using other apps that integrate with the platform.

Get $10 when you download Solo, link your active gig work account(s), and subscribe to a paid plan ! Connected accounts must have a minimum of one previous job, be using the latest version of the app, and have a connected payout method (Venmo or Paypal) in order to qualify for the RSG X Solo subscription bonus. Bonus amounts are subject to change.

Didn’t receive your bonus right away? Don’t worry — Solo subscription bonuses will be processed every Tuesday for the previous week (Monday-Sunday). As long as you have your Venmo or Paypal connected to your Solo Wallet, Solo will send the bonus amount as soon as Solo verifies you have linked your active gig work accounts. Bonus amounts are subject to change.

Additional Info: Tax Preparation For Drivers: Solo + Column Tax

From Senior RSG Contributor Jay Cradeur

In my case, I only work with Uber and Lyft. I have synced both, and now I have access to all my earnings and some excellent reports through Solo.

Since Solo has access to all your gig earnings and expenses, through the Solo app, you can also file your tax return directly through the app as well! This future feature makes completing your tax return a breeze.

This year, Solo will actually pre-fill your tracked mileage and expense information to make filing your taxes even easier.

- Gather Documents

For my tax return, I’m using my Uber and Lyft earnings.

You can download the information from Solo if you have Solo synced with your gig companies. I’m old school, so I downloaded my 1099s from Uber and Lyft through their respective websites.

You can also print out your 1099s and include them with your tax return. Additionally, I added revenue from a 1099 Misc. from a company called Teachable, which hosts a few courses for which I have contributed content.

- Entering Data

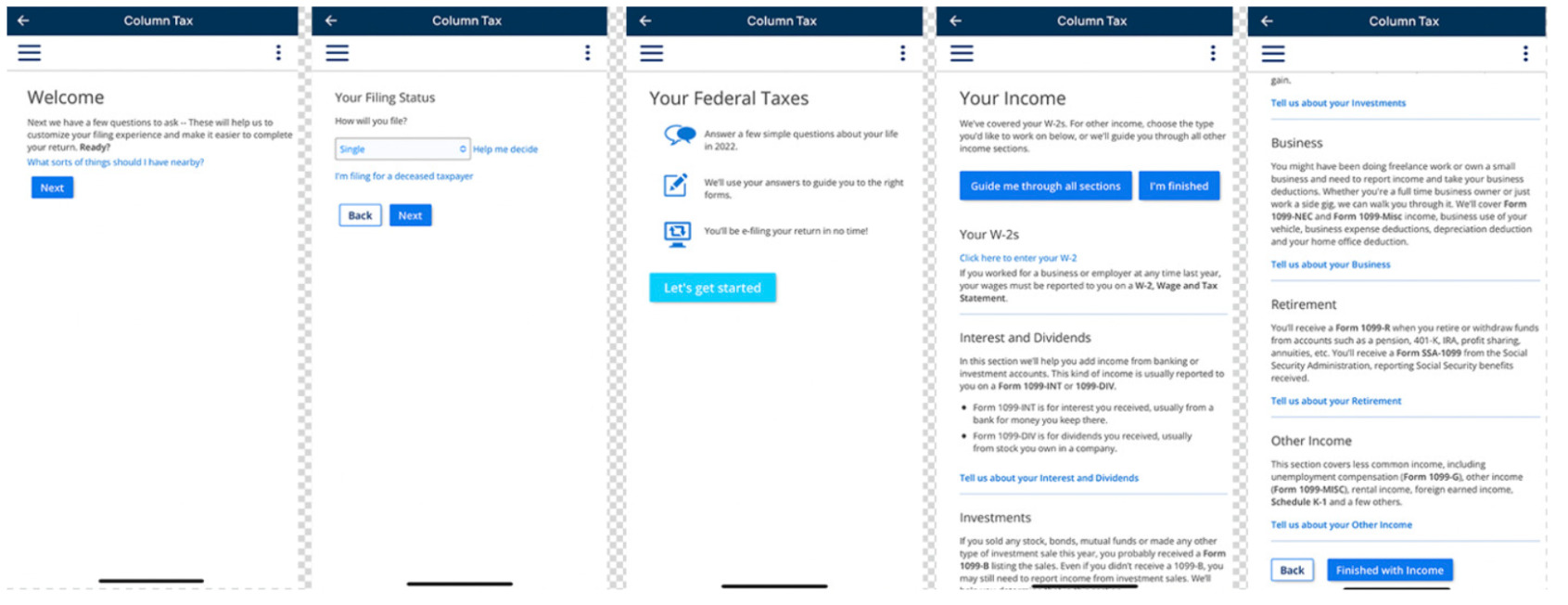

At first, I was concerned that I could only prepare my tax return through the app on my phone. Fortunately, I can also access my tax return on a web browser, which allows me to use my computer and mouse to input data.

- Federal Tax

Inputting your data is similar to the other tax software programs you may have used. You will enter your personal information, revenue, expense, and special circumstances, and then you are done.

Here are a few screenshots of the initial input screens:

The key is to have all your data handy so that you can input all of it. Solo makes it easy to stop, take a break, and resume inputting your data.

Once you have input all your data, you can download a preview version of your tax return. You can double-check all your entries, see what you owe or what you may be refunded, make further revisions, and then file your taxes.

- State Option

Solo also gives you the option to select a state and prepare your state’s tax return for filing. You won’t have to pay for the tax feature of Solo until you are ready to file your taxes. This is different from TurboTax, which requires me to buy the software first and then enter my data.

Solo vs. Turbo Tax Price Comparison

The Solo tax option for Pro and Pro Plus subscribers is FREE with your subscription.For Basic subscribers, you can file for $30.00 and no upsells. Even if you aren’t a Solo subscriber, you can also file for a flat fee of $50.00 and no upsells. Compare that to Turbo Tax at $75.99 from Amazon. Solo provides a $15 savings.

Need Help? You Can Contact Column Tax Support

Solo provides a customer support email, so if you have questions, you can ask and get an answer in a reasonable amount of time.

Solo cannot provide tax advice. For all tax related questions, please email Column Tax at support@columntax.com or consult a tax professional.

Key Takeaways for Solo + Column Tax Service

Doing taxes is always a bit of a drag. No one likes to do it. But we have got to pay the man.

Solo is a new player in the tax software industry. This year (2023), their service is comparable to software products like Turbo Tax and provides a $15 savings.

Next year (2024), when all the data you are accumulating in Solo can automatically integrate into your tax return, that will be amazing. The synchronicity is profound. Therefore, Solo has quite a bright future.

Check out their website and their FAQ page to learn more about their service and features.