Most self-employed people are not experts in accounting or accounting software, but it’s undeniable that drivers, couriers and other gig workers will need some sort of tracking software for income and expenses. But which online accounting software program is the best for drivers and couriers? Senior RSG contributor Paula Gibbins reviews the top accounting software for self-employed below.

Drivers have a lot more to consider than one may think. You’ve got to find a good way to keep track of your time and mileage (Uber and Lyft don’t always do an accurate job of this), prepare your own rideshare taxes and possibly invoicing if you share your rideshare knowledge with other drivers for a fee.

Why not do this all in one place to make your life as organized and easy as possible? For that, you might want to check out these self-employed accounting software programs we’ve researched for you.

This page contains references to codes and links that earn The Rideshare Guy a commission when used. Please see our affiliate policy here for more information.

Our top five recommended self-employed accounting software options:

How to Choose the Best Self-Employed Accounting Software

You might want to do your own research as well, which is great! But where do you start?

First, you have to know what you’re looking for so when you find the right fit, you know it’s best for you. Each rideshare driver has different needs, so only you can definitively say what you’re looking for, but here are some questions you might want to ask yourself before researching and a few tidbits you should keep an eye out for in the online accounting software that you’re coming across.

First, what are your needs? Are you simply self-employed or do you own an LLC or Sole Proprietorship? Do you drive for multiple platforms such as Uber, Lyft, DoorDash, Instacart and more or do you just do the one side gig along with a job where you receive a W2?

Answering these questions about yourself will help you determine how robust you need your self employed accounting software to be.

So, what should you look for in these programs? How do you know a product is right for you? Do your research (or build on the research we’ve already done for you)! If a self-employed accounting software program is billing itself as having a free trial, make sure it truly is free.

Does it come with too many bells and whistles? Don’t let yourself get bogged down with too much stuff you don’t need. The best software will have what you need without all the added frills that a larger company would need.

On the other hand, if you’re planning on expanding your business, make sure the software you choose can grow with you.

The Top 5 Accounting Softwares for the Self-Employed

1. Quickbooks Self-Employed

Quickbooks Intuit is probably one of the most well-known accounting software out there. But they have so many different versions. How can you tell which is the best version for the self-employed and specifically rideshare drivers?

Well, luckily, their naming system is pretty self-explanatory. Quickbooks Self-Employed is likely the best version for you.

If you do business under an LLC or are a sole-proprietor or some other kind of corporation or small business, you might want to check out Quickbooks Plus to see if it would better suit your needs.

Quickbooks is pretty intuitive. You can sync your bank accounts and cards that you specifically use for rideshare driving. Oftentimes, the software will know what category your expense should be filed under based on where it came from. You can also set it up to auto filter when you get paid and other expenses that are consistent.

It’s probably easiest to only sync those cards and accounts so that you are tracking only what you need for your business as opposed to every transaction you ever make and having to parse out the business stuff for when you file your taxes.

Check out the video below, where we walk you through how to set up QBSE:

They do offer a free 30-day trial so you can try out their self-employed accounting software with no strings attached. You do not give them any card information for your free trial. Simply sign up/log in with your email address. If you decide you want to keep Quickbooks, that’s when you’ll enter your payment information.

Even though they have a free trial, it’s not skimpy by any means. You get all the features of the full version, so you can make an informed decision if you want to move forward with the paid version.

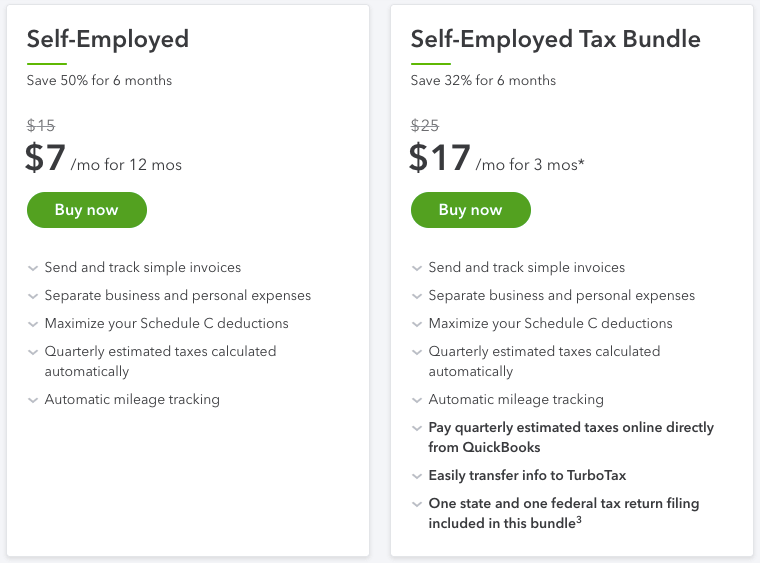

The Self-Employed accounting software has the basics that you’d need as a rideshare driver including estimated quarterly taxes, so you can choose to make payments throughout the year instead of having a larger sum owed at the end of the year.

The Self-Employed Tax Bundle software takes it one step further and allows you to pay those quarterly taxes online through the accounting software.

Plus, it works with TurboTax so you can quickly and easily file your taxes at the end of the year. The fee for filing one state and one federal tax return is included in the cost.

Cost: Self-Employed – $7/mo for 12 months

Self-Employed Tax Bundle – $17/mo for 3 months

Sign up with Quickbooks here – and get an exclusive RSG discount when you purchase!

2. Freshbooks

In some ways, Freshbooks is similar to Quickbooks as far as how they keep your information organized. You can link your bank account and cards you use for rideshare driving and it will help you keep everything organized. You can even scan receipts with the app and upload them to the program for easy tracking.

Freshbooks also helps you organize your information so tax time is easier to tackle. If you do more than rideshare, it even helps you with invoices, both creating and sending them, so you can focus more on your business and less on the little bits and pieces that bring it all together.

They, too, have a free 30-day trial and do not ask for your credit card information. They also specify that you can cancel at any time. Freshbooks uses cloud storage so your desktop and mobile applications are always synced.

It’s easy to sign up for and will ask you some basic questions about your business so they can steer you in the right direction on their site.

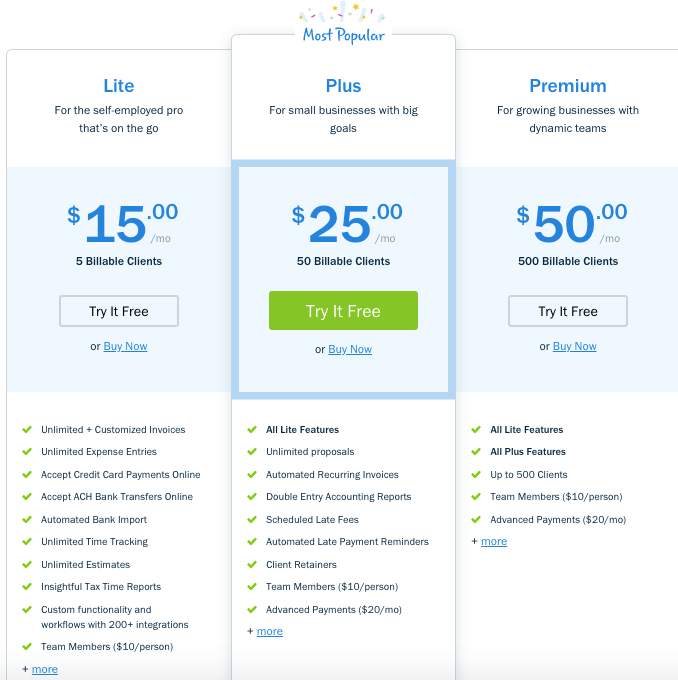

Cost: Lite – $15/mo

Plus – $25/mo

Premium – $50/mo

10% discount if you pay yearly cost up front

You can see how easy it is to set up Freshbooks with this video below:

3. Wave

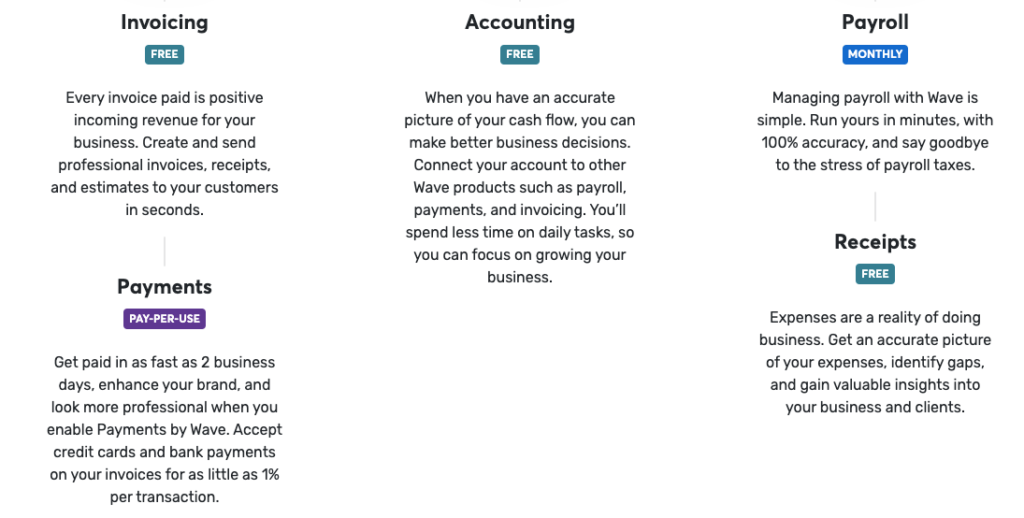

The Wave accounting software for self employed is easy to navigate and find what you need. The best part of Wave is that for the services majority of rideshare drivers would need, it’s free.

If you have people on a payroll, then it changes things a bit, but they have flexible options for you, as well.

Like the others above, you’re able to connect your bank and/or credit cards for easy expense tracking, as well as uploading receipts to keep everything in one place.

Wave easily integrates with Google Sheets, PayPal, Etsy and more, which allows you to easily track and organize your data, whatever that information may be.

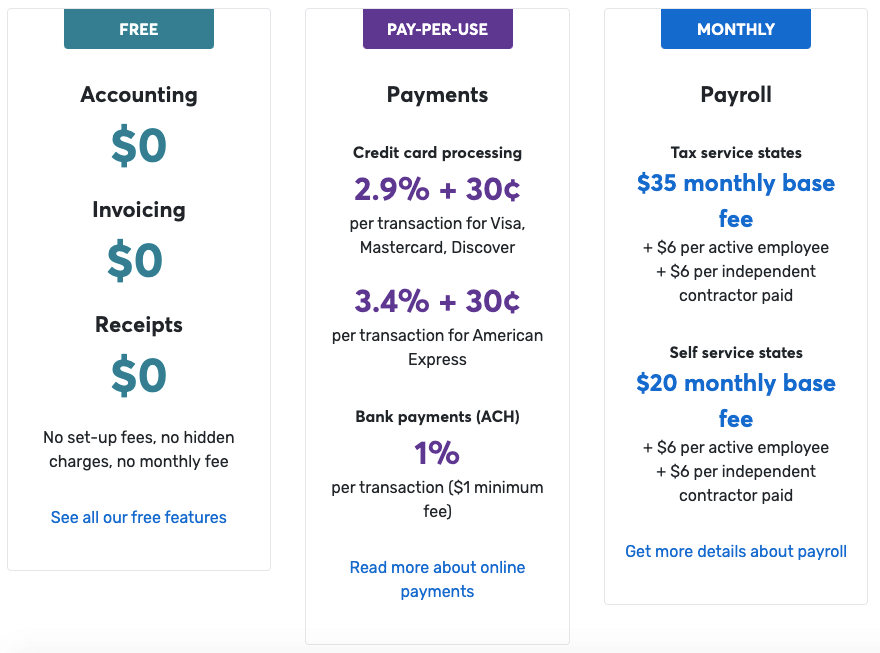

Cost: Accounting – FREE

Payments – Pay-Per-Use

Payroll – Tax service states: $35 monthly base fee; Self service states: $20

monthly base fee

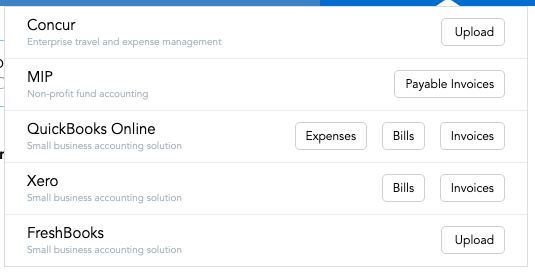

4. Concur

Concur offers what they call a “test drive” which is their way of saying a free trial of their services. From my research, I think the Concur Expense service is the service that would work best for the self-employed – with one caveat!

When we reached out to Concur about pricing, we discovered that Concur is the best option for those of you who run your own rideshare and/or fleet business. That’s because Concur makes the most financial sense when you’re overseeing 10+ employees with the expense tracking software.

If you’re not sure if Concur would work for your fleet business, sign up for the free 30 day trial on their website and see if this option works for you.

With Concur, you simply snap a picture of the receipt and it automatically captures the information. If you have regular business expenses, it looks like you can set it up to automatically sync that information as you pay it, for less work for you.

Cost: Cost is provided by a quote from Concur, best for rideshare or fleet businesses with 10+ employees

5. Xero

Another self-employed accounting software service to consider is Xero. As with the others above, Xero offers a free 30-day trial with no strings attached. You do not enter your credit card to get started.

Xero seems to be the most robust out of all of these, and might be a bit too bogged down with all the extra frills that the typical rideshare driver doesn’t really need.

Tracking your expenses is what I would consider to be one of the number one priorities for a rideshare driver. This is included in their Established plan, which I will price out for you below.

Xero, too, has a mobile app that helps you keep your receipts in order and expenses tracked. You can even set permissions if you have others working as part of your rideshare gig or as part of your small business.

If you currently use Quickbooks but want to make the switch to Xero, they have a conversion tool that will help you transfer your file over seamlessly.

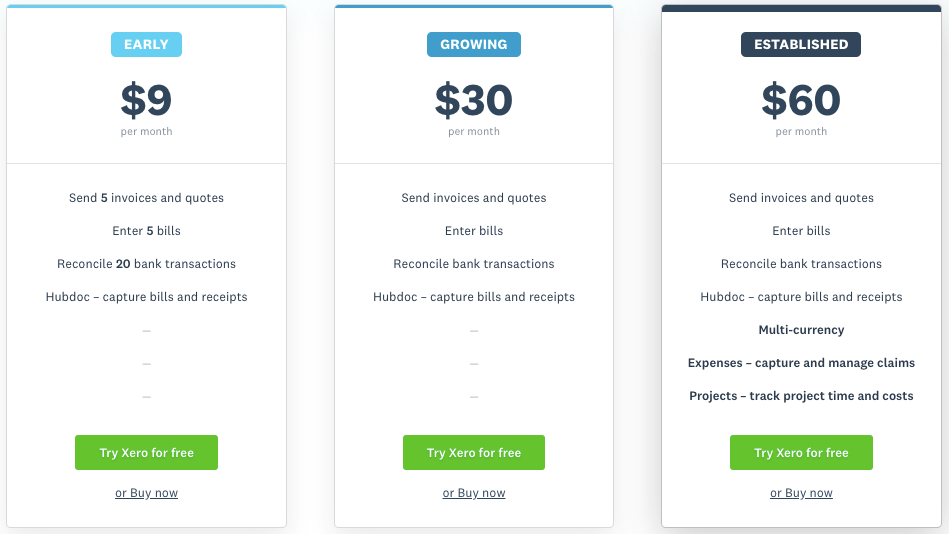

Cost: Early – $9/mo

Growing – $30/mo

Established – $60/mo

Bonus Tip: If you use TripLog to track your driving and expenses, you can link it to a few of these self-employed accounting software programs for a seamless way of keeping everything organized and in one place.

Summary: The Best Accounting Software for Self Employed or Independent Contractors

If you are just you out there doing your thing, I’d lean more toward Quickbooks Self-Employed, Freshbooks or Wave. They seem to be the most straightforward and affordable options that will get you what you need without bogging you down with details that don’t matter for your rideshare gig.

I love that Wave is free if all you want to use them for is expense tracking. I wouldn’t want to have to pay a monthly or yearly fee just to keep all of my information in one spot if I didn’t have to.

However, I also love that Quickbooks teams up with TurboTax, making it that much easier to file your taxes. It can get a bit confusing sometimes with the expenses and deductions associated with rideshare driving and not knowing for certain what you can and cannot claim.

If you’re a freelancer, small business owner or other such self-employed person, you might want to look closer at Concur and Xero. I can’t speak to the cost of Concur since you have to submit a form to get a quote for the services you’d want access to, but it seems to cover a lot of travel expenses and is broken down by services, job role, and other options so you can find your right fit, no matter what that might be.

Since you get a free trial with all of them, I’d suggest signing up for the ones that most interest you and giving them a test. With no obligations attached to any of them, you can truly see which self-employed accounting software is best for your needs.

Try it now:

What accounting software for self employed do you currently use? Do you like it or are you looking for something new that will better suit you?

-Paula @ RSG