It’s that time of year when it’s time to renew or enroll in health benefits. It’s called Open Enrollment Period (OEP), and it’s a small window of opportunity to sign up for health insurance..

As gig workers, we don’t have employer health benefits available to us, so we have to turn to other means if we don’t have access to insurance through a spouse or other job.

That’s where Stride Health steps in to help us out. We’ve been working with Stride Health since 2014 to help gig workers get covered and this year is no different!

This article is sponsored by Stride, but as always, opinions are our own.

What is Open Enrollment?

Open Enrollment is the period during which anyone is able to enroll in a health plan for the following year. So, currently, Open Enrollment (for most states) is available from November 1 through December 15, 2021, for health insurance coverage that will begin on January 1, 2022.

If you miss Open Enrollment, you either have to wait until the next Open Enrollment Period (next November!) or have a qualifying event that will allow you to get health insurance (such as getting married or divorced, changing careers, or other “qualifying life events”).

Changes to Health Insurance Benefits Due to Covid

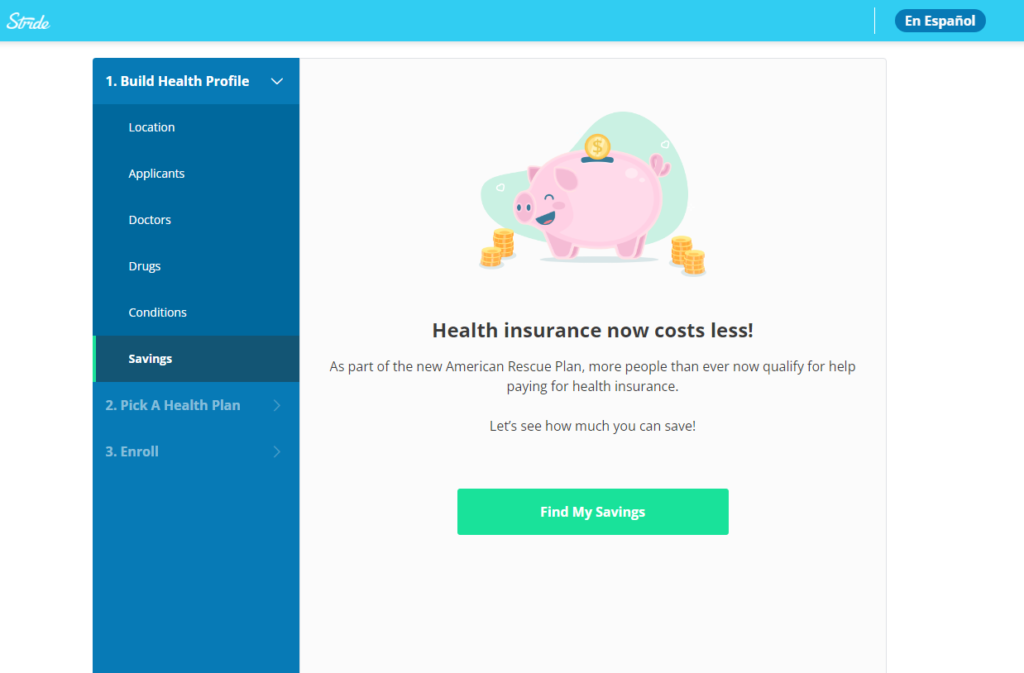

We all know the pandemic turned the world on its head and changed lives forever. One area it affected was health, in more ways than one. With massive amounts of layoffs and people having their hours cut back due to the pandemic, the government answered the call with what they call the American Rescue Plan Act (ARPA).

With the passing of this act, more people are eligible for subsidies. In a Stride article about ARPA, it stated:

“Before this expansion of the Affordable Care Act, people were only eligible for subsidies if they made 100 to 400% of the federal poverty line, meaning subsidies were limited to people below a certain income limit. With the expansion, people who make above 400% of the federal poverty line now qualify for health insurance savings (the income cap has been removed). The ARPA caps plan prices at 8.5% of your household income.”

Basically, depending on how much you earn, you could qualify for subsidies or even qualify for low or zero-premium health insurance, saving you money while getting quality health coverage. In fact, 4 in 5 people can get health insurance for $10 or less per month.

How Long Do You Have to Sign Up?

Time is running out, so please act fast. Open Enrollment ends on December 15!

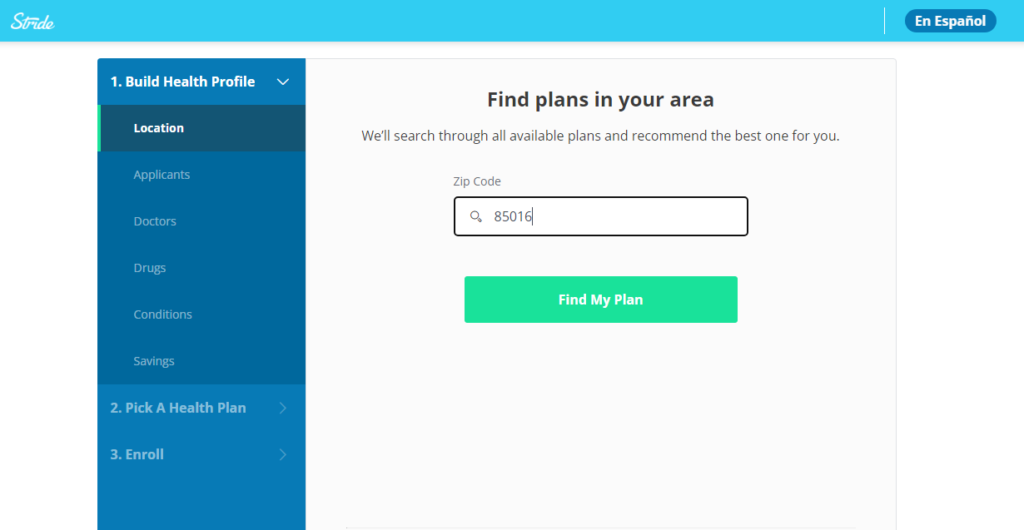

Stride Health makes it super easy to find what plans and coverage are available in your area. It truly is a one-stop shop for all of your health insurance needs.

Follow the prompts on their website to find the coverage that best suits your needs in 10 minutes or less, right from your mobile device.

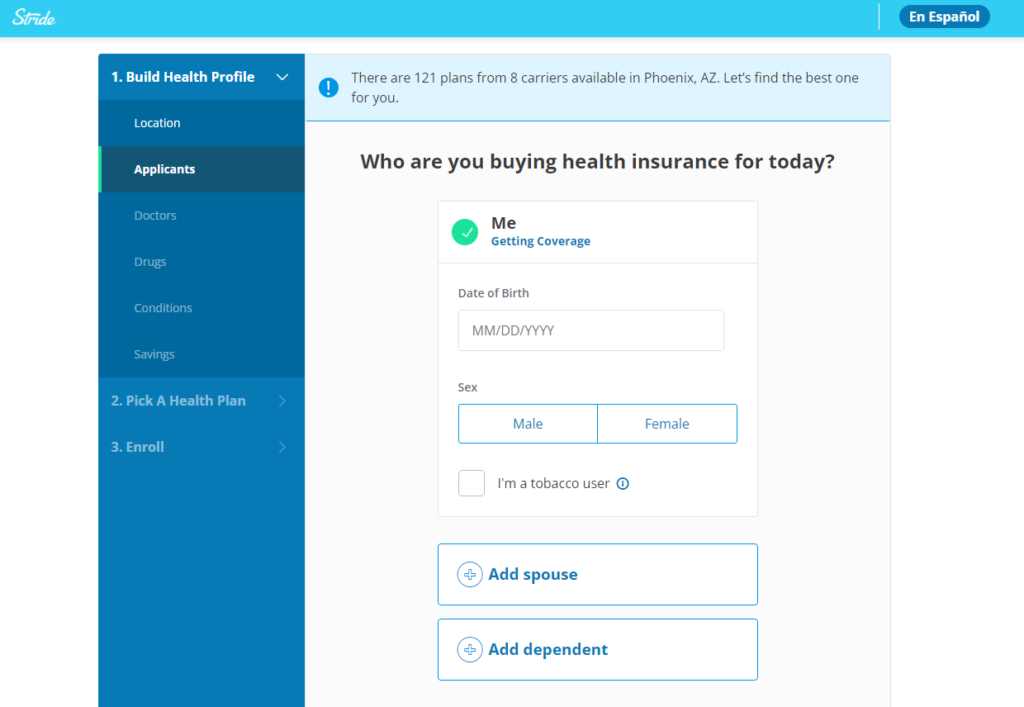

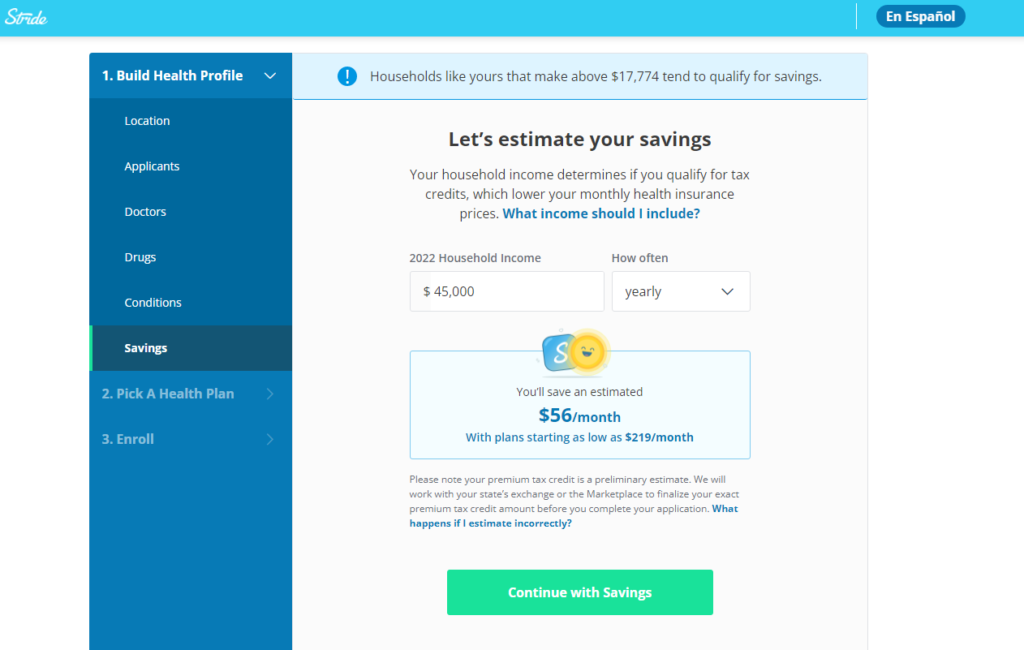

To see how this works for an average person, I chose a single man who makes $45,000 per year for the prompts below.

What Stride will find you in terms of health insurance will vary by so many factors, including:

- Your income

- Your dependents, if any

- Where you live (city and state)

- If you have health issues or specific medication

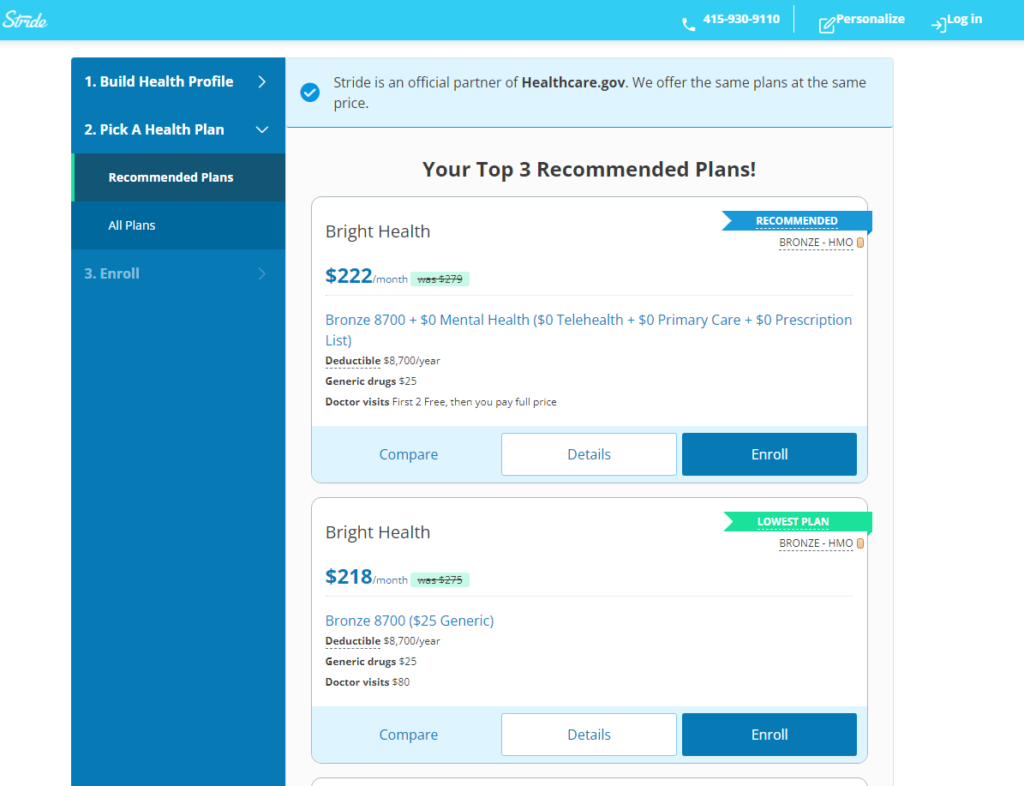

This is what Stride found “me” (aka the fictional person I created) as a single, younger man who earns $45,000 a year. Stride will find you different plans based on your unique situation and then recommend the best one for you!

Simple, easy and straightforward.

What Are Others Saying About Stride?

The Rideshare Guy team has been a big fan of Stride for years. In 2017, when former RSG contributor Christian Perea became a full-time independent contractor, Stride basically saved his life by connecting him to affordable health insurance options that would cover his needed medication.

In 2019, contributor-at-large Jay Cradeur used Stride to sign up for health insurance and saved $20,000/year vs. his previous health insurance plan! Since then, Stride has connected several others on the RSG team to health insurance options as well.

Some of the latest reviews on Stride confirm that Stride is not only excellent for business owners and independent contractors, but also helps reduce the time spent searching for insurance greatly.

As one recent reviewer commented, “I love Stride since it’s easy to use to get health insurance. Much easier than going through the marketplace. Very simple questions and can be done in less than 10 mins.”

Another recent review mentioned Stride’s dental options, which is another type of plan you can search for: “Cheap and great dental! Starts right away.”

Finally, if you’re worried if Stride is “just” a portal and can’t help you with your individual questions, one reviewer mentioned his hesitation and how Stride’s Member Experience Team helped him out: “I was very nervous about getting healthcare and spoke with Martin from Stride. The care and compassion he showed me will not be forgotten. The most helpful and kind human I have met in a while. He helped me in a time of uncertainty and made sure I was well taken care of.”

More Than Just Health Insurance

Stride provides more services than just helping you shop for healthcare. They can even help you track your mileage and help you prepare for tax season by showing you what deductions you can take.

Now more than ever, it’s important to be insured. If you’ve been on the fence about getting insurance (or seeing if you can reduce the amount you pay for insurance), why not check out Stride and see what’s available?

With recent changes to health insurance funding, you might be pleasantly surprised by how much you qualify for! Check out Stride’s options for you and your family here.

-Paula @ RSG