Let’s be honest. Everyone loves lottery tickets. Who wouldn’t want to play and try out their luck every day, investing a small amount of money in hopes of a jackpot?

Believe it or not, Americans spend more than $80 billion on lottery tickets every year. However, not even half of this amount is paid out to the players, so they eventually lose.

But, what if w told you that you could participate in a lottery without buying any tickets? Enter, Yotta, online savings account that lets you earn interest on your money while trying out your luck for lotteries every day.

Interested? Read this Yotta review for details.

What is Yotta?

Yotta is an online banking platform created by co-founders Adam Moelis and Ben Doyle. The duo wanted to introduce a platform similar to UK’s Premium Bonds Program in the US and help Americans become more financially secure.

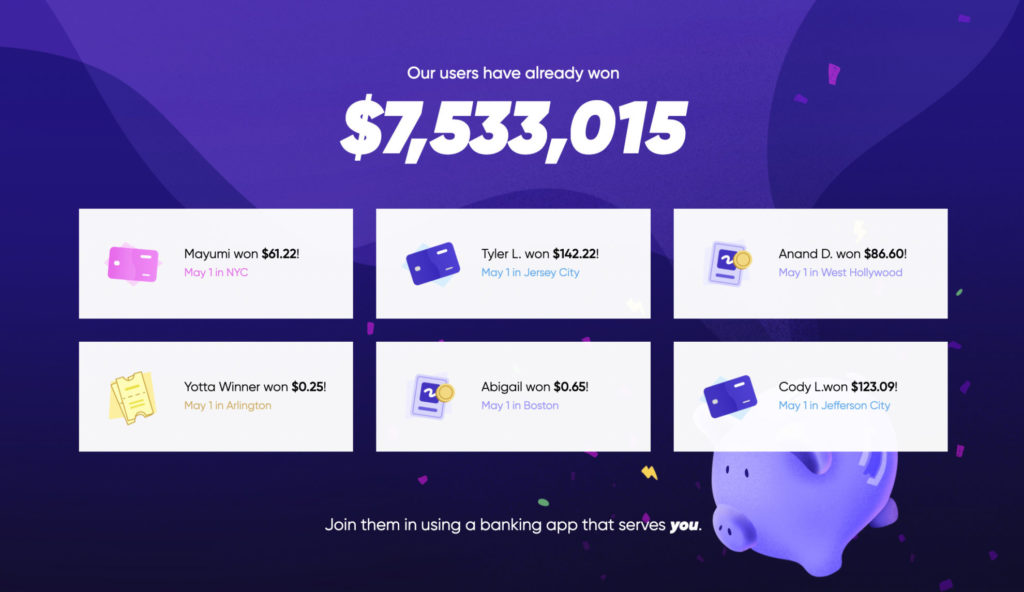

If you’re a gig worker or rideshare driver wondering where to put your hard-earned savings, then Yotta is an excellent option. Since its advent in 2019, the platform has already gained more than 400,000 active members and has awarded more than $4 million in lottery prizes.

Yotta aims to convert saving money into a fun and playful task for gig workers. Here, clients can automatically participate in lotteries based on their account deposits.

Meaning that they no longer have to burn a hole in their pocket by purchasing lottery tickets. Additionally, it provides an excellent incentive for everyday wage earners hoping to hit the jackpot someday.

Furthermore, yotta is also known for its high APY and fee-free platform.

Try Yotta

How Does Yotta Work?

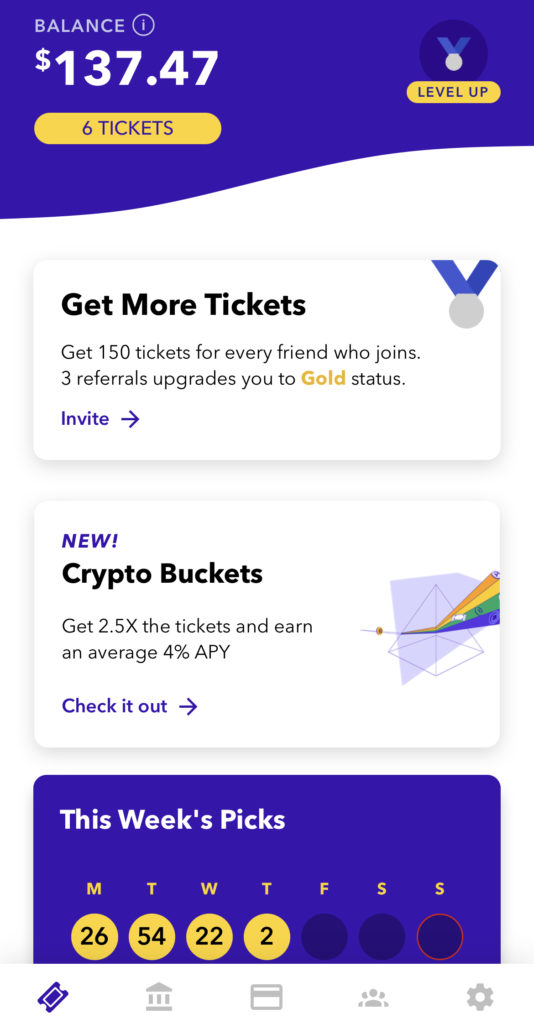

Yotta works similar to the renowned company Premium Bonds, a popular savings platform in the UK. But, unlike the well-known program, users can only access Yotta through its iOS and Android compatible mobile app.

It works by providing its users with an online savings account where they can deposit their money and earn interest in return. Additionally, users can also participate in online lotteries and get a chance to make millions every day.

You have to deposit $25 into your Yotta account. Then, Yotta assigns a recurring ticket for you to participate in the lottery. You can choose seven numbers. If you don’t, the platform gives random numbers.

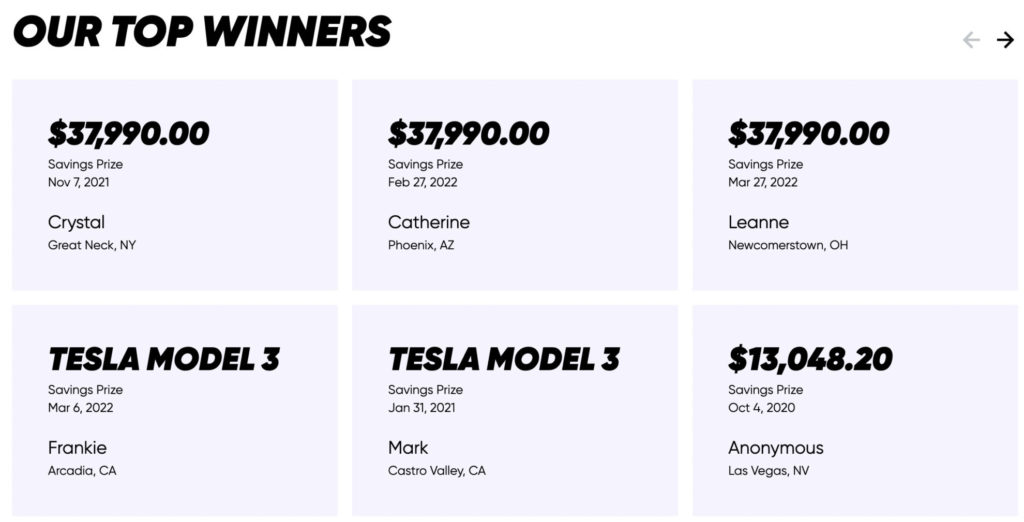

Yotta conducts a lucky draw every night, drawing a single number. Eventually, the last digit is drawn on Sunday. Even if you don’t match all the numbers, you will get the ultimate jackpot of $10 million.

Yotta is a beneficial savings account app for gig workers and rideshare drivers, apart from the gamified lottery system. It offers attractive banking features such as debit and credit cards, interest on savings, loans, and perks for account holders.

Looking for something that may be better suited for true freelancers? Check out Found, a fintech banking platform for small business owners.

How to Join Yotta?

Signing up and creating a savings account with Yotta is relatively easy, thanks to its easy-to-navigate app with a user-intuitive interface. Start by downloading the app, and you’ll pretty much know what to do after that by yourself.

Once you hit the sign-up button, the platform will ask for basic details to ensure your eligibility. This includes your name, contact, email address, and social security number.

Similarly, you will have to provide your bank account details which you will link to your Yotta savings account. The platform is partners with Plaid, a network that allows you to sync any bank account from any bank with your Yotta account.

However, you should meet a specific eligibility criterion to create an account on Yotta. First, you should be a US citizen residing in the US aged 18 years or above.

If you meet this criterion and own an Android or iOS device, you can download the app and create an account in minutes. After creating an account, you’ll have to fund it by depositing your first $25. After that, you will receive a lottery ticket to try your luck in the next draw held on the app.

Key Features

Now that you have the essential details about Yotta, you’re probably thinking about trying your luck on the app.

Let’s face it; when there’s money involved online, you can never be too careful. While creating an account on the app is profitable and fun, you should know how it operates to see if it is the right choice.

Here, we have discussed its salient features in detail so you can make an informed decision while depositing your hard-earned money online.

Yotta Savings Account

Whether you’re a rideshare driver looking for financial stability or a gig worker looking to maximize your income, you should know that Yotta is not a bank. Unlike conventional banks, it has no physical locations and operates only online.

Besides that, you will have to connect your Yotta account with another bank account to conduct your transactions effortlessly. We know what you’re thinking. So what’s the use of going for a Yotta savings account?

A Yotta savings account provides multiple benefits that attract business owners and gig workers. For starters, its basic interest rate on your savings is almost twice as much as conventional banks.

The basic interest rate on the app is 0.2% on your savings. Additionally, you will also get a chance to win cash prizes ranging from $0.01-$10 million every week.

To put things into perspective, this interest rate is one of the highest in the market compared to other banks. For example, Wells Fargo, one of the largest banks in the US, offers only 0.01% interest, similar to Chase, another renowned bank.

Similarly, Citibank hikes up their late by making it $0.04%, but that’s not even close to what Yotta offers its users.

Moreover, your Yotta savings account is highly accessible and easy to use. You can make up to six withdrawals every month from your account. The amount takes around 2-3 business days to process once you apply for the withdrawal.

If you win a lottery prize, the amount you win will appear in your account by the end of the week, which you can later withdraw as you wish.

Most importantly, Yotta provides facilities that make it easier to save your money. For example, the platform sets a $10,000 daily and $40,000 monthly limit on deposits and withdrawals. Also, it lets you set recurring deposits for every week or month, so you’ll never forget to set some money aside as savings.

Yotta Banking Features

Along with its impeccable savings account facilities, Yotta has pretty impressive banking features that make it a go-to online savings account. Here’s a list of Yotta’s top banking features to give you further insight.

Debit and Credit Cards

Yota offers free debit card services with your savings account. You can withdraw money through your cards anytime you like and access more than 55,000 ATMs across the country.

The best part is that the platform charges no foreign transaction fees, so you can send money and payments anywhere you like.

Moreover, Yotta has placed irresistible offers on their credit and debit cards. For example, using a debit card, you have a 1/150 chance of the platform covering your entire purchase through a program called Lucky Swipes. Similarly, you’ll get an extra lucky ticket for every $10 you spend using your debit card.

On the other hand, their credit card gives you a 2% chance of availing of Lucky Swipes. Similarly, you’ll get a lottery ticket for every $5 you spend through your credit card.

The best part is that your credit card’s limit is your current account balance on Yotta. This means you won’t owe any money to the platform for using the service, and they don’t charge any service fee either.

Buckets

Most of the time, people have specific goals in mind when they intend to save money. For instance, you could be saving money for a house, car, luxurious vacation, or all three. If you save all your money in one pool, you’ll have a hard time deciding which goal to complete first.

Yotta lets you divide your money into buckets. You can create multiple buckets by allocating specific percentages of every deposit. Similarly, you can convert a particular portion of your earnings into crypto through its crypto bucket facility.

What’s more, you get a higher chance of winning lotteries by converting your money into crypto. You will get a lottery ticket for every deposit worth $5 in your crypto bucket. Also, you can earn interest with an APY of 4.0%.

Similarly, Yotta also offers a credit-builder bucket for those looking to boost their credit score. The bucket is a small loan from the platform itself, which you can pay off in installments. Yotta also reports your timely payments to well-known credit bureaus.

If your payments are late, you will be charged a fee of 5% of the total due amount. Furthermore, late payments will also be reported to credit bureaus directly.

Yotta Perks

Another great feature that sets Yotta apart from typical banks is that it gives you access to your paycheck earlier. With Yotta, you can access your direct deposit up to two days earlier than conventional banks.

Similarly, you will also get early access to tax refunds to avail of these payments every month instead of waiting for the end of the year.

Yotta Lottery

One of the most attractive features of Yotta is its lottery system. The numbers are picked through a third-party insurance carrier, so the platform itself does not know which numbers are chosen every week.

This means the lottery system is entirely transparent, and Yotta has no way of manipulating it. Moreover, the lottery prizes are managed and handed over to the winners by a third-party company.

You will receive a lottery ticket for every $25 you deposit into your account. Then, a number will be announced every day until the jackpot winner is announced on Sunday. Based on the numbers that match your ticket, you can win any amount from $0.01 to $10 million.

Furthermore, you can also join Yotta’s Pool Play feature to play along with multiple members and increase your chances of winning a jackpot.

Yotta Fees

Believe it or not, Yotta is a 100% free service. They charge no monthly account fee, and you don’t have to pay anything for deposits, withdrawals, foreign transactions, or ATM services. Also, you don’t have to meet any minimum balance thresholds, but Yotta charges a 50-cent monthly fee if your balance is under $5.

Another way you’ll incur a nominal fee on Yotta is by using its instant withdrawal and deposit service. The platform charges 1.5% of the amount in both cases.

Pros of Yotta

Here are the benefits of joining Yotta at a glance.

Fun Gamified Elements

Yotta adds fun incentives to typical savings accounts through lotteries and gaming.

Weekly Lucky Draws

Every week, you get a chance to win millions based on your deposits and account balance.

Impeccable Banking Features

Yotta’s savings accounts have market competitive interest rates and flawless banking services.

Referral Bonuses

You can maximize your income on Yotta by referring the app to your friends and family.

Cons of Yotta

When you’re deciding to save your money online, you should remember that there are always two sides to every coin. So here are the downsides of Yotta that you should know before creating an account.

Lack of Other Account Options

Yotta is solely designed for saving accounts, so it does not have other account options such as retirement, CD, or checking accounts.

Only for Mobile Users

Yotta is a savings app designed for mobile use only. The platform does not have any website you can use on your desktop.

Interest Rate Subject to Market Fluctuations

Currently, the high-interest rate on the platform is maintained through its lottery-based model. However, this is mainly subsidized by other investors, meaning the interest rate can drop in the long run.

Limited Customer Support

Yotta provides no contact number or lives chat option on its app. You can only contact them through their email address, where you usually get a reply within 2-3 days.

Is Yotta a Good Option for Rideshare Drivers?

Yotta is an excellent option for gig workers and rideshare drivers who want to put some money aside for their financial goals. You can divide your cash into buckets to maintain financial discipline and earn interest and bonuses to maximize your income.

Moreover, you can get a chance to earn millions every week through their lottery and Pool Play program. However, if you’re looking for a bank account with multiple banking features and options such as housing and medical loans, this is not your platform.

Get The Yotta App