Solo and Stride are our top recommended mile tracking apps. Check out the full list of top mile tracking apps here.

One of the best ways to save money on rideshare expenses is tracking your mileage. Tracking your mileage can potentially save you thousands of dollars – it’s true! Below, we had RSG contributor Chonce Maddox Rhea review MileIQ, a top mileage tracking app for drivers.

Can we all agree that a mileage app is one of the best ways to track your rideshare mileage and expenses? Yes, the pen to paper method or using a spreadsheet is still effective, but it requires a few more steps and you often have to reconcile everything once you get home.

Don’t believe me? Check out this video from Jay below on how he saved thousands of dollars on his taxes (mileage tracking being a part of that!):

With a mileage app, you can keep track of everything on the go while you’re driving for Uber, Lyft, or any other platform. In this MileIQ review, I’ll go over the core features of the app along with the cost and how it works so you can decide if it’s right for you.

Quick links:

- MileIQ automatically tracks your rideshare mileage for you

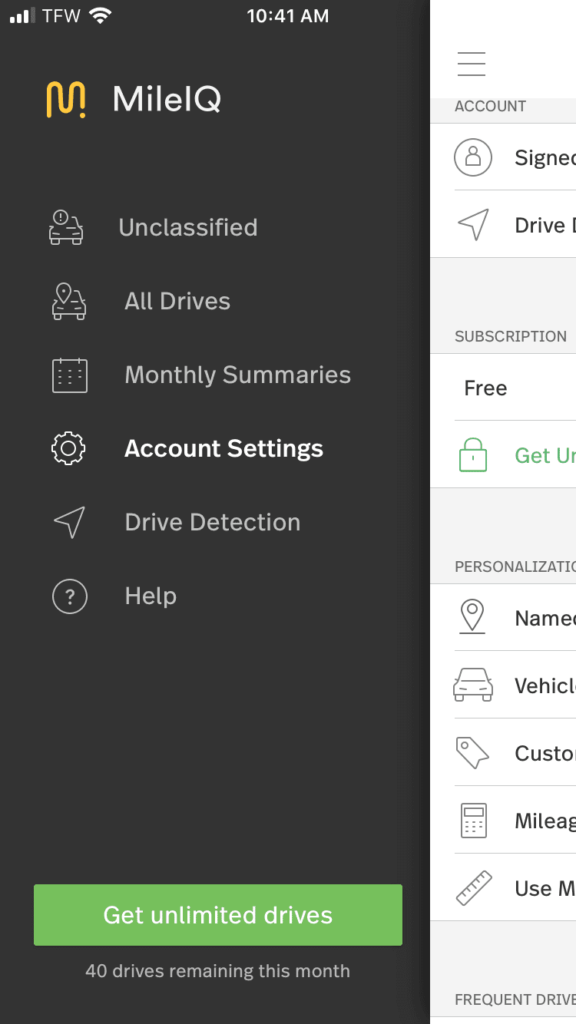

- There is a free version – it only tracks 40 drives a month though, so it’s not a good option for full-time drivers

- Sign up for MileIQ here

What is MileIQ?

MileIQ is an app that automatically tracks your rideshare mileage for you. The platform is not just an app but also has a web dashboard version as well. MileIQ was founded back in 2013 and has helped drivers track over 20 billion miles to date.

MileIQ gives you the option to track your miles flexibly on the go through the app, and review the data at home on your laptop or desktop computer.

It’s easy to forget sometimes to write down your mileage getting in and out of your car driving for rideshare companies especially if you are worn out after a long day of driving. So it’s nice that MileIQ can automate that for you and keep you on top of your record keeping.

How MileIQ Works

There is a free version of the app that can track up to 40 drives per month. That would be good for one trip per day, but most people drive more than that in order to make more money – especially full-time drivers!

The Drive Detection feature starts tracking after you drive a half-mile. You can also manually enter in the drives if that works better for you.

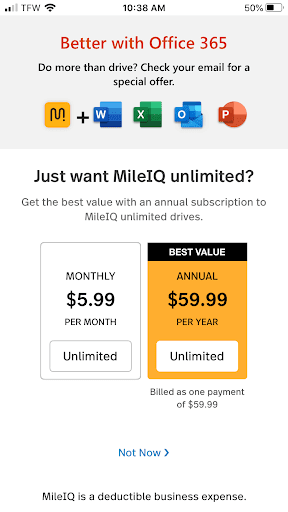

If you need to be able to log more than 40 drives per month, you can pay either $5.99 per month or $59.99 for a year of unlimited trips. Using the app with your WiFi on is recommended by the company, so always make sure you’ve charged your phone and brought some charging equipment as well.

Even when you aren’t directly connected to a hotspot, your phone will use the hotspot proximity. Having this enabled is more efficient on your device battery life than some of the other location sources like GPS.

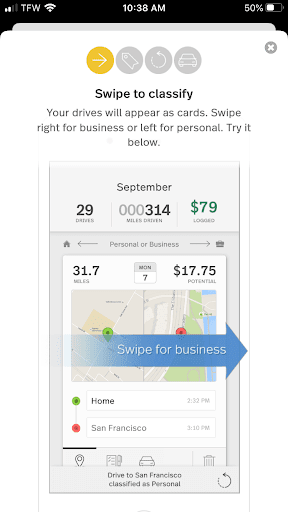

The app will run just fine in the background of your device and doesn’t have to be up and open while you’re driving. After each trip, the app does a great job of providing you all the information you need. This includes the start and end location, mileage driven, and potential dollars that the trip is worth.

Tracking Your Mileage and Expenses

You can easily track your business miles with MileIQ. After a drive, you can simply swipe left or right to indicate if the drive was personal or business. Left is personal and a right swipe is for business.

You can go into even more detail and give the business trips a purpose. Add a purpose by simply slowly swiping left or right and holding. The reasons for the drive will then pop up. Some of the business drive purposes include:

- Between offices

- Customer visit

- Meetings

- Run an errand for supplies

- Get a meal

- Airport or travel

A few of those can be directed toward rideshare purposes.

Mileage isn’t the only thing you can manually enter as well. The app also lets you track parking and tolls.

Each month you can get detailed reports of your drive all in one place. Before you can send it, though, you have to classify all the drives on your account.

Tax Filing Assistance

As far as I can tell, MileIQ app users would have to settle for entering their numbers manually if they chose to use online tax-filing software like TurboTax.

MileIQ does partner with Xero though, which gives you a chance to report your mileage to Xero for easier expense tracking and tax filing.

Getting Set Up with MileIQ

The first step would be to download the app onto your device. You also have the option to use MileIQ from your desktop as well.

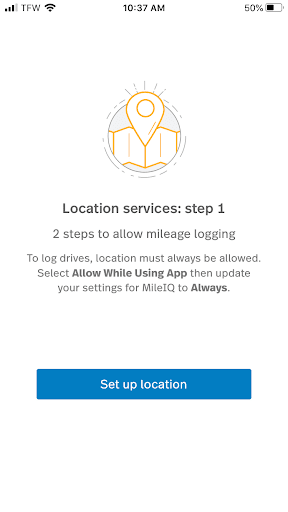

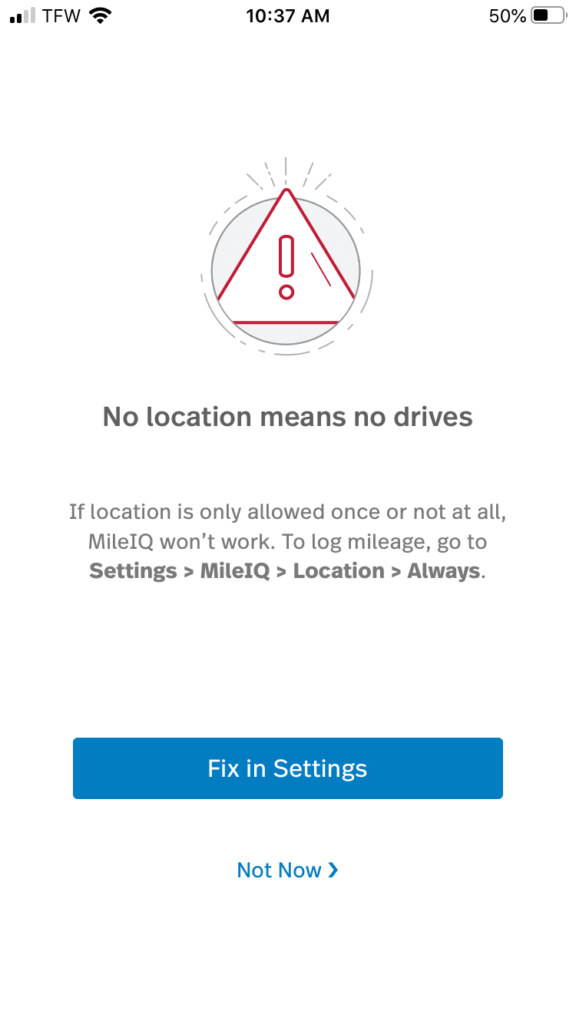

Enter the email and password that you’d like to use for your MileIQ account. You need to make sure when starting out be sure to enable location always for the MileIQ app.

If you select allow once or not at all, the app will not be able to do its job properly. If you make a mistake at this stage, you always have a chance to go back and fix it in settings if necessary.

The free version clearly has limitations, so most rideshare drivers are going to have to get the paid version for around $60/year for accurate mileage tracking.

One thing to note is that if you have a Microsoft Business 365 account, MileIQ Unlimited is included with your subscription.

Pros of Using MileIQ

- Allows you to link separate trips together

- User-friendly automatic mileage tracker and get weekly reports

- Can bundle with Microsoft Business 365 (to get the premium version for free)

- Mile IQ Xero integration

- Detailed reports

Cons of Using MileIQ

- App doesn’t completely eliminate manual tracking since you may have to change some of the mileage and trip details that get automatically generated. During our comparison of the top mileage tracking apps for rideshare drivers, we found that MileIQ was the least accurate (103.6 miles of 129 odometer miles traveled) while also using the most cell phone data out of all the apps.

- Uses more data and battery than other mile tracking apps

- Rideshare drivers will most likely have to pay for premium service

Final Thoughts: MileIQ Review

Like most mileage tracking apps, MileIQ seems to want to help rideshare drivers work smarter and not harder when tracking their mileage. However, I do wish it had some more features to better match up to apps like Stride Tax.

The apps partnerships with Xero and Microsoft Office 365 could be beneficial if you use those programs as well to manage your business expenses. At the end of the day, you want to be able to use the features and benefits that you’d be getting from the app with the cost.

Readers, do you use a mileage tracking app?

Resources:

- Sign up for MileIQ here

- Try out Stride here