Download Stride Tax here for FREE using our affiliate link.

———-

Keep more of your profits and pay less taxes by tracking your mileage. The free Stride Tax App makes it easy.

If you’ve been following The Rideshare Guy for a while, you’ll know Stride is our favorite mileage tracker, but did you know Stride can also help you with your taxes? We had RSG contributor Chonce Maddox Rhea gives us the latest Stride tax app updates below.

Rideshare drivers have a lot to do and think about on a daily basis. Why not make your life a little bit easier with the help of the Stride app? Use Stride to automatically track your mileage throughout the year as well as tracking expenses and income. The best part? It’s free to use.

Quick links:

- Get the Stride tax app and mileage tracker here

- The full list of our top mileage tracking apps here

- Your guide to rideshare taxes

What is the Stride App?

The Stride Tax app is 100% free and runs in the background to track your mileage for you. All of your miles while working as a rideshare driver for companies like Uber, Lyft, and Via are tax-deductible, including the miles from home to your starting point and back home again at the end of your shift or day.

Check out our video below for our latest Stride app review to see Stride in action:

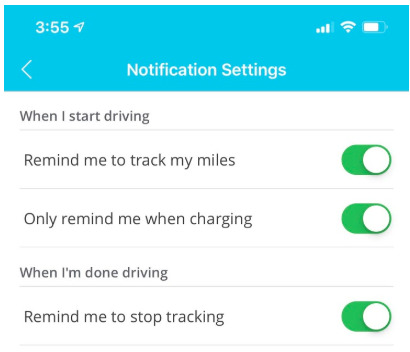

You can set up the app to know you’re driving when you plug in your phone. If you do not plug it in for charging, no notification or popup will show, so it’s less intrusive if you’re riding in a car with someone else at the wheel.

When you do plug in your phone and start driving, the app will send a popup asking if you’re driving for work. If you are rideshare driving at the moment, click on that notification and click on the plus symbol on the bottom of the page that pops up.

From there, click on track my miles and it will start tracking your rideshare driving miles. You do not need to track your personal miles, only the ones used for rideshare driving.

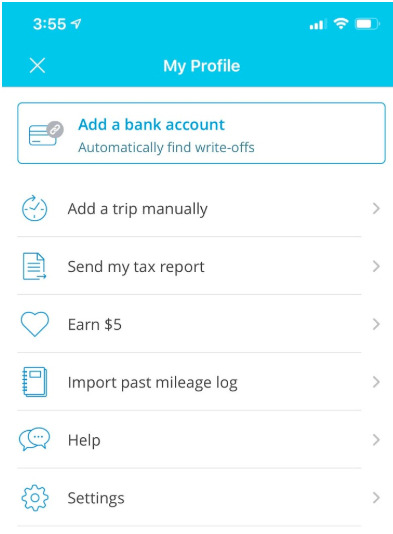

If for some reason you forget to track your miles, you’re able to manually add a trip into the app. As you can see below, you can also link a bank account if you have one that you use specifically for rideshare driving, and the app will automatically find write-offs for you.

This isn’t always 100% accurate, so it’s smart to go back in once a month — or more frequently if need be — to clean it up and move transactions to their correct categories.

The downside is that you do have to manually input to track your miles. It does not do it automatically for you like some similar apps.

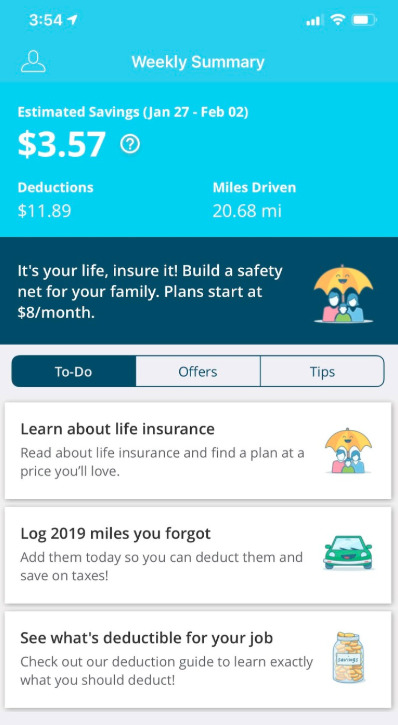

The big difference you’ll notice with Stride, however, is that you can file your taxes through it, just like Keeper Tax. It’ll even show you throughout the year what your estimated taxes will be based on the mileage and expenses input into the app.

How Can I Track My Business Expenses with Stride?

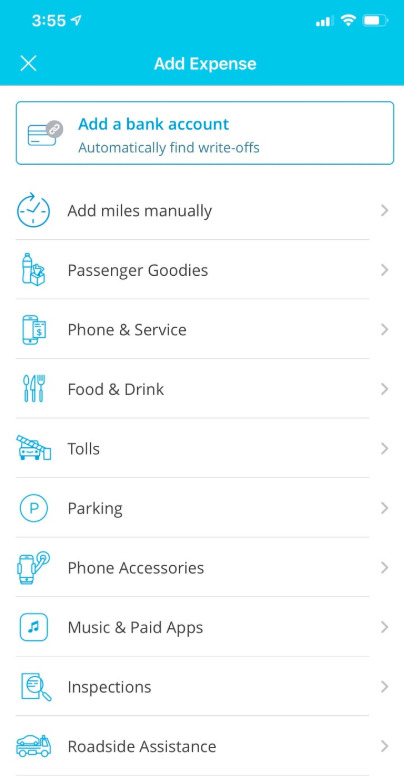

As rideshare drivers, we have a lot of miscellaneous expenses that add up throughout the year. Aside from the obvious like gas and maintenance on your vehicle (that is already included in the standard mileage rate automatically calculated within the Stride app), there’s also music app subscriptions, airport permits, vehicle inspections, your cell phone bill, dash cams and more to account for — and that’s not even if you go the extra mile to provide water or candy or extras like that for your passengers.

When you set up your app, you can choose what you do for a living. When you choose rideshare driving, it will auto-populate possible expenses you may incur while rideshare driving.

After you spend money on gas, tolls (while rideshare driving), inspections and more, you can add those expenses directly into the app so it will track everything for you in one spot.

Other Features of Stride App

More than just tracking mileage and expenses, Stride can be there for you in several other ways. Within the app, there’s also a benefits tab that shows other insurance options you can shop for including health, dental, vision and more. You do not have to buy into any of the options, but it’s conveniently all in one place for you.

For the health insurance aspect of it, you start by typing in your zip code so they know what is available in your area. From there, it asks more personal questions such as who you need coverage for (yourself, spouse, dependents, etc.), age and gender. It even allows you to specify if there’s a specific doctor you want covered by the plan you sign up for. So, if you work with a specialist or love your general practitioner, you can find a plan that includes their services.

After entering my general practitioner, Stride let me know that there are 10 plans that are accepted by my medical team. That lets me know I will have 10 options to choose from, and hopefully one fits my needs.

From there, you can enter your prescription drugs you take on a regular basis. This helps narrow down plans that will suit your basic health needs. It also asks about some basic medical conditions where you can check off the ones you have. It’ll then ask how much you estimate you will earn in the coming year in very general terms — either less than or more than $35,000.

As they specify, this should be income before taxes but after deductions. If you’re unsure of what that might look like, a good practice would be to look at your taxes from last year to give a rough estimate, especially if you’re thinking you’ll earn similarly to your past.

For me, Stride showed me the top three choices they found for me that work with my conditions, are accepted by my general practitioner and are commensurate with my income. They broke those three options down by their recommended option, the lowest price, and a similar plan.

Stride even let me know what the estimated fill cost is for drugs as well as the pertinent information like the price per month, deductible per year and estimated out of pocket costs.

You can then click on each plan to learn more or look at all the plans that you qualify for so you can make your own informed decision. Under each plan, it’ll break down into more information that you need to know such as how the plan handles surgery and treatment, emergency care, pregnancy and more.

Once you decide, you can pick the plan that’s best for you, create an account and they’ll walk you through the rest from there.

Feel free to explore the other insurance options available and see if any of them work for you and your needs.

Does Stride Integrate with Tax Programs?

Stride integrates with H&R Block’s tax program. When tax time rolls around, you can connect Stride with H&R Block to automatically import all of your expenses with just one click.

Final Thoughts

If you’re willing to manually start and stop your mileage tracking, this free tax and mileage tracker could be great for you. It’s so convenient having everything together in one place.

Also, pay attention to the deduction estimates throughout the year. If you ever start having to owe, you can make adjustments as needed and estimated tax payments so you won’t take as big of a hit at the end of the year.

Overall, Stride is an excellent tool to have as a rideshare driver because it can simplify the tax process for you so much at the end of the year. All you’ll have to do at tax time is load it up, input your expenses into whichever tax program you use, and then finish up your taxes.

Download Stride Tax here for FREE using our affiliate link.

Readers, how do you track your mileage as a driver?

-Chonce @ RSG