Solo and Stride are our top recommended mile tracking apps. Check out the full list of top mile tracking apps here.

Looking for a mileage tracking app that can help you do your taxes and link up to any other gig work you do? You might be looking for Hurdlr! RSG contributor Chonce Maddox Rhea introduces us to Hurdlr, how it works and how it can help you save money come tax time.

Note: Although this article is written with drivers in mind, it’s good for all types of drivers and gig workers, include Instacart, Amazon Flex, and DoorDash couriers. If you’re using your car to drive for one of these gig jobs, make sure you’re tracking your mileage!

As an independent contractor, it’s important to understand that your gross income doesn’t always tell the full story. I like to look at expenses, and when my husband started driving for Uber and Lyft 3 years ago, I knew he’d have to track one of the biggest factors for rideshare drivers – mileage.

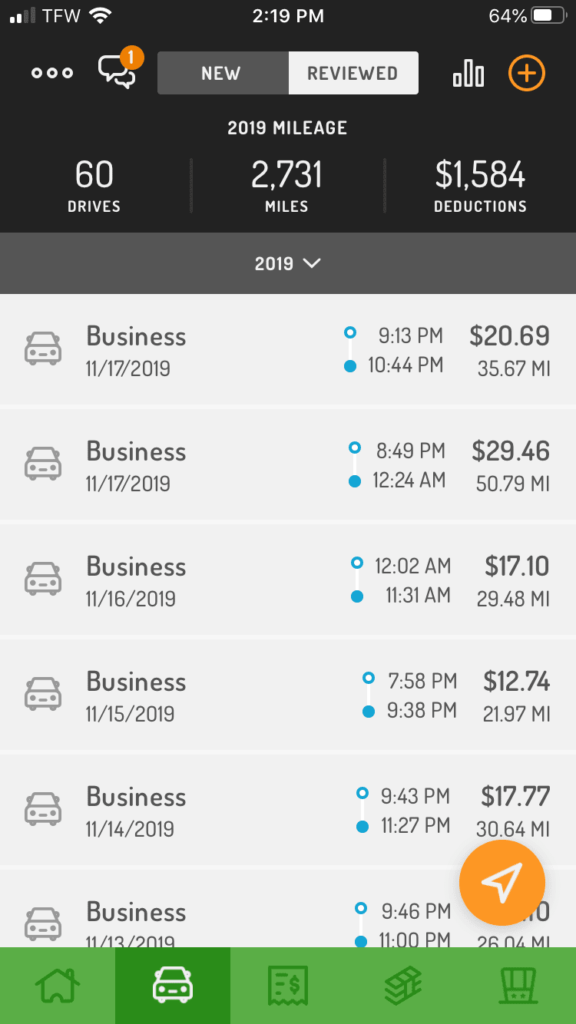

Mileage affects the wear and tear on your car. Plus, independent contractors like Uber and Lyft drivers qualify for a federal tax deduction of 57.5 cents per mile. You don’t want to miss out on this deduction as it can save you tons of money on your taxes, so consider using a mileage and expense tracking app like Hurdlr.

Quick links:

- Check out the top mileage tracking apps here

- Your ultimate guide to rideshare taxes

What is Hurdlr?

Hurdlr is a popular automatic business expense and mileage tracker that can help you estimate your tax deductions in real-time.

What I love about Hurdlr is that you can connect it to your Uber driver account to enable real-time net earnings tracking as well.

Hurdlr has a free and paid version and is one of the most accurate mileage tracking apps around. Their premium version of the app is around $8 per month or $60 per year.

Since this would be a business expense, you can deduct these costs.

How Hurdlr Works

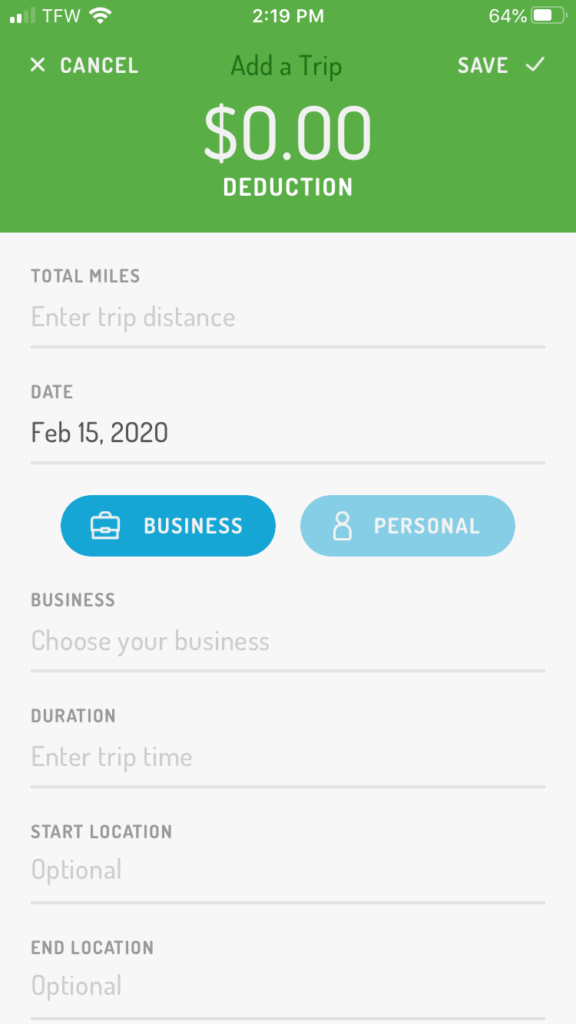

You’ll want to use the Hurdlr app to track your mileage automatically or manually. For manual mileage tracking, you just need to enter the trip distance, duration, as well as the starting and ending location.

To set up automatic tracking, you will need to enable the app to always track your location by going to the settings section on your phone.

Use the app to review your trips, and classify them as business or personal by swiping left or right.

You can also set your work hours, which is convenient if you like to stick to a particular schedule with rideshare driving. This will help the app better track your mileage for trips automatically.

Plus, all the mileage that is accumulated during your designated work hours will automatically be added to your business deductions estimate.

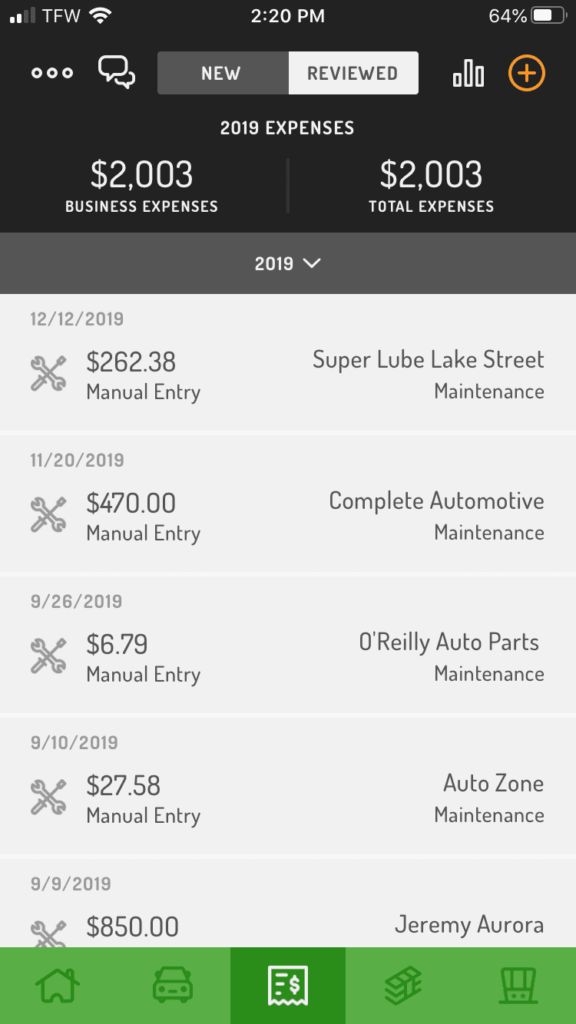

Hurdlr also offers expense tracking that can be done automatically or manually. You can even upload images of your receipts for maintenance, car washes and other expenses if this helps you stay organized.

Finally, income tracking is another cool feature of this app, and you can set this up to be tracked automatically for Uber only or you can enter your income manually for Uber or Lyft-related expenses.

Filing Your Taxes

At the end of the year, you can file your state and federal taxes with TaxSlayer through the Hurdlr app. The app will also help you estimate your quarterly taxes and know when to pay them.

Pro-tip: Remember to check through a shopping portal like Rakuten to save money and get cashback on your tax software purchases! Earlier this year, Rakuten had a 37% discount on TaxSlayer! Sign up with Rakuten here.

Getting Set Up

Start by downloading the app on your smartphone, or you can access a desktop version of Hurdlr on your computer. You’ll need to use the app to connect your bank account in order to enable auto-tracking for expenses. You can also connect to Uber to auto-track your mileage during trips.

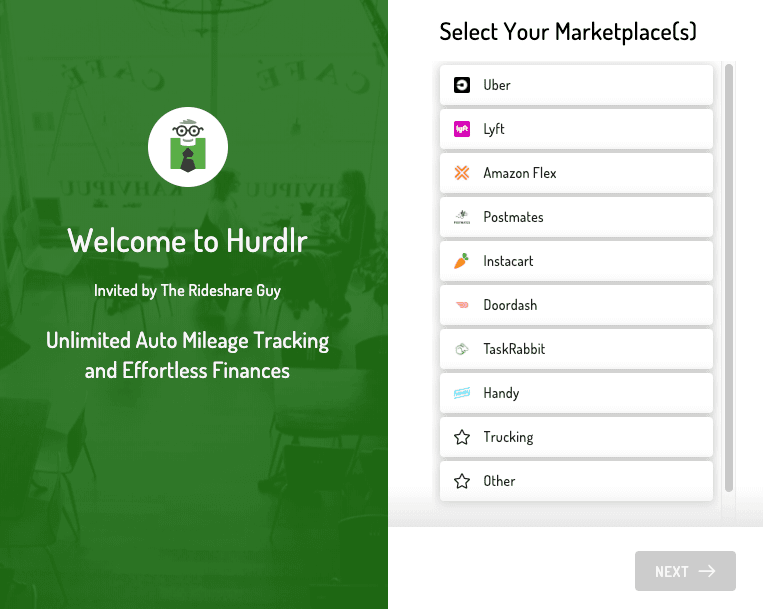

From there, you’ll choose which companies you drive for (including DoorDash and Instacart!) and Hurdlr will then walk you through the process of setting everything up.

Even if you don’t file taxes through the Hurdlr app, setting up this feature could still be helpful in terms of making quarterly estimated payments and just having a backup source to use.

You can make edits to your Tax Setting in the app by tapping Taxes > Tax Settings (gear icon in the top-right corner). From there, you can set your marital status, state, dependents, and annual wages before taxes.

Pros of Using Hurdlr

- Easy way to track all your rideshare expenses in one place (automatically or manually)

- Include photos of receipts for expenses so even if you lose the paper copy you’ll have a digital version.

- Customer support was available through the app

- Free option for basic expenses and mileage tracking needs

- Monthly subscription can be tax-deductible

- App gives an estimate on what you may owe for taxes and when taxes are due

- Can automatically convert Hurdlr data to TaxSlayer to file your taxes online.

- Use Siri to turn on auto-tracking

Cons of Using Hurdlr

- Auto tracking is only available with Hurdlr Premium, so you can only do manual tracking with the free version.

- If you forget to turn your mileage tracker off when you get home it will run all night causing you to have to manually change it the following day.

- The app can also use quite a bit of your data so be mindful of that.

Final Thoughts

Hurdlr is still one of our top mileage and expense tracking apps for rideshare drivers due to all of its features.

It’s easy to use and what you see is what you get. Even though it does cost to use the automatic tracking feature, this expense can be deducted on your taxes and also help you stay organized.

Sometimes it’s worth the money to have a smoother process when filing your federal and state taxes.

What are your thoughts on expense tracking apps for rideshare drivers? Do you use Hurdlr?

-Chonce @ RSG

Resources:

- See the top mileage tracking apps here

- Your ultimate guide to rideshare taxes