This tax season, you may be wondering what tax preparation software is the best for you. As rideshare drivers, we have more complex options than straightforward tax prep. Below, senior RSG contributor Paula Gibbins reviews H&R Block tax prep software and how it works for rideshare drivers.

Filing your taxes can be daunting. I took the liberty of going through H&R Block’s filing process to learn if it’s worthwhile for rideshare drivers to pay for this service.

Yes, it is something you have to pay for since we do not get W-2s through Uber or Lyft. If all you had were W-2s, you would be able to file for free with this service, but no such luck for us rideshare drivers.

Let’s go through the options you have with H&R Block.

Ready to get started? Use the links below to get started on your taxes:

- Use H&R Block to do your taxes

- Need a tax professional? Sign up and get connected with a Rideshare CPA here

- Don’t forget one of your biggest write-offs – mileage! We recommend Stride for tracking miles

- Looking for more tax-filing information? Check out our guide to 2020 taxes here

How to File with H&R Block

You’re given multiple options right off the bat. You can find a local office, file online or with their software.

I decided to go through the online process, but if you have more complicated taxes, I would recommend going into an office and filing in person.

Like I said before, if you’re filing anything other than W-2s, which you would be doing as a rideshare driver, then you’ll need to pay. Here are the options they offered:

I started with the free file, and as soon as I got to a point where I needed to upgrade, the website let me know and added it to my cart to be paid after filing.

You would have to decide for yourself which option works best for your needs, but when I was filling out my info, it upgraded me to Premium first and then said I actually needed Self-Employed. So, it would have cost me $59.99 to file online without the assist option.

If you want extra help as you go, you’ll be paying more for the Online Assist option.

Is H&R Block Easy to Use?

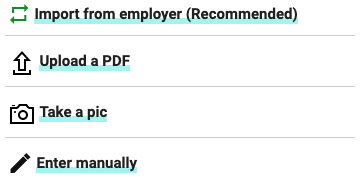

It can be tedious, like most tax filing options out there. However, H&R Block does offer to submit the forms directly from your employer, and allows you to take a picture or upload your documents or enter the information manually.

In hindsight, I should have used the take a picture option for ease of use, but instead I chose manual entry instead.

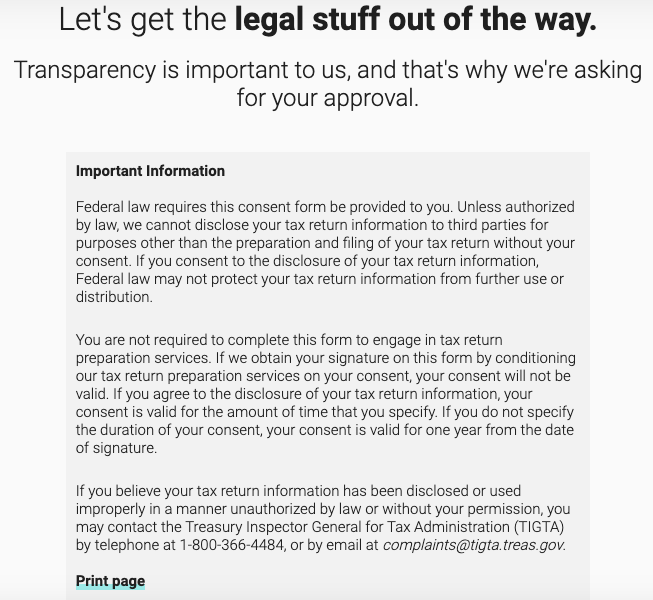

When you get started, it’ll ask you to import last year’s taxes if you didn’t file with H&R Block. There’s also a spot when you first get started/sign up where it asks your permission to use your provided tax information for third parties.

It does nothing to affect your ability to sign up or to file with H&R Block. Here’s what it looks like:

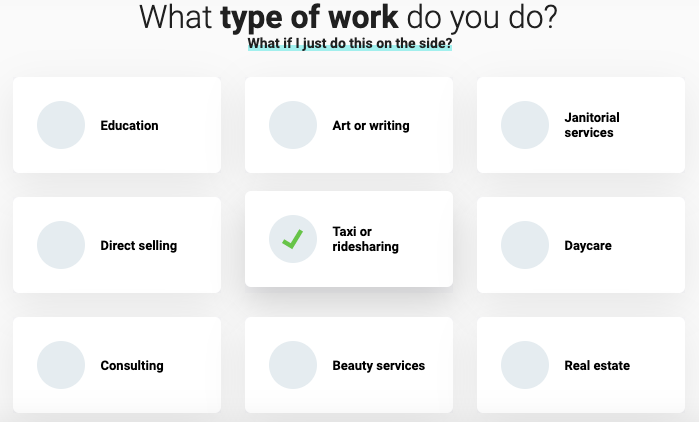

From there, you’ll be able to start entering your information. At one point it will ask you what type of work that you do, and they will better customize your experience from there by suggesting possible deductions and expenses you might have related to it.

Right in the middle is the option you’ll want:

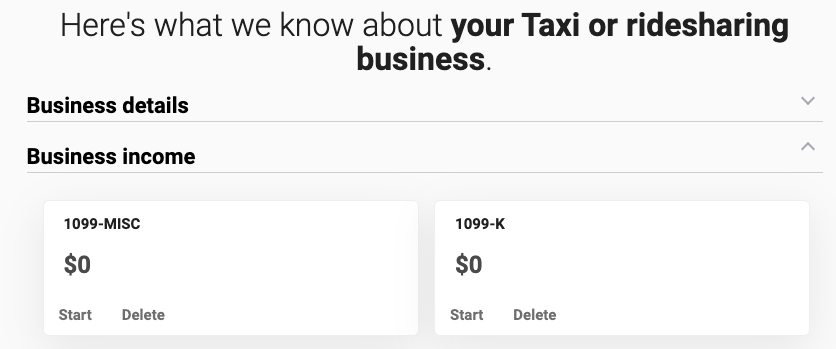

From there, it’ll ask you what kind of forms you received and if you have other income.

Many of you, if you did not earn enough, will not actually receive a 1099 from Uber or Lyft, so you’ll have to enter that income manually, based on the tax summary that each sent to you at the end of 2019/beginning of 2020.

Enter your 1099-MISC and/or 1099-K information if you did receive those forms and the website will guide you to wherever you need to go next for entering any expenses and deductions you may have, including mileage.

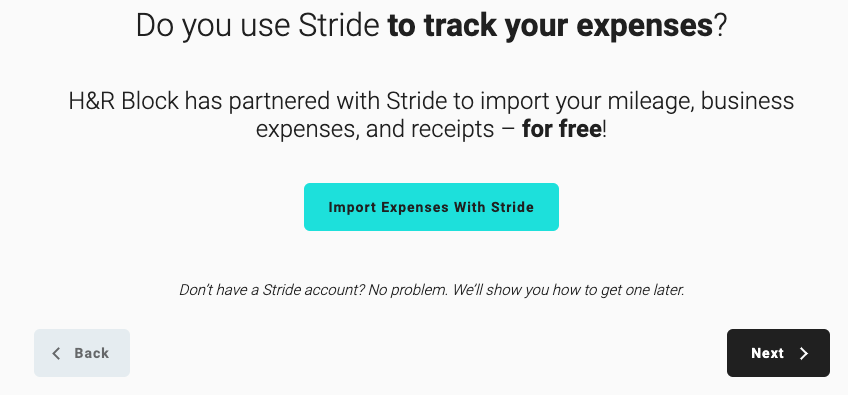

If you use Stride, H&R Block makes it that much easier for you to enter your information.

H&R Block and Stride have partnered together to import your mileage, business expenses and receipts to make the process as smooth as possible.

As you go, it’ll ask you about basic business expenses you might want to deduct as well.

If the list shown doesn’t cover everything, click the “Show more” button for even more options that are likely to relate to rideshare driving and might be expenses you’d like to deduct.

What If I Have Questions Along the Way?

As you go, there is an online chat feature where you can ask basic questions. Be sure to click on the chat feature, and not the Get Online Assist (which will charge you extra as outlined in the Online Assist payment options I showed earlier).

There’s also a question mark that is a help feature. You can search basic words or phrases (such as “ride sharing”) to find answers along the way. This helped me find where I needed to enter information I’d forgotten to enter the first time through.

The help menu looked like this:

Cost Breakdown

As I mentioned above, you’ll likely need to pay to use H&R Block because you won’t have W-2s, which are the most straightforward forms out there. However, there are things you can do to bring the cost down.

Overall, $59.99 is not that bad considering you can also write it off next year under costs of tax preparation. However, you can get a little something sooner.

If you have Rakuten, a cash back app and extension for your search browser, you can currently get up to 8% cash back.

Granted, it’s not an immediate discount, you’ll see the cash within a couple of months, but every little bit helps, right?

Is H&R Block Worth It?

That really depends on what you want to get out of it. I have researched a few of these types of websites and somehow the same information entered on each has given me a different amount owed or due to come back to me.

This one said I owed significantly less than a free website, so I’m wondering if behind the scenes they categorized my information differently so I’d get the maximum deduction possible.

I’ll know what I owe for real when I file my taxes for real with my accountant, so I’ll see then if one of these others is truly worth it or not.

As it is, this was a very comprehensive website that made it easy to enter my information and easy to know where I was supposed to put earnings and expenses related to my rideshare driving. But, is it worth $60? That’s up to you to decide.

Readers, what do you use for tax preparation? Do you do it yourself, use a program, or work with a CPA?

-Paula @ RSG

Resources:

- Use H&R Block to do your taxes

- Need a tax professional? Sign up and get connected with a Rideshare CPA here

- Don’t forget one of your biggest write-offs – mileage! We recommend Stride for tracking miles

- Looking for more tax-filing information? Check out our guide to 2020 taxes here