Uber introduced upfront pricing last year and within weeks, we started getting screenshots from drivers that showed huge differences between what the passenger was paying and what the driver was getting. We even wrote an article about these differences and provided screenshots of four examples.

To be clear, drivers have always gotten paid based off the actual time and distance of a ride, but Uber now quotes an upfront fare to passengers that will not fluctuate as long as the driver takes one of Google Maps’ recommended routes. So the driver gets paid what the meter runs and the passenger gets to pay what Uber quotes them. Uber has maintained that they lose money on some fares but make money on others and it all evens out in the end.

Upfront Pricing Ripe For Abuse?

Uber doesn’t have the greatest track record with transparency, and they are essentially saying ‘trust us, we promise not to take advantage of this system’. Around the time Uber instituted upfront pricing, drivers also started noticing a processing delay at the end of the trip. In the past, the payout to the driver would appear instantly on the screen but now it takes 1-2 minutes to show up. Drivers were paid the exact same way (based off actual mileage/time) before and after upfront pricing, so I see no reason that Uber would need ‘to process the ride’ unless they didn’t want drivers comparing their payouts to what riders paid.

This new delay made it difficult for drivers to cross reference their pay for the ride with the amounts passengers were paying, but we still get e-mails on a weekly basis from drivers who give a ride to a friend and compare the cost, only to see a large difference in what the passenger paid and what the driver received.

Is Uber Taking Advantage of Upfront Pricing?

When I read in Quartz that Uber declined to “provide details on whether these [Upfront Pricing] discrepancies net out in Uber’s favor” I had a pretty good hunch that they were making more money than they were losing, but how to prove it?

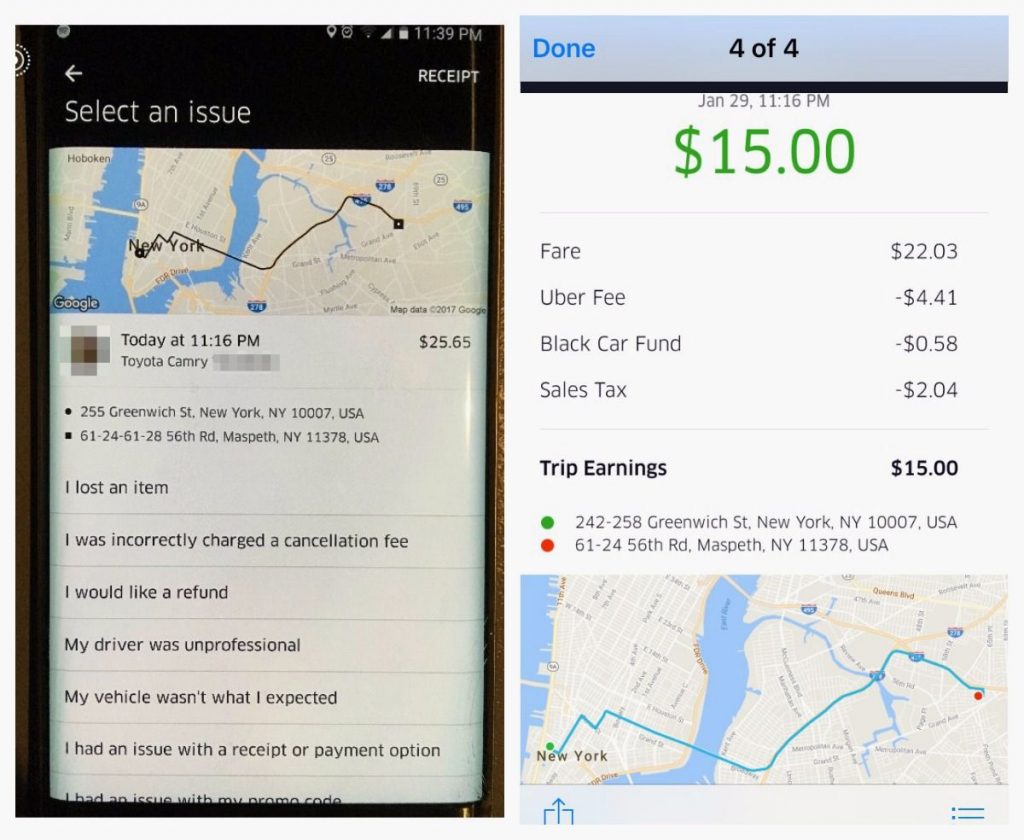

And after talking with Christian Perea who contributed to this article, and with Alex Rosenblat, we realized that we could actually use data from New York drivers to figure out what the passenger was paying. NYC is one of the only cities that levies a 8.875% sales tax and a 2.5% Black Car Fund tax on each and every single ride and those amounts show up on a driver’s ride receipt.

If we take a look at the driver’s receipt on the right, we can actually back calculate the passenger’s fare without the passenger receipt (shown on the left). If you add the $0.58 Black Car Fund (2.5%) to the $2.04 sales tax (8.875%) you get $2.62 and then all you have to do is divide it by the sum of the percentages.

$2.62/11.375% = $23.03 (So this is the price before BCF and sales tax)

$23.03+$2.62 = $25.65 (This is the final price the passenger paid and matches the price shown above from the passenger’s receipt)

If you drive in NYC, you can do use the above method to calculate what your passengers paid to Uber without their side of the receipt and then subtract it from the ‘Fare’ on your driver receipt.

This tells us that Uber made $3.62 ($25.65-$22.03) extra on this ride. Now Uber will say that for every +$3.62 ride, there’s a -$3.62 ride that will even things out, but I wasn’t convinced.

We Calculated Payout Differences Across 165 Rides

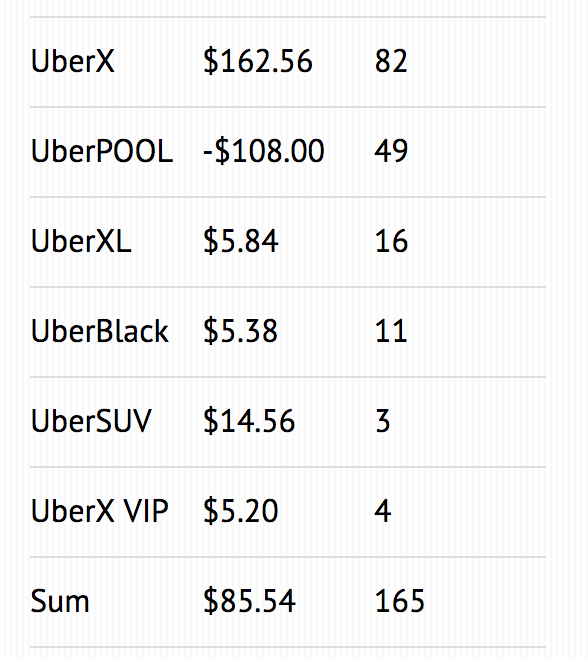

We found a driver in NYC willing to share his data with us, and we calculated the price that passengers paid for 165 rides across various Uber services in order to see whether Uber is breaking even like they say they are, or if they are making extra on each ride. This driver actually had a vehicle (luxury SUV) that was eligible for everything from UberX and UberPOOL all the way up to UberBlack and UberSUV.

Uber Is Coming Out Way Ahead

A majority of the rides were UberX requests, and we calculated that Uber made an extra $162.56 over 82 UberX rides. When it came to UberPOOL, we found that Uber actually lost $108 over 49 UberPOOL rides. And when we factored in the other 34 rides on UberX VIP, UberXL, UberBlack, and UberSUV, we found that Uber made an extra $30.98. All together, we found that Uber made an extra $85.54 across 165 rides.

We’ll examine UberX and UberPOOL in further detail below, but this is raw data that has not been altered in any way. We simply calculated what the passenger paid and subtracted that from what the driver received in order to see whether Uber broke even on upfront pricing, like they say they do, or whether they were skimming money off the top.

How is Uber Making So Much on UberX?

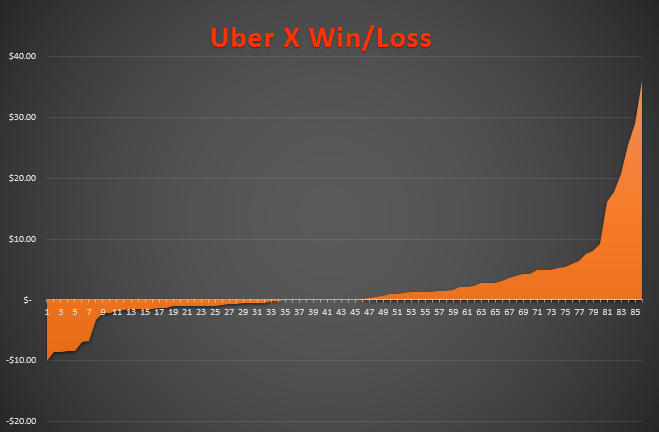

We looked at 82 UberX trips over a 5 week period in February-March and found that Uber made an extra $162.56. That comes out to $1.98 per trip and above, you can see the win/loss for Uber on each trip. Negative numbers (to the left) reflect trips where Uber made less money than they charged and positive numbers (to the right) reflect rides where Uber made more money than they charged due to upfront pricing.

$162.56 (or $1.98/trip) is a large number and, when you consider the fact that Uber does 250,000 trips per day in NYC, it gets even bigger. If we conservatively assume that half of those 250,000 trips are on UberX, that would mean Uber is making an additional $247,500 in revenue per day ($1.98*125,000 trips) or $7.43 million per month ($1.98*125,000 trips*30 days) just in New York.

We haven’t found a reliable way of calculating the difference in other cities, but I would assume the numbers would be similar.

Uber’s Biggest Wins

We did find six instances (7.3% of all UberX trips) of Uber over-charging passengers by $10 or more. And fortunately, we had a passenger receipt from one of the trips where Uber made an extra $25.46 so that we could double check the numbers. On this specific ride, Uber charged the passenger $142.70 to go from Staten Island to the Bronx. The driver received $72.45 for the fare and $44.75 in tolls (In NYC, drivers get a $20 surcharge that is deemed a toll whenever they cross into/out of New Jersey). After you take out Uber’s 25% commission and the sales tax and Black Car Fund (BCF), the driver was left with $84.52.

If we back-calculate the price the passenger paid using our method, we add the sales tax and BCF to get $14.57 ($3.20+$11.37). Divide that by 11.375% in order to get $128.09. And then once we combine that with the $14.57, we get a total passenger price of $142.66 which just about matches the passenger receipt below on the left (not sure where the 4 cents went but may be due to rounding errors).

Uber’s top six ‘wins’ all happened on rides where the passenger paid $60 or more. There are a lot more variables on the longer rides (and remember NYC has higher rates so average fares are close to $25) and it appears that Uber is way over-calculating the fare on these longer rides. But if we look at the opposite end of the spectrum, Uber never lost more than $10 on a single UberX ride.

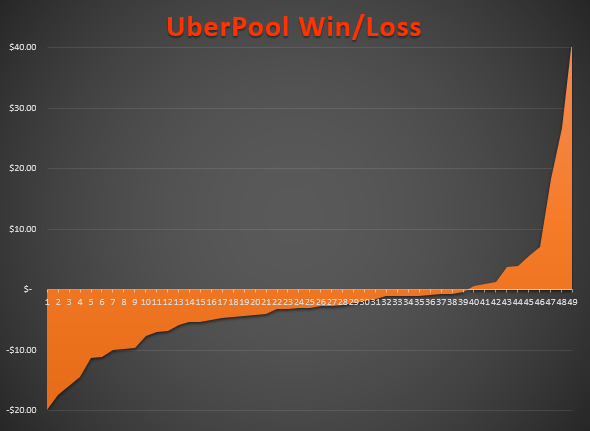

Why Is Uber Losing So Much On UberPool?

We tracked 49 UberPOOL trips and found that Uber actually lost $108 on these rides. So if Uber is making so much off of UberX with upfront pricing, then why are they losing money on UberPOOL rides? Here are a few reasons:

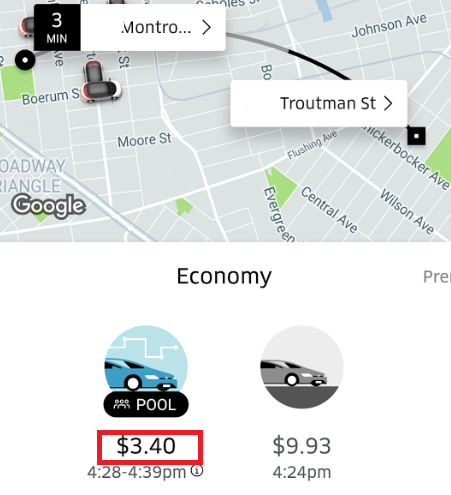

UberPOOL is subsidized: As drivers, we know that short rides have a low tendency of being matched. And many passengers know this too, so they call for an UberPOOL on short rides since it’s a good chance for passengers that they can save a few bucks and won’t be matched. But since Uber still has to pay minimum fares to drivers, they actually lose more on these rides, as we’ve shown in the past.

UberPOOL promotions: Uber has run several promotions for UberPOOL that offers flat-fare pricing of $2.99 for any passenger to take an UberPOOL that is less than $30. It isn’t clear how the $30 monthly fee plays into these calculations, if at all though. I suspect that if many of these passengers were on $2.99 promotional pricing, the numbers we calculated are actually conservative (and Uber is losing less on UberPOOL rides) since the sales tax and BCF are based on the $2.99 price.

High risk/high reward: Even though Uber lost money on most of their UberPOOL trips, we saw that when they did win, they won big. On their most lucrative UberPool matched ride, Uber made an extra $86.29 ($18.27 on the first passenger, $26.78 on the second passenger and $41.24 on the third passenger) after a triple UberPOOL where three passengers matched on a long distance ride from JFK to New Jersey (there’s no sales tax on drop-offs in New Jersey) with a stop in NYC for one passenger.

So I would suspect as more trips start to match and Uber offers less subsidies to UberPOOL passengers, these numbers will rise.

What Does This All Mean For Drivers?

Based on this data, it seems clear to me that Uber’s upfront pricing is not so upfront. But I think it points to a couple larger issues for drivers and the rideshare industry as a whole.

The first has to do with transparency. Uber (and lots of other tech start-ups) seems to think that keeping their data secret is one of the keys to dominating the rideshare industry. But they don’t have the greatest track record with drivers and releasing data:

- Uber used to claim (they deleted the blog post lol) that drivers could make $90,000 a year. This turned out to be debunked by multiple news outlets and common sense.

- Uber claimed that NYC Uber drivers made more than taxi drivers. But they forgot to mention the fact that they compared net income of taxi drivers to gross income of UberX drivers. Since UberX drivers have to pay all their own expenses or rent from fleet owners for up to $500-$600/week, their net earnings are much lower.

- Uber cut fares three years in a row and told drivers ‘lower rates mean higher earnings‘. In three years of running this blog, I have talked to an estimated 50,000 drivers via e-mail, social media and in person and have yet to meet a single one who tells me they make more money after rate cuts.

So when Uber tells us they make money on some rides but lose money on other rides and, in the end, Upfront Pricing will all even out, I’m skeptical. Uber lost $3 billion last year and as the company shifts towards profitability, initiatives like this could be ripe for abuse. But that’s not the only downside for drivers.

The second facet of this story and most worrying has to do with the de-coupling from what the passenger pays and the driver receives (and to be fair, this is also a practice that Lyft has taken to). Uber drivers are independent contractors yet it’s becoming more and more difficult to figure out how we’re paid. If Uber is going to claim that they’re merely a ‘technology platform that connects drivers and riders’, they should act like it. I appreciate them facilitating payment but I don’t want them charging the passenger one price and then paying me another price. As a driver, I should always know exactly what the passenger paid, what I got paid and what Uber’s cut was – that’s how a marketplace works.

Uber maintains that they break even on upfront pricing, but until they release the data that says otherwise, I’m going to go with my gut.

Drivers, what do you think about Uber’s upfront pricing discrepancies? Should Uber be forced to release data that shows how much they’re earning off Upfront Pricing or do you think as long as drivers are paid the correct mileage/time, Uber can charge the passenger whatever they want.

-Harry @ RSG