What’s the future of AB5, Proposition 22 and the PRO Act? Our latest article on the PRO Act and state-by-state legislation here.

Uber and Lyft are pulling out all the stops against a bill in California called AB5 that could turn rideshare drivers from independent contractors into employees overnight. It could also impact drivers of food delivery services as well!

AB5, as its known, passed the state Assembly a few weeks ago and is now headed for a hearing at its first policy committee in the state Senate.

It aims to codify a California Supreme Court decision (known as the Dynamex Case) from 2018 that would instruct businesses to use an ‘ABC test’ to determine whether workers for top gig jobs are independent contractors or employees. And as you’ll see below, Uber and Lyft FAIL this test with flying colors.

This bill is no joke since it could set precedent in other states and if drivers were to become employees, it would cost the companies a ton of money. We don’t know exactly what life would look like for rideshare drivers if we were to become employees, but it’s clear that Uber and Lyft see this as an existential threat to their business.

Uber really doesn’t want you and me to become employees of Uber.

In their latest attempt to quell the employee movement, Uber has released an 18-page document that provides Uber’s ideas about how to improve the rideshare drivers’ experience. Uber’s CEO Dara Khosrowshahi even penned an op-ed in the New York Times detailing why this matters.

Watch our video analysis below or here: Uber’s New Benefit Fund for Drivers

Note: If you’re a reporter needing more information or an interview, contact me: harry[at]therideshareguy.com

The Potential Impact of AB5 for Rideshare

If you haven’t read the text of the bill yet, I suggest you go take a look at it on the site of the California Legislature. I like to think that my audience is pretty thorough, so if you really do care about this issue, go read it – it will take less than 5 minutes. There’s a bit of legalese, but I also found the latest Bill Analysis (5-24-19) to be helpful.

Basically, the bill is trying to codify a California Supreme Court decision from 2018 called The Dynamex Case. From The Verge,

The California Supreme Court ruled on Monday in favor of workers for a document delivery company called Dynamex Operations West that were seeking employment status. The drivers for the delivery service first brought their case over a decade ago, arguing that they were required to wear the company’s uniform and display its logo, while providing their own vehicles and shouldering all the costs associated with the deliveries.

As part of this decision, the CA Supreme Court also laid out an ‘ABC Test’ to help businesses determine whether workers are employees or independent contractors.

The ABC Test

To hire an independent contractor, businesses must prove the following (my take is below in italics):

- (A) that the worker is free from the control and direction of the hirer in connection with the performance of the work, both under the contract for the performance of such work and in fact.

- Uber and Lyft set the rates, deactivate you if you fall below a 4.6 star rating and have lowered rates over the past 5 years and replaced them with Quest bonuses that tell you when and where you have to drive. I would say they fail this one.

- (B) that the worker performs work that is outside the usual course of the hiring entity’s business

- Uber and Lyft’s business is to get passengers from Point A to Point B like a taxi and drivers are the ones who get riders from Point A to Point B, so I would say they also fail this one.

- (C) that the worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed for the hiring entity.

- Around 22% of drivers work more than 40 hours a week for Uber and Lyft so this might be one that they’re sort of ok on.

In order to hire an independent contractor, you must meet all of the requirements in the ABC test, so you can see that Uber and Lyft would fail this test pretty easily. So if AB5 passes in its current form, it’s a good bet that Uber and Lyft would have to designate all of their drivers in California as employees instead of independent contractors.

That would mean they would have to abide by minimum wage laws, pay into unemployment, provide benefits and more.

What Uber and Lyft Are Doing to Stop AB5

Last week, Uber and Lyft sent out e-mails and in app notifications to drivers in California asking for their support. Yes, just a couple months after cutting driver rates in LA, a move that spurred nationwide protests, Uber is now asking drivers for their help.

The irony is astonishing. From Uber:

Recent changes to California law could threaten your access to flexible work with Uber. Unless lawmakers take action now to modernize the law, you could lose your ability to work with multiple apps and control when and where you drive.

After years of Uber double speak, it’s important to take anything the company says at this point, with a grain tablespoon of salt. This is the same company that once told drivers your earnings will go up after a rate cut before their own study later disproved it. And while the wording sounds ominous for drivers, it’s not really what AB5 is saying – remember, you read it.

If AB5 is passed, the law would require drivers to be treated as employees, but it would be up to Uber to decide whether you can work with other apps and deal with the scheduling issues.

Uber has announced various changes to driver pay and flexibility in late 2019 and 2020, but how have those changes affected drivers? We analyzed what it was like driving for Uber in California after the changes to surge and pay.

Would Employee Drivers Lose Their Flexibility?

One of the key arguments that Uber and Lyft are making against the switch to employees is that drivers would lose their flexibility, but as many labor experts have pointed out, there’s nothing in the law that says employees can’t have a flexible schedule.

But we also live in a reality where I can’t think of a single job that comes anywhere close to the flexibility of driving for Uber and Lyft.

I think it would be more fair to say that the business model could drastically shift but even then, we don’t know what it would be like if drivers were to become employees. There are a lot of unknowns.

Would we lose some flexibility? Probably.

It doesn’t take a rocket scientist to realize that if drivers were guaranteed a minimum wage, you wouldn’t be able to just flip the app on anytime from 10 am-3 pm because there would be way too many drivers and not enough rides.

Here are just a few of the unintended consequences that could happen if drivers became employees:

- Drivers would get minimum wage + 57 cents per mile reimbursement (good)

- Uber and Lyft could limit drivers to no more than 40 hours per week to avoid paying time and a half for overtime (bad)

- Uber and Lyft could limit drivers to under 30 hours per week to avoid having to pay healthcare costs (bad)

- Drivers could be prevented from working for multiple apps (bad)

Want to learn more about Uber and Lyft’s strategies to combat AB5? Take a listen to this podcast with Alex Rosenblat on what AB5 means for the rideshare industry.

Uber Turns Up the Heat

On Monday, October 5, 2020, the CEO of Uber, Dara Khosrowshahi, launched another blog post explaining the financial repercussions of switching drivers over to employee status versus independent contractor.

Dara doesn’t sugar coat it when throwing out the numbers of drivers who would be out of a job if Uber is forced to make the change to an employee-based model.

He states: “Uber conducted an analysis to measure the economic impact of requiring all drivers in the U.S. to be employees. Before COVID-19, nearly 1.2 million drivers in the U.S. were actively earning income on Uber’s platform each quarter.

According to our research, if Uber instead employed drivers, we would have only 260,000 available full-time roles—and therefore 926,000 drivers would no longer be able to work on Uber going forward. In other words, three-fourths of those currently driving with Uber would be denied their ability to work.”

Dara also mentioned that this number didn’t really change when you take full-time versus part-time drivers into consideration. There would still be about 900,000 drivers out of a job.

I think most people can agree that the current model isn’t working, but also the employment model has some holes as well. If an employer really cares about their workers—no matter how they are classified—they would do everything in their power to make the majority of their workers happy.

Drivers need fair wages, flexibility and basic employment needs. Uber and Lyft can do better and should do better.

Uber and Lyft are Agreeing to Two Major Concessions

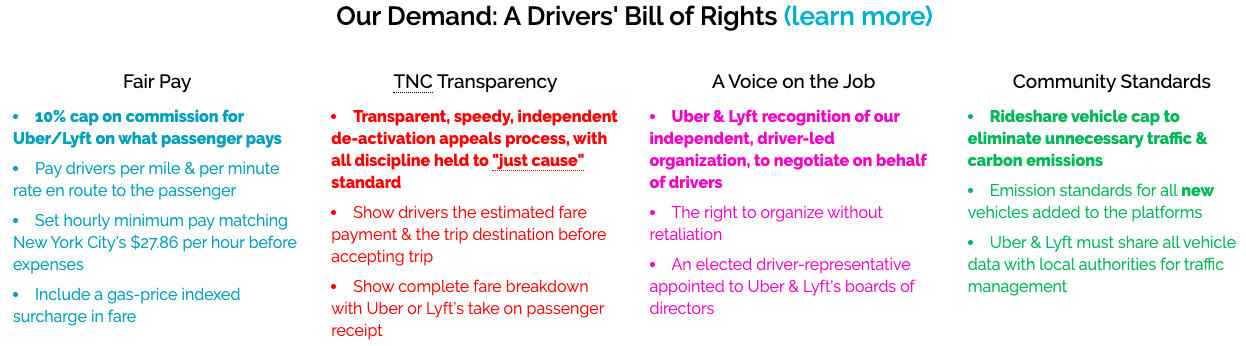

In their joint op-ed, Uber and Lyft made it clear that they do not want to see drivers become employees so instead, they’re willing to give drivers a minimum wage and form an organization that would advocate on driver’s behalves IF legislators allow drivers to remain independent contractors.

I like both of these concessions and I think a minimum pay requirement based on utilization (like what we saw in NYC) would be a good thing for drivers since it would ensure a pay floor for drivers and that Uber/Lyft wouldn’t be able to flood the streets with drivers.

The initial results of the NYC rules look promising too, with many drivers reporting to me that they are earning more. And a recent Buzzfeed analysis of TLC data indicated that drivers are now earning $16.33 per trip vs $14.22 before the minimum pay requirement was instituted.

And again similar to NYC’s Independent Drivers Guild, I think an organization that is independent from Uber and Lyft and represented drivers would be a good thing. The IDG in New York has advocated on behalf of drivers for all the issues they care about: higher pay, lower commissions, benefits, etc (I’m on their e-mail list) and they are getting things done in NYC.

What Drivers Think of Becoming Employees

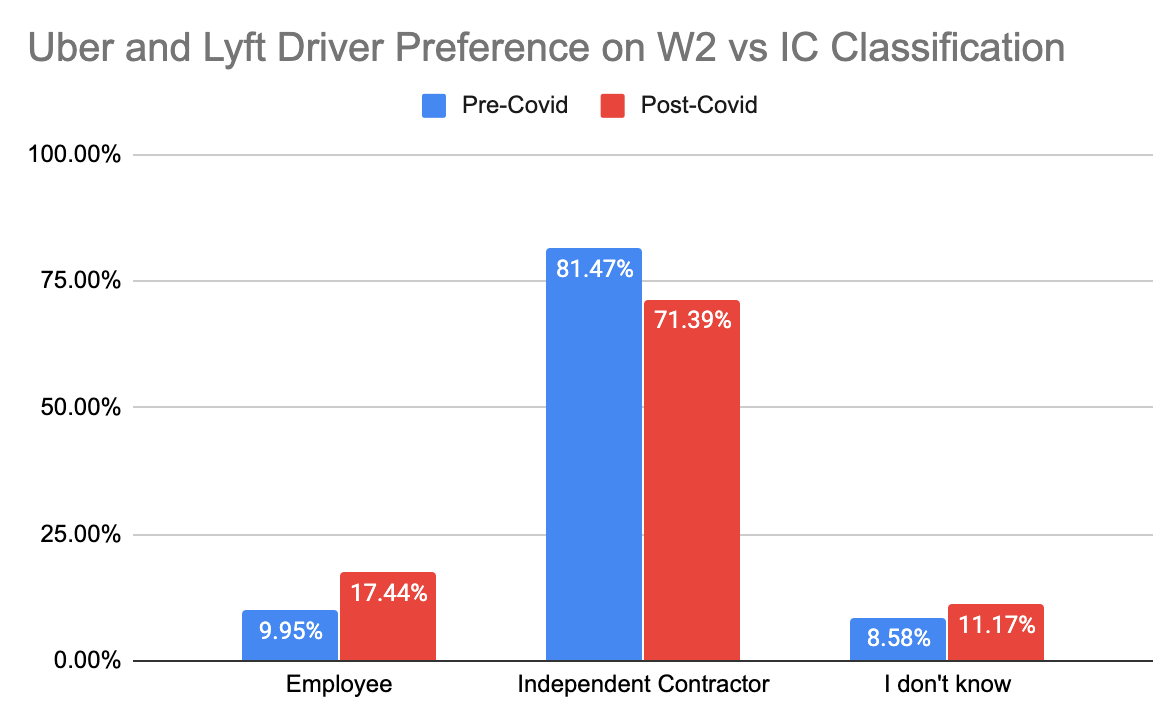

We recently (5/6/20-5/11/20) sent out a survey to our e-mail list of 80,000 drivers across the country and posted on social media asking for responses to a simple 9-question survey and received 734 responses.

The goal of the survey was to determine how Uber and Lyft drivers felt about employee vs independent contractor status in the wake of the coronavirus pandemic – have drivers’ attitudes toward becoming employees vs. independent contractors changed?

It turns out that 71% of drivers surveyed still want to be independent contractors. Prior to COVID-19, 81% of drivers stated they wanted to remain independent contractors. So, no matter how you look at the info, most drivers would rather be independent contractors than employees.

In that vein, with the current state of the world in reference to the pandemic, drivers might be fearing what Uber and Lyft could do during times like these if they were employees instead of independent contractors. In recent news, Uber and Lyft have been laying off employees at alarming rates.

In that vein, with the current state of the world in reference to the pandemic, drivers might be fearing what Uber and Lyft could do during times like these if they were employees instead of independent contractors. In recent news, Uber and Lyft have been laying off employees at alarming rates.

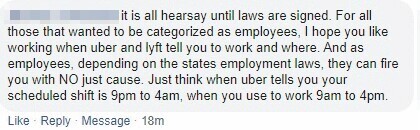

When we shared the news on The Rideshare Guy Facebook page, the immediate reaction from drivers was also not pleased.

This driver expressed a common concern among drivers: loss of flexibility on when to drive.

For many drivers, flexibility and the opportunity to turn on your app whenever to earn money is one of the biggest perks of being an Uber or Lyft driver. If drivers become employees, this could potentially lead to the loss of this perk.

This driver also expressed disappointment in potentially earning less. While there’s no evidence drivers will earn less if they are employees, it’s a common concern we’ve heard from drivers. Employees with paychecks often have other expenses associated with the protections of being an employee.

We don’t yet know what an ‘Uber or Lyft driver employee’ could look like, but New York City gives us a glimpse into what this could look like.

In New York City, Uber and Lyft are required to pay minimum fares and they have completely overhauled the way drivers go online with schedule blocks and shifts.

Under AB5, drivers would be allowed benefits as full-time employees, but there’s nothing to say that Uber or Lyft has to allow their drivers to be full-time drivers.

Uber and Lyft could literally cut drivers off from the app when they are nearing the minimum hours for a full-time employee, in essence ensuring they won’t have to pay those benefits because they have no full-time employees.

If you’re confused about the difference between becoming an employee vs remaining an independent contractor, take a look at the video below, where Harry discusses the differences and shares what he believes to be the best outcome for drivers:

Arguments from Both Sides

I spoke with Nicole Moore from Rideshare Drivers United (RDU) about the lawsuit and what it means for drivers. Harry actually interviewed Nicole about RDU last year – take a listen here: Nicole Moore on Fighting for Drivers with Rideshare United.

Want to hear more from gig workers groups? Listen to this podcast interview with Rebecca Stack-Martinez from Gig Workers Rising on AB5.

Before I dive into what she said, I’m going to give a brief background of RDU. According to their website drivers-united.org, “We’re Uber and Lyft drivers uniting for a fair, dignified, and sustainable rideshare industry.”

When speaking with Nicole about RDU and the lawsuit, she emphasized how critical it is that AB5 be enforced. “The government is doing what it should be doing,” she stated. “They are enforcing the law. I am so proud.”

Nicole went on to say that the reason she and many others feel that Uber and Lyft are countering AB5 with the Protect App-Based Drivers and Services (PABDASA) ballot measure is because they are afraid of losing their own flexibility in what they can and cannot make drivers do.

Many arguments for PABDASA focus on the flexibility of drivers and state that only with PABDASA will drivers keep their current flexibility, which is what many drivers want. They want to be able to go online whenever they want and they want to be able to accept whatever rides they want.

RDU and Nicole’s argument is that drivers will be able to maintain their current flexibility while Uber and Lyft follow the current laws in place thanks to AB5 because that is the way the apps and systems are currently set up. In order to take away that kind of flexibility, Uber and Lyft would have to do a complete overhaul of their processes, and it would be unlikely they’d spend the money and take the time to do so.

But the counterpoint to RDU’s take is what’s happening in New York City, where Uber and Lyft are required to pay minimum fares and they have completely overhauled the way drivers go online with schedule blocks and shifts.

Another big part of RDU is to allow drivers to unionize and have a voice for themselves and each other without retaliation from Uber and Lyft.

Now, on the side of the Protect App-Based Drivers and Services (PABDASA) coalition—they want to maintain the independent contractor categorization while also getting a few perks from Uber and Lyft.

One reason some drivers are skeptical of this coalition and what they represent is that the ballot measure they are supporting on this November’s ballot is being largely backed by Uber and Lyft.

I reached out to the coalition and was given a recent press release to reference. Part of the press release states:

“Today, members of the Protect App-Based Drivers & Services coalition expressed significant concern after the state and three city attorneys announced a lawsuit that seeks to take away the choice that app-based drivers make to work as independent contractors. If successful, this lawsuit would force more Californians out of work and eliminate access to these essential services when millions are relying on them.”

It does not outline how the lawsuit would put current app-based drivers out of work, but hints that if drivers have the independent contractor categorization taken away, they would not be able to continue what they are doing if classified as an employee instead.

Here’s What Should Happen

I don’t think there’s any way Uber and Lyft will allow AB5 to pass in its current form since we’ve already seen them take extraordinary measures in the form of a triple op-ed, galvanizing support from drivers and a whole lot of lobbying behind the scenes.

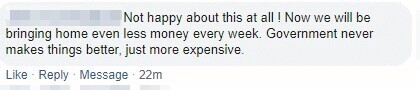

So far, they’ve agreed to offer drivers in California a minimum wage and form a driver organization, but that’s not going to be enough. Uber and Lyft have been screwing over drivers for too long and now is the perfect time to get what we want.

Unlike Uber and Lyft, I don’t think drivers becoming employees would ruin rideshare, but I do believe it would do more harm than good.

Ultimately, you’re never going to get all drivers to agree on the employee vs IC issue but I do think there are some things we all care about. Minimum wage and a driver organization are a great first step, but here’s what else ‘labor’ should be asking Uber and Lyft for:

- Higher Pay: All of the top issues drivers complain to me about revolve around pay so let’s find a way to increase the pay.

- Option 1: Pay drivers 70% of taxi rates. Here in LA, taxi drivers get a $2.85 base fare + $2.70 per mile and 49 cents per minute. By comparison, Uber pays a measly 60 cents per mile and 21 cents per minute! At 70% of taxi rates, Uber would still be much cheaper than taxis yet it would pay drivers more and establish a framework that other cities/states could follow.

- Option 2: Give drivers the right to set their own pay. Uber and Lyft should be free to set suggested rates but if drivers want to work for more or less than that amount, they should be able to do that. That seems like a true independent contractor to me and it’s not hard to do either – Sidecar, the company that invented rideshare had this feature from day one and it was popular with drivers.

- Limit Uber and Lyft’s commission to 25%: Uber and Lyft deserve to make money off every ride, but I’m tired of all the upfront pricing BS and I know drivers are too. Uber and Lyft should never be allowed to take more than 25% of a fare when drivers are the ones doing all the work.

- See where riders are going: As a true independent contractor, you should know where the rider is going before you accept a job. If that means that no one picks up riders who are going a short distance, Uber and Lyft need to raise the prices of those rides – it’s simple supply and demand. Or send the rider on a scooter.

AB5 is far from becoming a law but it’s clear that there are a lot of people vying for self-preservation and my worry is that the opinion of a majority of drivers is going to be left out.

Share what you think below in the comments and if you’re in California, don’t hesitate to reach out directly to Assemblywoman Gonzalez’s office (her office tells me that they are reading your e-mails) or on Twitter . Uber and Lyft have made their first offer and now it’s time for drivers to counter.

How Could AB5 Affect Delivery Drivers?

How would AB5 affect delivery drivers, like the ones listed in our best delivery services to work for? We took a deep look into DoorDash and Instacart (below) specifically, although our takeaways remain the same for all gig workers of delivery companies. DoorDash’s costs will certainly increase. How might your deliveries change with these new circumstances? As we’ve learned:

- Labor isn’t particularly expensive.

- Mileage is extremely expensive.

- DoorDash earns money on a 25-30% cut of the restaurant meal value, plus customer fees.

You will continue to see:

- The 2-mile round trip, $10 value Taco Bell order. Although DD won’t earn much on their cut of the $10 order, the minimal mileage expense should keep these orders modestly profitable.

- The 10-mile round trip, $75 value California Pizza Kitchen order. The lucrative cut of the meal value more than pays for the mileage expense. Furthermore, a customer paying $75 for their meal is likely to provide a tip, contributing to your take home. Again, minimum wage isn’t a huge concern, so if it takes you 45 minutes to complete, well, sit back and scroll some Twitter.

In trouble:

- Long-distance, low-value orders. You know, those forgettable ‘filler’ orders we all get. Those 8-mile, $16 orders of 4 ice cream sandwiches delivered to kids in the nice part of town? The ones that make you think, “Technology is incredible! Through my phone I can receive an order to pick up four frozen items, deliver them across town to people I’ve never met, and the company, customers and I will all benefit?” Then you think, “Oh, collectively we probably melted a square meter of Arctic Ice doing it.” These orders will be even less profitable than before, and will likely incur restrictions or additional delivery fees to make the numbers work.

Basically, we’re all waiting to see what happens with AB5, how hard Uber/Lyft and other companies fight against it, and what it will mean for the on-demand industry as a whole. It’s difficult to say at this moment how ‘becoming an employee’ will look, as much of driver pay, scheduling and benefits will depend on what the companies do. For now, they’re staying quiet on this topic (no doubt hoping AB5 crashes and burns).

Instacart Reached Settlement for Health Care for Workers in San Francisco

Recently, Instacart reached a settlement with the city of San Francisco to pay almost three-quarters of a million dollars to a total of 985 Instacart workers for health care contributions and sick leave benefits.

The city of San Francisco requires that companies provide employees with this compensation. The argument that Instacart had is that they consider their drivers to be independent contractors, not employees, which is a hot debate all over California since AB5 was officially put in place in January 2020.

However, the time period this settlement covers is from the third quarter of 2013 to the second quarter of 2016, before the time of AB5, but on the grounds that Instacart was already treating their workers like employees, minus the benefits.

This is not the first time that Instacart has been sued over the misclassification of drivers. It happened last year in San Diego, but that case is yet to be resolved. It is currently on hold pending an appeal.

The workers would only get paid if they were actively shopping/delivering orders. Downtime was not compensated. Additionally, Instacart would set the route for delivering orders, even if it was less than efficient. The drivers did not have a choice as to which orders to deliver first, even if they were closer to one address as opposed to another.

Instacart’s payment in this settlement is set at $727,985. Just $3,772 of that will cover city investigation costs while the rest will be paid directly to Instacart workers by the city of San Francisco.

How much each individual will be paid will depend on how many hours they worked during the time period of the case and can range from a few dollars up to $9,000.

How This Could Impact Iterations of AB5 Around the Country

This is possibly bigger than Instacart would hope. Just having one case win helps future cases against the company, and helps with similar cases against similar companies; i.e., Uber and Lyft, DoorDash, etc.

I think it’s great that this passed even with legislation that was in place before AB5, which has made it even clearer that these companies are supposed to be billing their drivers as employees (whether the drivers want to be classified this way or not). The point is that the law is the law and companies like Instacart haven’t been following that law since day one.

Since the majority of these kinds of companies are based in California, where laws like AB5 are put into place to specify how companies should be classifying their drivers, we’re likely going to be seeing even more lawsuits come out of this. Whether it’s from 2013 or from 2020 or anywhere in-between.

Drivers are going to start to realize they can get money out of it and they’ll be more likely to opt-in to similar lawsuits or go into arbitration using similar arguments over misclassification. This is far from the end.

How is AB5 Affecting the Federal Government?

On September 22, 2020, the Labor Department submitted a proposal that could build the case for gig workers to be considered contractors rather than employees. The goal is to bring clarity to what an employee is versus a contractor.

However, this legislation would be considered an “interpretive rule” and not a regulation that is enforceable by law. To that end, this proposal would not affect what is currently under the microscope in California.

Each state is able to make their own determinations and set their own laws, though employers do tend to follow the Department of Labor guidance when making their decisions on worker classifications.

As far as this proposal is concerned, once published in the Federal Register (slated for this week or early next week), the public will have 30 days to comment.

According to the Department of Labor press release on the matter, the proposal:

- “Adopts an “economic reality” test to determine a worker’s status as an FLSA employee or an independent contractor. The test considers whether a worker is in business for himself or herself (independent contractor) or is economically dependent on a putative employer for work (employee);

- Identifies and explains two “core factors,” specifically the nature and degree of the worker’s control over the work, and the worker’s opportunity for profit or loss based on initiative and/or investment. These factors help determine if a worker is economically dependent on someone else’s business or is in business for himself or herself;

- Identifies three other factors that may serve as additional guideposts in the analysis: the amount of skill required for the work; the degree of permanence of the working relationship between the worker and the potential employer; and whether the work is part of an integrated unit of production; and

- Advises that the actual practice is more relevant than what may be contractually or theoretically possible in determining whether a worker is an employee or an independent contractor.”

What’s Going on With Independent Contractors vs. Employees in Other Countries?

One of the world’s largest food delivery companies, Just Eat Takeaway, is pledging to switch to an employee-based model instead of hiring gig workers in the UK.

The CEO Jitse Groen stated, “We’re a large multinational company with quite a lot of money and we want to insure our people. We want to be certain they do have benefits, that we do pay taxes on those workers.”

This, of course, comes after Uber and Lyft have been under the microscope for misclassifying their workers as independent contractors when they should be considered employees under the law in California.

Groen said they might keep a freelance model in some countries, but there was no indication that flexibility would disappear for the workers when switched from gig worker to employee.

Frequently Asked Questions About AB5

Don’t forget to subscribe to the RSG YouTube channel to get all the latest videos and YouTube Live videos! Make sure to turn on notifications (bell on the top right of the screen!) to get notified of every new video.

How Will AB5 Affect Other States?

So while we know that the passing of this bill will directly affect Californians, this doesn’t mean that drivers in other states won’t be affected in the future as well.

Today, the passing of AB5 doesn’t mean a whole lot for drivers. They’re still going to be able to go out and drive day to day, but there will be tradeoffs. To be honest, we’re not 100% sure what that will look like but it’s safe to say you won’t lose all your flexibility like Uber and Lyft are claiming.

This bill is important for drivers everywhere to pay attention to because other states are looking into similar legislation (which could be even scarier for Uber and Lyft). If this passes in California (likely) others states will likely pick it up as well.

Would Drivers Rather Be Employees or Independent Contractors?

Harry asked two really important questions to drivers as part of the RSG annual survey to see if they’d prefer to be classified as employees or independent contractors.

The results:

- 15.8% of drivers want to be employees

- 65.7% want to be independent contractors

- 18.5% aren’t sure

This makes sense since most driver like not having a boss and being able to drive when it’s convenient for them. The big caveat is that in reality, driving for Uber and Lyft is a lot less independent than it used to be.

Does the Bill Give California Cities the Ability to Sue These Companies?

This was one of the later amendments that was added into the bill. It basically gives cities a little more power to sue Uber and Lyft if they’re not complying but it’s clear how stubborn Uber and Lyft are and how bad they don’t want this to pass. It can also be a hassle trying to regulate all of this.

Drivers Can Use All the Tools of the App to Maximize My Earnings?

If you’re part of the Rideshare Guy community, you should be using the strategies we share to out-earn the average driver, like surge-only driving.

It pays to be in the know and take advantage of these tips and tools we talk about to help you earn more money. There is some variability allowing you to make more with rideshare driving. If drivers became employees, it may be a lot tougher for those high-earning drivers.

Can Driver’s Offset Rate Changes and the Effects of AB5 With Other Rideshare Services?

We’ve covered other services and programs that help rideshare drivers make more money like Cargo and Firefly.

Since Lyft recently cut rates in a lot of cities, drivers should definitely consider adding other services like these to help make up the difference. You can possibly make 5% – 10% more which is not a ton but it can help offset some of the rates. However, Lyft may continue to copy Uber with rate changes and more perks for drivers. We analyzed if Lyft will continue to copy Uber.

If Uber Offered Drivers $30 per Hour to Cover Expenses Would That Motivate Drivers to Oppose AB5?

Uber knows what drivers care about but have failed to deliver in many ways. One of the biggest issues is that they didn’t set the platform up to enable drivers to become a true independent contractor.

If Uber and Lyft paid higher rates, would you then be against AB5? The answer for most people is probably yes. No one was complaining about being an employee when they made more money.

A lot of AB5 supporters are preaching that ‘everything is going to be great’ – drivers can make more money and be treated as employees. This is a pretty ambitious statement as you probably won’t see huge changes overnight.

What’s Going to Happen When it Comes to Your Taxes?

AB5 is going to hurt the savviest rideshare driver. Harry has talked about how much you can deduct as an Uber or Lyft driver. You can pay a little close to $0 or a small percentage if you optimize deductions properly.

As an employee, you wouldn’t be able to make those deductions. You may get a reimbursement on mileage as an employee on tops of your minimum pay and we’ve seen this with platforms like Eaze.

There’s a lot of complexity so you can’t decide whether this is going to be 100% better or worse just yet.

Like with anything in life, there’s going to be tradeoffs and people are not talking about who stands to gain the most from becoming an employee along with who stands to gain the least. Full-time drivers have it hard because they aren’t getting PTO vacations, disability, etc. yet they’re often driving 40-60 hours per week.

Some of the part-time drivers spending 5-10 hours per week may find it better to maintain an independent contractor status.

Will AB5 Make Drivers Accept More Trips and Not Cancel?

Yes, but Lyft is already doing this in a way. Lyft’s new pay structure means drivers can start getting paid from the time they accept a trip, but the overall rate has been lowered. This encourages drivers to accept more trips although Lyft has already been shifting slightly toward an employee model but don’t want to pay the drivers more.

So as Employees, Would We Lose the $0.58 per mile Deduction?

Yes, but in California, you would get reimbursed $0.58 per mile.

A RSG contributor drove for Eaze and they already use employees as their drivers and Harry plans to start sharing more of this content in the coming weeks to preview what life would look like for drivers who are treated like employees.

What Can California Drivers Do If They Want to Receive Back Pay?

If you’re concerned about receiving what’s owed to you, consider hiring a lawyer, as our RSG contributor Jay did, and see what more can be done for you. He hired Potter Handy, LLP to handle his case.

Potter Handy, LLP is an experienced San Diego law firm that represents gig economy rideshare drivers in California who want to pursue legal action against Uber and Lyft.

Potter Handy is only representing drivers in California. Law firms may only practice law in the states in which they are licensed to practice law, and Potter Handy is a California law firm. Also, California has laws and statutes that support this type of claim.

If you are in another state, you should contact an employment attorney to consult on your particular case as Uber and Lyft are facing numerous similar legal challenges in states across the country.

Here’s What the Presidential Candidates Think About AB5

Current Administration’s Take on AB5

Federally, gig workers are even less protected under the Trump administration. In late April, the Department of Labor issued an opinion letter to an unnamed “virtual marketplace company” that the company’s “service providers” would be classified as contractors under the Fair Labor Standards Act.

The National Labor Relations Board (NLRB) and the US Department of Labor (DOL) revealed their stance on this key question, with both determining that that Uber drivers are independent contractors. As reported in Forbes magazine, the NLRB released an Advice Memorandum that concluded UberX and UberBLACK drivers were independent contractors.

The NLRB reached that conclusion by applying the common-law agency test, which utilizes 10 qualitative factors. However, within the taxi and rideshare industries, the NLRB places most emphasis on just two of the 10 common-law factors: level of control by the company over the worker and how the workers are paid in relation to the company.

With respect to the level of control, the NLRB found the following facts critical in concluding that the Uber drivers were independent contractors:

- The drivers could set their own work schedules.

- The drivers were allowed to work for competing ride-share companies.

- The drivers could control where they worked.

Unfortunately for the drivers, the NLRB placed little weight on the fact that:

- Uber set the fares.

- Drivers could not subcontract their services.

- Uber would lock drivers from using the app if they had an excessive number of trip rejections.

- Drivers could not solicit customers away from Uber to Uber’s competitors.

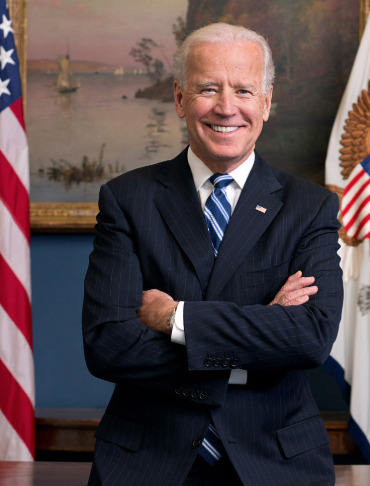

Joe Biden

Joseph Robinette Biden Jr. served as the 47th vice president of the United States from 2009 to 2017. Biden also represented Delaware in the U.S. Senate from 1973 to 2009. A member of the Democratic Party, Biden is a candidate for president in the 2020 election.

Joe Biden tweeted his support for the drivers during the May 8 strike. “I’m proud to stand with Uber and Lyft drivers across the country today. Every worker in this country deserves to be treated with dignity and respect.”

I’m proud to stand with Uber and Lyft drivers across the country today. Every worker in this country deserves to be treated with dignity and respect.

— Joe Biden (@JoeBiden) May 8, 2019

Kamala Harris

Kamala Devi Harris is lawyer and politician serving as the junior United States Senator from California since 2017. A member of the Democratic Party, she previously served as the 27th District Attorney of San Francisco from 2004 to 2011 and 32nd Attorney General of California from 2011 until 2017. She is a candidate for the Democratic nomination for President of the United States in the 2020 election.

Kamala Harris is backing the landmark California labor bill AB5 that could upend the gig economy and hand workers significantly more rights, a stand that’s at odds with her own brother-in-law Tony West (Uber Chief Legal Officer). Tony West is married to Maya Harris, Kamala Harris’s sister and campaign chairwoman.

Harris has been vocal about supporting legal changes to protect against the misclassification of gig workers. She cosponsored Sen. Bernie Sanders’ (I-Vt.) 2018 bill backing a national “ABC test” that creates a much higher burden of proof for companies to say their workers are contractors and not employees that’s similar to the California Supreme Court ruling. She also tweeted support of a one-day national strike of Lyft and Uber drivers earlier this year. “All workers deserve a living wage, protections, benefits, and the right to join a union. Standing with the thousands of Uber and Lyft drivers across the country striking today.”

All workers deserve a living wage, protections, benefits, and the right to join a union. Standing with the thousands of Uber and Lyft drivers across the country striking today.

— Kamala Harris (@KamalaHarris) May 8, 2019

Drivers, what do you think about AB5 and what do you think of the three demands I’ve laid out? Drivers setting their own rates, limiting Uber and Lyft’s commission and seeing where riders are going. Is that enough to keep you happy or would you rather become employees?

More Uber Ab5 reading:

What Would Happen if Drivers Become Employees?

Uber and Lyft Drivers Could Get Employment Status Under California Court Ruling

Josh Eidelson’s Twitter thread on what’s at stake

Lyft petition sent to California drivers

My interview with Alex Rosenblat on how AB5 will affect the rideshare industry

-Harry @ RSG