If you’ve been paying attention to what’s going on in California, between AB5 and Uber and Lyft threatening to leave, you may have heard a little about a proposition called Proposition 22. What is Prop 22, how is it different from AB5, and what will happen once it takes effect in California? Also, what are the implications for drivers in other states? Senior RSG contributor Paula Gibbins answers these questions and more below.

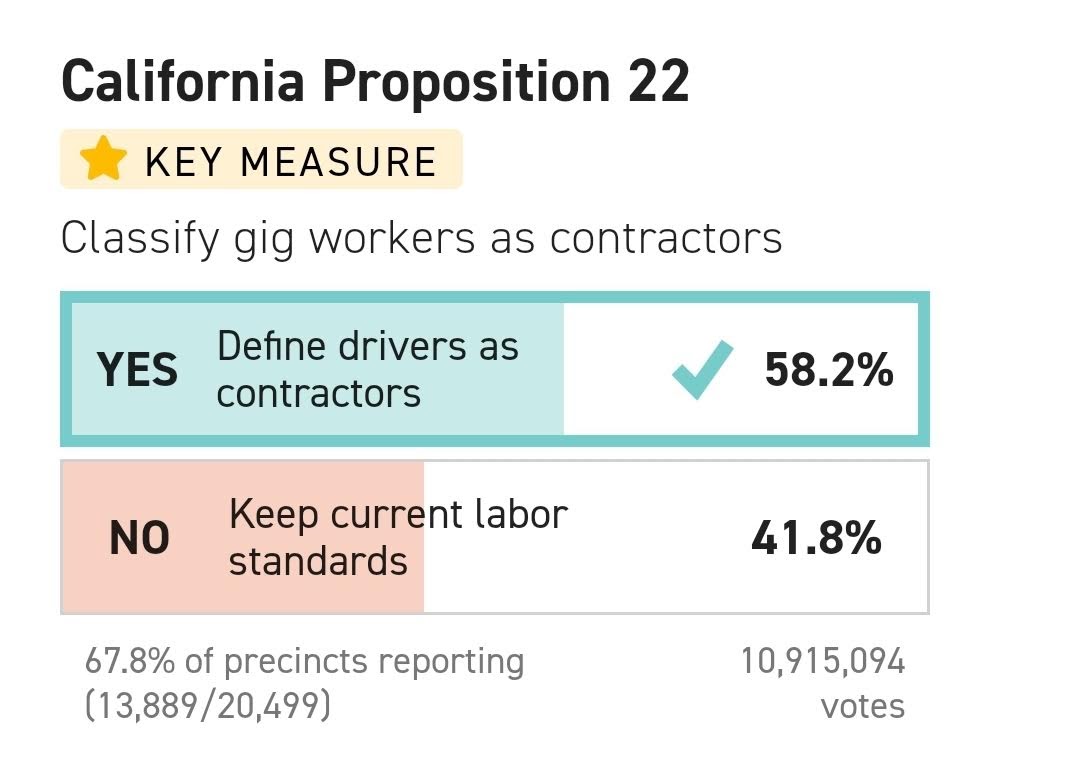

Proposition 22, also known as the App-Based Drivers as Contractors and Labor Policies Initiative, was on the ballot in California this year. It was voted on by California voters on November 3, 2020.

After 67.8% of the California precincts were reported, Yes on 22 was at 58.2% while No on 22 was at 41.8%. Politico called it at that point and checked off that Yes on Prop 22 passed with more than 10.9 million votes in its favor.

Update on Prop 22 August 2021: Prop 22 Ruled Unconstitutional in California

California’s controversial Proposition 22, which was approved with 58% of the vote, was ruled unconstitutional on Friday by California Superior Court Judge Frank Roesch. Uber plans to appeal this ruling, which stated “the entirety of Proposition 22 is unenforceable,” according to The Verge.

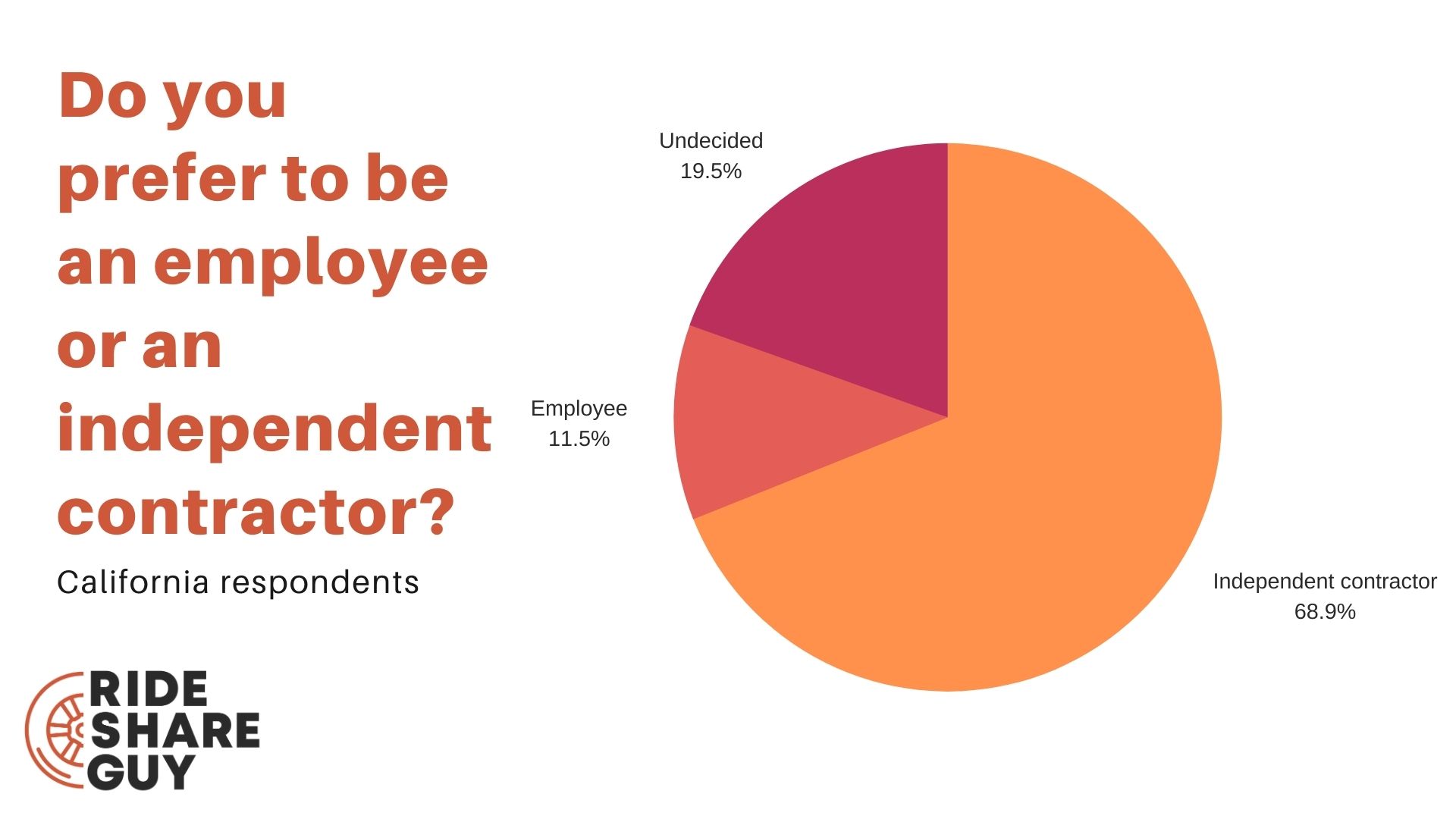

It’s interesting to see the framing around this, which seems to say this is a major victory for gig workers, even though the majority voted “yes” on Prop 22. In fact, when we surveyed our California readers in 2020 before the voting took place, 68.8% said they wanted to remain independent contractors. Only 11.5% wanted to become employees, and 19.5% are undecided or said they didn’t know which classification they preferred.

This is a victory for the minority of people who voted “no” on Prop 22, which is fine to fight for, but it’s not factual to frame this ruling as what “all gig workers want” when it’s clear that’s not the case.

__________________________________________________________________

The news below reflects pre-August 2021 news.

Yes on Prop 22 Wins – What Does it Mean for Drivers?

With the Washington Post calling the results for Proposition 22 passing, it’s official that now rideshare and delivery drivers will be considered independent contractors – not employees.

Do the results surprise you? Below, Harry shares his thoughts about the results, and he was surprised that the sheer amount of money Uber and Lyft spent did not backfire on them:

Wow. Not as close as I thought it would be! https://t.co/mFSO3yvYJj

— Harry Campbell (@TheRideshareGuy) November 4, 2020

Listen to what Harry and NYTimes reporter Kate Conger had to say on the passing of Prop 22 and what it means for drivers nationwide here.

Changes Roll Out to California Gig Workers

As of mid-December 2020, drivers across California began receiving updates in their Uber driver portals, detailing the changes coming to them. Among these changes include: healthcare stipend, guaranteed minimum earnings, and injury protection. Below, we detail what drivers received from Uber and include our perspective and analysis.

Healthcare Stipend

According to the email California drivers received from Uber:

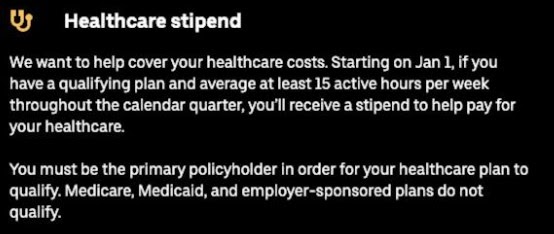

We’ll begin with the healthcare stipend, since any kind of healthcare coverage is a new concept for drivers. The way it sounds is you have to be signed up for a qualifying plan and average at least 15 active hours per week each calendar quarter to receive a stipend to help cover the cost of your healthcare plan.

Note: 15 hours of active time realistically means, for drivers, 20-30 hours of online time. Since it’s per company, you can’t combine hours. This is not a good deal for drivers! This should have been combined and allowed drivers to work for multiple apps, having all hours on any platform count as ‘active’ time.

In this instance specific to the healthcare stipend, active hours start as soon as you accept a trip and end when you complete it. For the healthcare plan side of things, you must be the primary policyholder. If you’re on Medicare, Medicaid or a plan paid for by an employer, you cannot receive the stipend from Uber.

Under their “How it works” section for this, Uber states:

- To qualify for a healthcare stipend, you must be the primary policyholder. Medicare and Medicaid plans and those paid by employers are excluded from this benefit.

- If your plan qualifies, you’ll need to submit proof of health insurance enrollment. This may include a health insurance identification card or coverage forms.

- Receive 50% of the stipend when you average at least 15 active hours per week over the calendar quarter.

- Receive 100% of the stipend when you average at least 25 active hours per week over the calendar quarter.

Read more about how the health care stipend works here.

Guaranteed Minimum Earnings

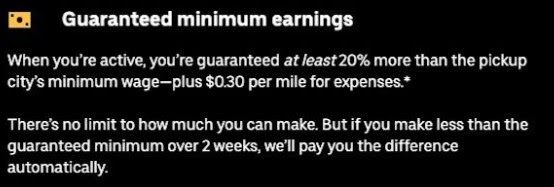

This one is fairly straightforward, but of course, comes with some stipulations. The basic concept is that you’ll earn a minimum of at least 20% more than the city minimum wage of where you’re picking up passengers or food, PLUS $0.30 per mile for expenses when you are “active”.

One big stipulation that stands out is that “the $0.30/mile compensation does not apply for delivery people on foot or bicycle.” It does apply if you are doing Uber Eats deliveries using a car or motorbike.

This means, if you do Uber Eats by using your bicycle or walking, the minimum earnings doesn’t apply to you because it’s meant to go toward vehicle expenses such as gas and vehicle wear and tear.

Just like with the healthcare stipend, the “active time” is considered to start when you accept a trip and end when you complete it.

This is slightly better than we’d all feared when Prop 22 was first proposed. Back then, it sounded like active time was only once you picked up the passenger, but the wording they use here sounds like it’s as soon as you accept a trip and are then making your way toward it.

It is unclear, however, what happens if you accept a trip while actively driving someone else. Will the time overlap/double up or will it just kind of mesh together as if it’s one long trip?

Uber goes on to explain, “The guarantee takes into account your trip fares and any money made through promotions. Tips, refunds for tolls and cleaning fees, cancellation fees, and referral payments are not counted toward the guarantee.”

Injury protection

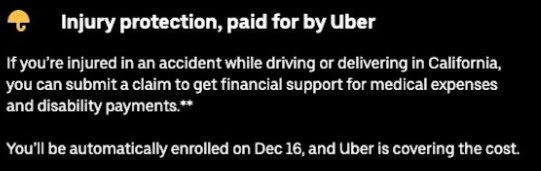

Uber’s post states, “Effective December 16, 2020, you’ll be enrolled in Injury Protection insurance, paid for by Uber.** If you get into a covered accident, this insurance will help protect you and your family from financial hardship.”

Benefits include medical expense coverage, disability payments and survivor benefits. You do not need to take any action. You are automatically enrolled as of Dec. 16, 2020 at no cost to you. It only counts towards trips that start in California or while you’re waiting for a trip while in California.

More details are available to you in the Insurance Hub in your Uber Driver app.

Other Changes Coming to California Drivers

Along with the big changes mentioned above, there are a few other changes being rolled out now that Prop 22 has been voted in. This is taken directly from the Uber Blog post:

- Deactivation appeals: If your contract is terminated by Uber on or after December 16, 2020, you can now make an appeal through a new process.

- Required breaks: You’ll be required to go offline for at least 6 consecutive hours if you drive and/or deliver by car for more than 12 hours in a 24-hour period.

Safety training:

- You’re now required to complete a new Prop 22–mandated safety course before July 1, 2021. Safety courses will be made available in the Driver app.

- If you sign up to drive or deliver with Uber after January 1, 2021, you’re required to complete this training before you can take your first trip.

Note: Proposition 22 will also affect delivery drivers, like the ones listed in our best food delivery services to work for article.

30 Cent Wording in Proposition 22

Since Prop 22 was passed, we’ve all been biding our time to see how it all shakes out. One portion is still hotly debated because it’s still not 100% clear what Uber means.

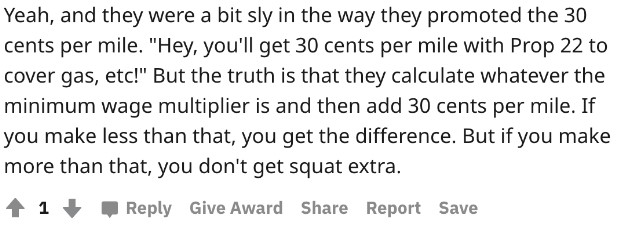

Uber states:

“When you’re active, you’re now guaranteed at least 20% more than the pickup city’s minimum wage—plus $0.30 per mile for expenses.*”

But what many drivers are finding is that what Uber really means, as this Reddit commenter posted:

“Yeah, and they were a bit sly in the way they promoted the 30 cents per mile. ‘Hey, you’ll get 30 cents per mile with Prop 22 to cover gas, etc!’ But the truth is that they calculate whatever the minimum wage multiplier is and then add 30 cents per mile. If you make less than that, you get the difference. But if you make more than that, you don’t get squat extra.”

“Yeah, and they were a bit sly in the way they promoted the 30 cents per mile. ‘Hey, you’ll get 30 cents per mile with Prop 22 to cover gas, etc!’ But the truth is that they calculate whatever the minimum wage multiplier is and then add 30 cents per mile. If you make less than that, you get the difference. But if you make more than that, you don’t get squat extra.”

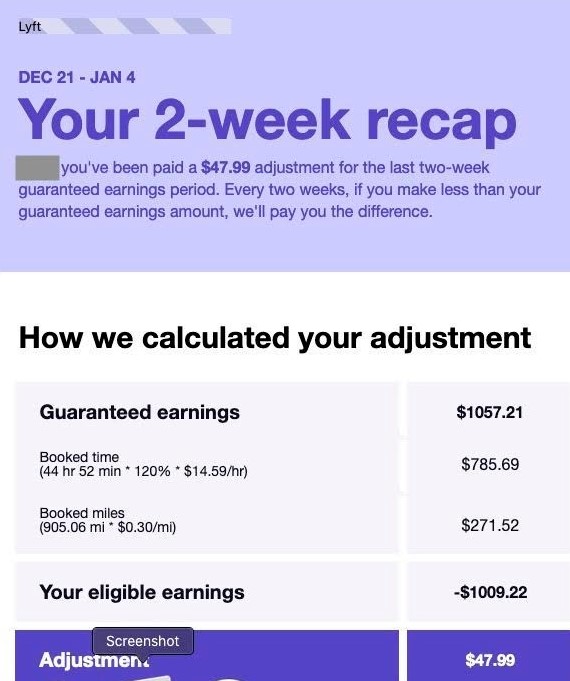

Lyft breaks down the guaranteed earnings for the two weeks in a recap:

This driver had their earnings adjusted by $47.99 to make up the difference for the minimum earnings they were guaranteed. Since this person only earned $1,009.22, but his minimum earnings showed he should have earned at least $1057.21, Lyft made up the difference.

Piecing together all of this information, it seems like the rate of 20% more than the minimum wage in the area is the starting point for earnings when looking at your booked time.

The 30 cents per mile is tacked onto your booked miles (a passenger in your vehicle). If the booked time at the 20% above minimum rate, and the booked miles times the 30 cents per mile is more than what your earnings show you made, you’ll be given the difference.

For example, let’s say you were booked for 10 hours and 0 minutes, and let’s say you drove 200 miles and you earned $300 (not including tips) and the minimum wage in the city you drove in is $14/hour. Using the formula from Lyft, here is what that would look like:

Booked time:

10 hrs x 120% x $14/hr = 168

Booked miles:

200 x $0.30/mile = 60

Next, add your booked time to your booked miles:

168 + 60 = 228

228 is your guaranteed minimum. Since you earned $300, you will not receive anything extra. If you had only earned $200, Uber or Lyft would have “topped you off” with the difference of the $28 to give you the guaranteed minimum earnings for those two weeks.

This calculation is done every two weeks, and if you made less than the guaranteed minimum, they add the difference to your payout after those two weeks.

With the breakdown that Lyft provided, it shows that they are still “adding on” $0.30 per mile, but if you earn over the minimum, you’re not going to see anything extra.

If President Biden succeeds in raising the federal minimum wage to $15 an hour. Then, the calculation would shift slightly.

10 hrs x 120% x $15/hr = 180

Your booked miles would stay the same, so:

180 + 60 = 240

If federal minimum wage passes, your earnings could increase slightly.

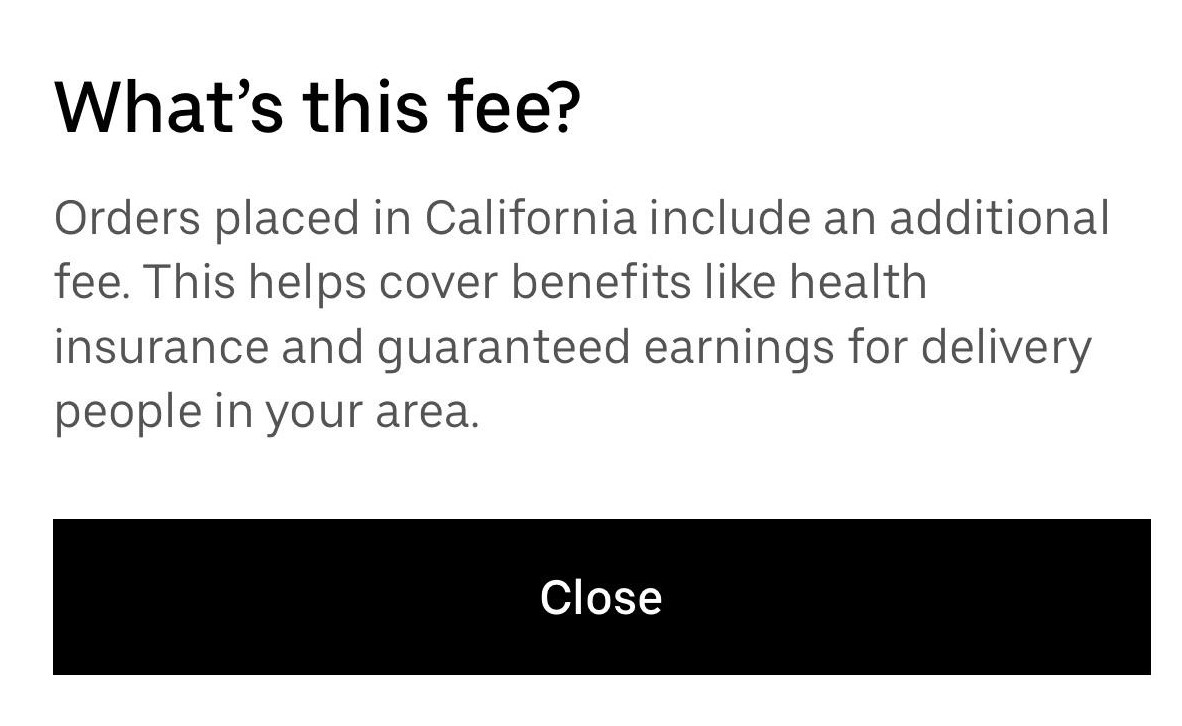

Uber Already Increases Fees on Customers

It didn’t take long for Uber to announce the fee increases on customers, which they’re saying goes to health insurance and guaranteed earnings. According to a screenshot this customer shared on Reddit:

California customer and driver response to this was swift. One important point this customer made:

But Uber, you need to stop playing! You’re really telling me that you’re not making enough money DAILY that you can’t cover the driver benefit yourself? Does this mean we don’t have to tip drivers now? Is that seriously the message you’re trying to send?

It’s definitely a concern that some customers could see the words ‘fee’ and ‘guaranteed earnings’ and think their drivers or couriers are being paid adequately and don’t need a tip – this is still far from the truth for the majority of drivers!

Unfortunately, a Berkeley study already pointed out Uber and Lyft could pay drivers more without increasing passenger fares – but that study seems to have had no impact on this fee increase in California.

Another Reddit user pointed out Uber’s never been under any obligation to pay workers fairly, and in fact is using Prop 22 as a benefit to boost their bottom line:

Uber is saving millions of dollars on not having to pay full employee benefits with Prop 22 recategorizing them as contractors. They have been given an exemption to existing law, an advantage to increase their profits by decreasing costs.

But rather than keep prices low you see higher prices and added fees, because surprise surprise they don’t care about drivers they care about their bottom line and manipulated drivers and voters to further their profit seeking agenda.

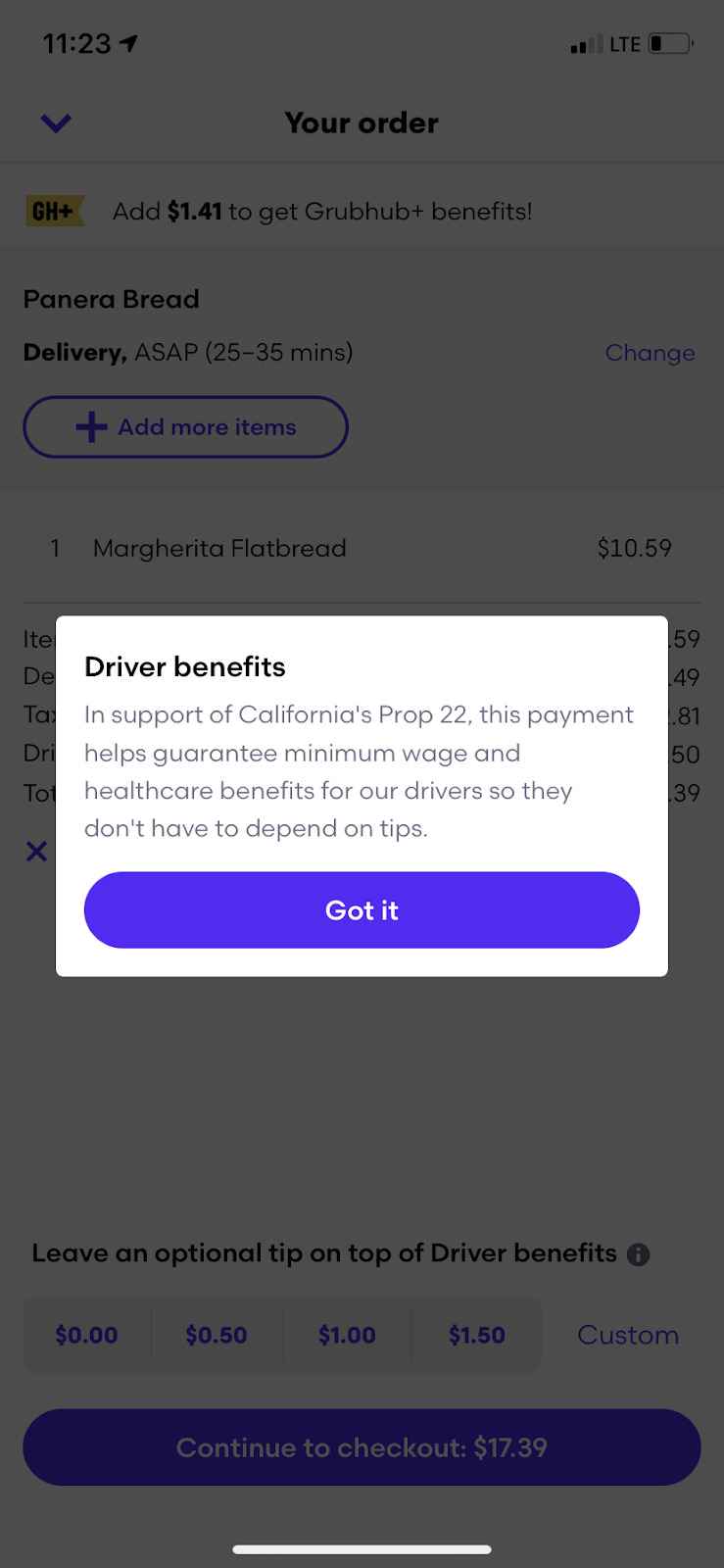

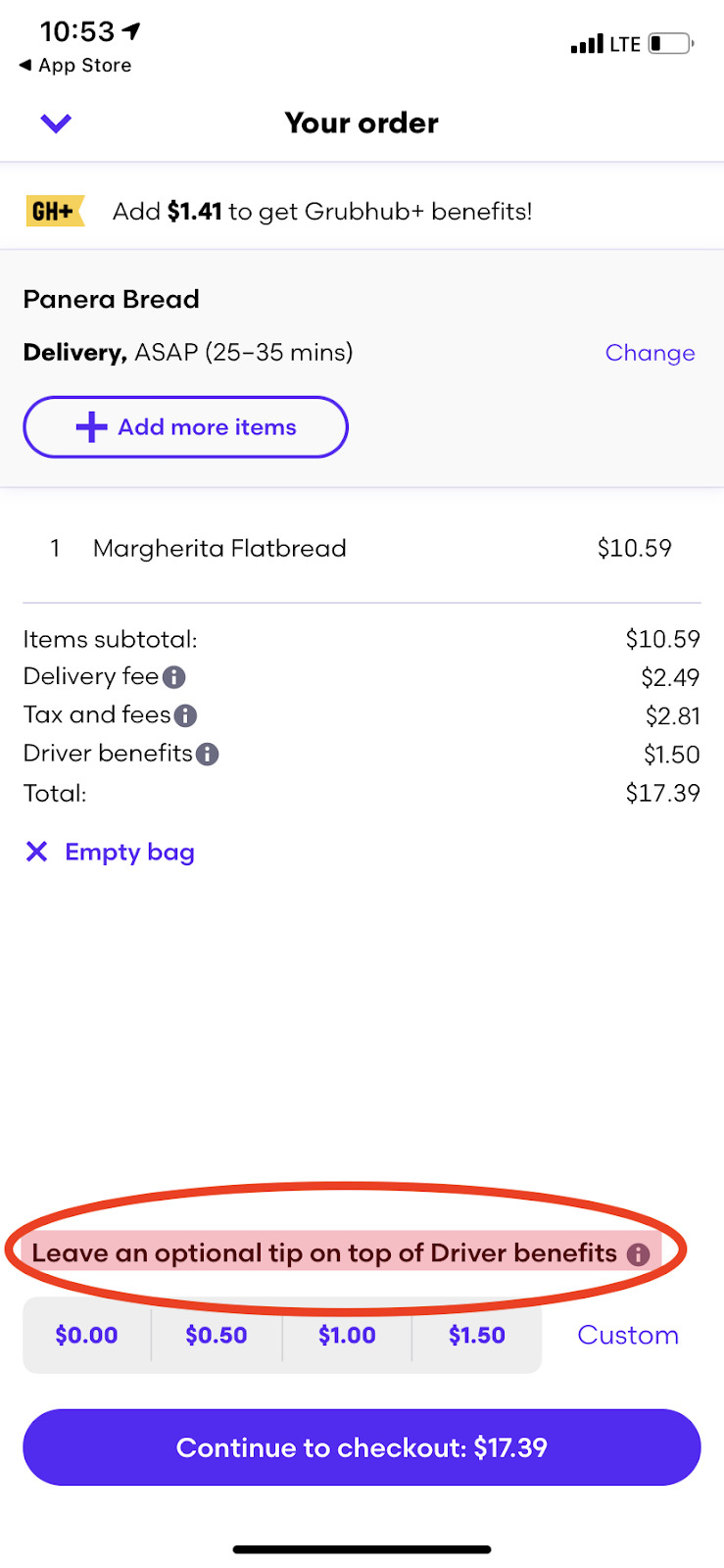

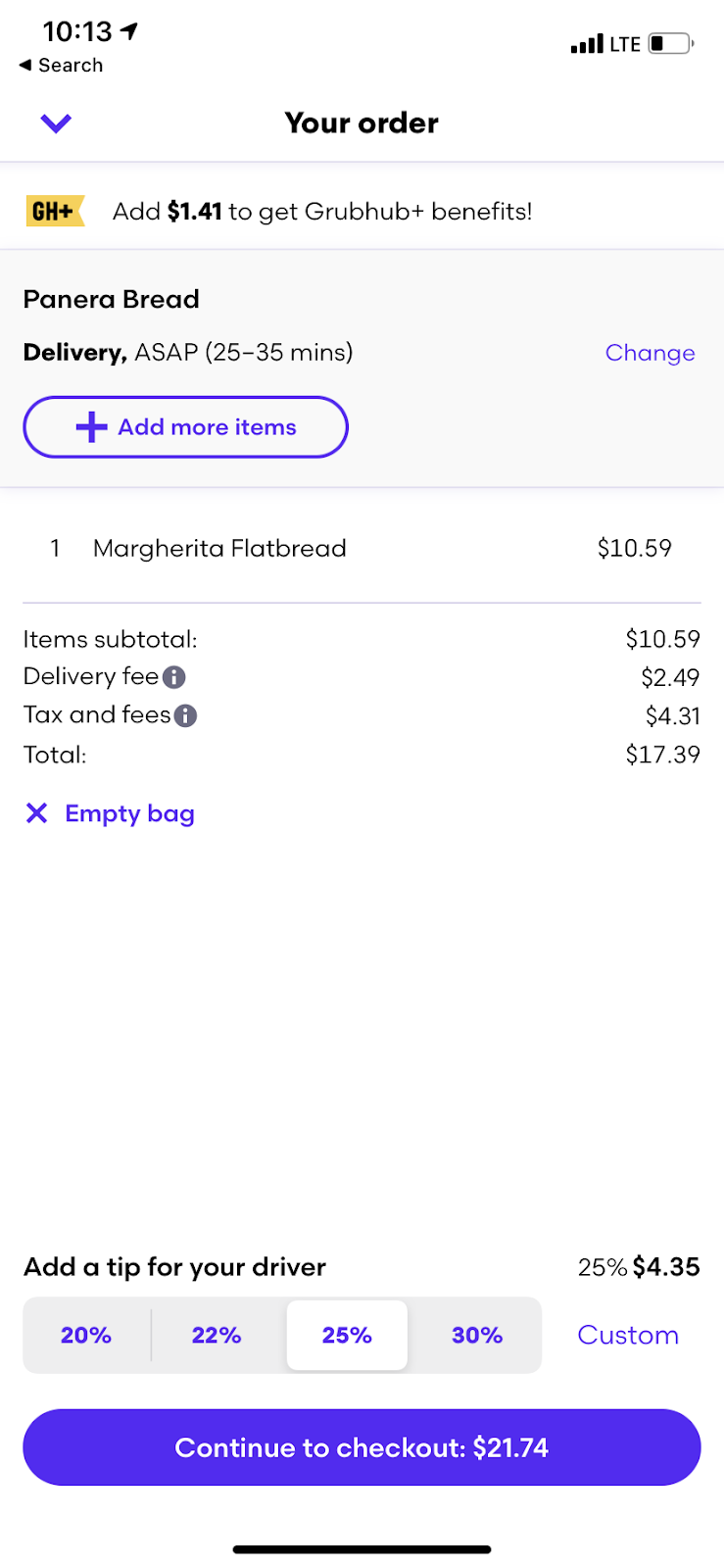

Grubhub Rolls Out Changes to Driver Tipping Screen, Blames Prop 22

It appears that Grubhub has changed the way they display suggested tips within its consumer app. Instead of a percentage, such as 15% or 20%, they are shown a dollar amount where the top suggested amount is no more than $1.50.

Customers have also noticed that there’s an added fee on their orders. The explanation given within the app is this:

“In support of California’s Prop 22, this payment helps guarantee minimum wage and healthcare benefits for our drivers so they don’t have to depend on tips.”

The fee is simply called “Driver benefits”. On top of that, at the bottom of the screen where a customer is typically encouraged to leave a tip, they are greeted with the message “Leave an optional tip on top of Driver benefits.”

This almost sounds like Grubhub is replacing driver tips with this “Driver benefit” fee that is not optional and discourages customers from actually leaving a tip. It sounds like they are just trying to get around paying for the driver benefits themselves.

In the old system, the customer was given a range of percentages from 20% up to 30% to choose from, all of which are higher than $1.50 in the new system.

Typically, customers will base their tips on what is suggested. If they want to go lower, they will, but will rarely go higher if that option is not directly in front of them.

As you see in the example above, with the old system, this driver could have gotten a $4.35 tip versus the $1.50 of the new system. It was also not labeled as “optional” to tip your driver previously.

Instead, it had the simple wording “Add a tip for your driver”. Nothing about optional and nothing about “on top of X fee”.

Driver Response

Understandably, drivers took to the internet to vent their frustrations at the change.

One person on Reddit stated: “It is certainly an interesting middle finger to their drivers. For this to have gone live, it means somebody with the authority to force it through or stop it made it happen despite doubtless many people telling them this was going to backfire.”

That thread goes on for over 100 comments, mostly with the sentiment that Grubhub is doing a huge disservice to their drivers, most especially the week before Christmas. In many instances, it’s pushing drivers to drop Grubhub and go work for competitors, such as DoorDash.

On a similar thread, this driver said, “Haven’t gotten higher than 1.50 tip in the last 3 days.”

To be clear, $1.50 is not the max allowed on the app at the moment, but it is the highest option shown on the tipping screen.

A customer posted, “Grubhub’s max suggestion on tips is $1.50. You can customize but most people are lazy and with Grubhub’s wording, they are strongly influencing the $1.50 max. I ordered and just tipped cash for the first time because of this.”

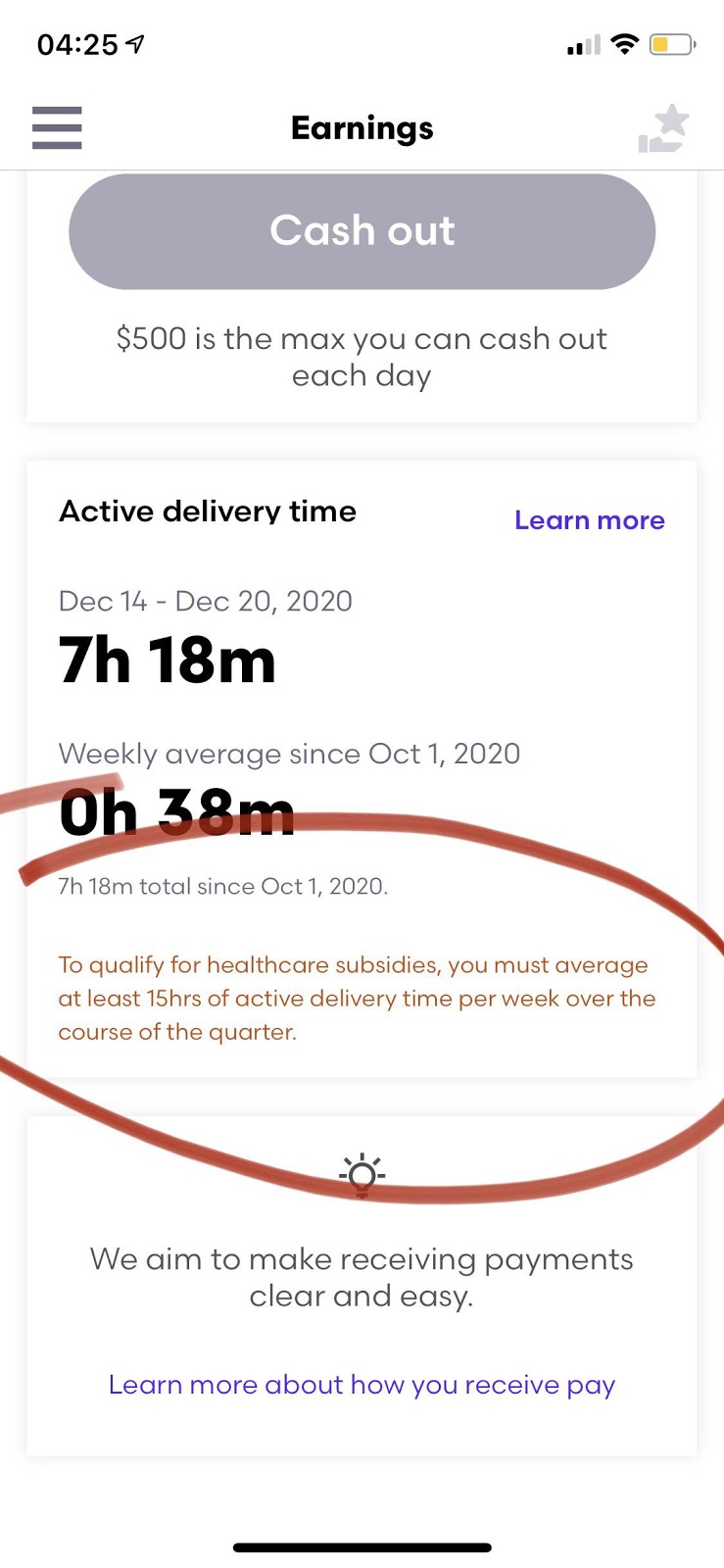

Of course, with the passing of Prop 22, other changes have been happening as well. One of them is what a driver needs to do to qualify for the “healthcare stipend” that was promised with the passing of Prop 22.

This screenshot shared on Reddit shows: “To qualify for healthcare subsidies, you must average at least 15hrs of active delivery time per week over the course of the quarter.”

It is what was promised in the proposition. Apps such as Uber and Lyft have stated that their definition of “active time” for this qualification means once you accept a trip until the completion of the trip.

On Grubhub, it states, “Active delivery time is the period of time from when a driver accepts an offer to when the driver completes the order, or to the time when the order is canceled by the customer or restaurant.”

It also stipulates, “You will not be paid for active delivery time if you abandon or choose not to complete the delivery after you have accepted the offer, or if other fraud is detected by Grubhub.”

Unfortunately for drivers, this doesn’t make clear what would happen if you’re unable to complete an order because no one answers the door or other instances where it’s impossible to complete the delivery.

Reactions to Prop 22 Passing in California

Some on Twitter said this was a solid rebuke to Assembly Bill 5, although Uber and Lyft did not run on that explicitly:

Some don’t trust Uber and Lyft to stick to their promises:

According to MarketWatch, Uber and Lyft’s stock is up, reflecting the uncertainly as to how Prop 22 would play out, but then rewarding the companies once it was announced Prop 22 had passed:

“Shares of Uber Technologies Inc. shot up 11.0% toward a near 9-month high in premarket trading Wednesday, after the ride-hailing company won an election fight in California, where the passing of Proposition 22 allows drivers to be considered independent contractors instead of employees. Rival Lyft Inc.’s stock soared 14.9% ahead of the open.”

That did not go unnoticed by some journalists, including Hamilton Nolan, who pointed out that Uber and Lyft’s relatively small investment led to huge gains:

Uber and Lyft invested around $200 mil in a ballot measure to minimize labor costs and have gained around $8 billion in value in one day as a result. That’s how democracy works folkshttps://t.co/H00LjXmPhZ

— Hamilton Nolan (@hamiltonnolan) November 4, 2020

Lyft made an announcement on their blog regarding the Proposition 22 news:

“This is the result of years of work to secure both independence and benefits for drivers. We’re grateful for the progress and appreciate you being part of the Lyft community.”

DoorDash co-founder and CEO Tony Xu also had this to say in his blog post:

In a statement re Prop 22, DoorDash CEO @t_xu says: “Now, we’re looking ahead and across the country, ready to champion new benefits structures that are portable, proportional, and flexible. It’s what workers want and provides the protections and benefits they deserve” pic.twitter.com/bxuF8gOxkB

— sara ashley o’brien (@saraashleyo) November 4, 2020

What This Means for Drivers Outside of California

While the news that the Yes on Prop 22 campaign was successful mainly pertains to California drivers, this does not mean drivers are off the hook in other states.

In Massachusetts, expect Uber and Lyft to take their winning momentum against Massachusetts’ current law classifying drivers as employees:

“That may foreshadow developments in Massachusetts, where Attorney General Maura Healey recently sued Uber and Lyft to enforce a state law that she argues does essentially the same as that in California: classifies drivers as employees.”

The same tactic could also be used in New York City, as well.

It isn’t all that surprising to me that Prop 22 has passed. The amount of money that Uber and Lyft (and others) put into this ballot measure—along with advertising including push notifications through the Uber app—it’s likely their message got through to people a lot easier and clearer than their opposition.

It will be interesting to see if the courts decide that Uber and Lyft will owe back pay to their drivers for the time period where they should have been treating their drivers as employees based on California labor laws before Prop 22 took the win.

Wondering what will happen with Prop 22 legislation across the nation? Check out our updated article on PRO Act and similar legislation here.

__________________________________________________________________

The news below reflects pre-election result reporting.

The Latest News on Proposition 22

As we come down to the wire for voting on Proposition 22, a flood of news has come out recently about polling numbers and funding the for/against campaigns. As of October 2020, total contributions have “surged past $218 million, the most cash raised for any ballot measure campaign in California history.” Most of this funding is led by Uber, Lyft and delivery companies like DoorDash. According to this Los Angeles Times article, “the ‘yes’ side’s money-raising has dwarfed the opposition’s – $187.5 million to about $15 million.”

According to the Los Angeles Times, this could “end up being the most expensive campaign in the nation.” As recently as October 24 (10 days before election day), Uber, Postmates, and Instacart added another $9 million to the Yes on 22 campaign.

Uber, Instacart, and Postmates throw in together on another $9 million to the Yes on 22 campaign, bringing its total raised to $199 million.https://t.co/B87XqBPFFi https://t.co/8J8G3xT36K

— Rob Pyers (@rpyers) October 23, 2020

In general, adding money like this to a campaign where you’ve already overwhelmed the opposition doesn’t speak highly of your confidence that the result will go your way. What is internal polling for the Yes on Prop 22 campaign saying? It may not be polling well.

The Latest Poll Results

According to the Los Angeles Times, the UC Berkeley Institute of Governmental Studies released survey results on Monday (October 26), and “found that 46% of likely voters said they’ll vote (or have already voted) to support the proposal written by the app-based companies, allowing drivers to remain as independent contractors but offering them new wage guarantees and benefits — albeit less generous than those the drivers would receive if classified as employees.”

Forty-two percent of likely voters survey said they oppose Prop 22. The number of undecided voters is 12%.

In September, we sent a survey to our driver readers about Prop 22 and received 609 responses. Out of these respondents, 73.7% of drivers were from California. We asked a series of questions about Proposition 22, including:

- Are you for or against Proposition 22?

- Do you prefer to be an employee or an independent contractor?

- Why are you ‘for’, ‘against’ or ‘undecided’ about Prop 22?

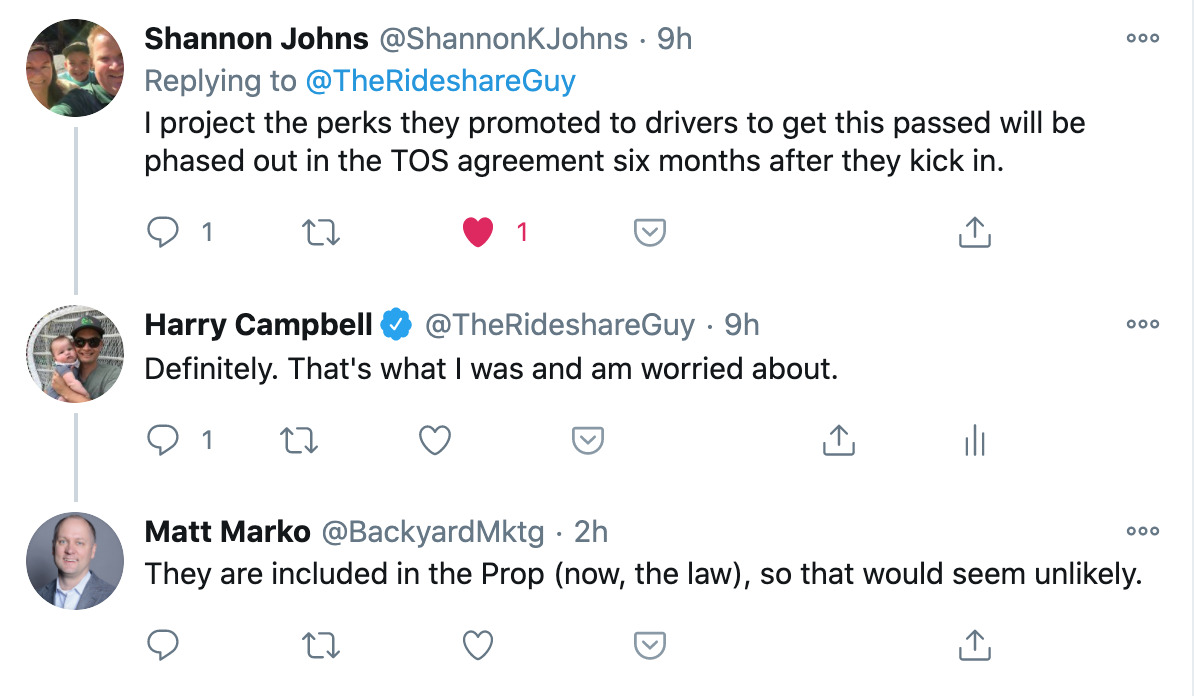

60% of California Drivers Are ‘For’ Proposition 22

Out of California respondents, 60.1% are in favor of Proposition 22, with 23.6% against and 16.2% ‘undecided’ or ‘I don’t know’.

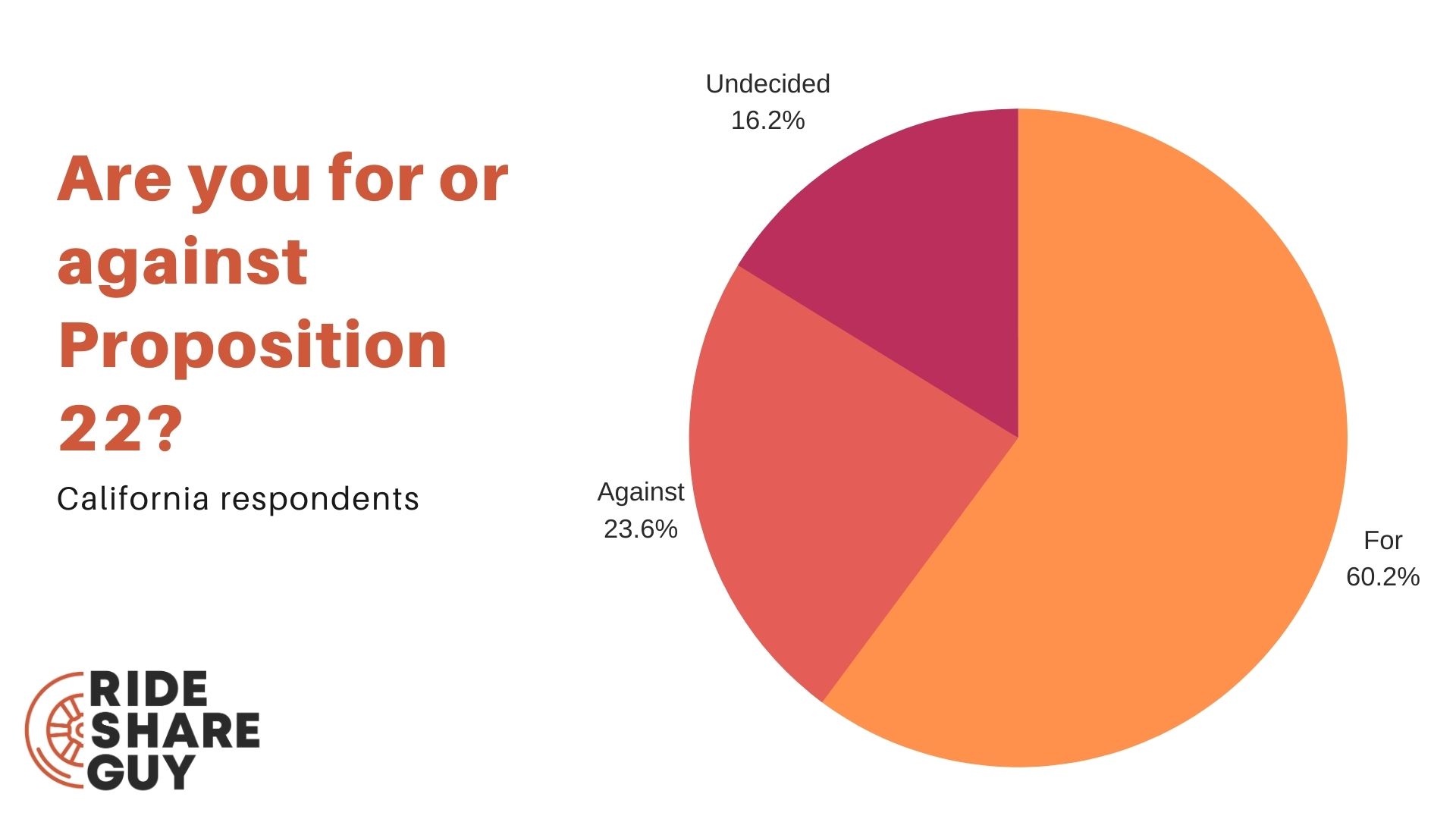

For all of our respondents, an overwhelming 67% are for Prop 22, while 27% are against and 7% are undecided.

For all of our respondents, an overwhelming 67% are for Prop 22, while 27% are against and 7% are undecided.

Overall, the numbers between drivers nationwide and California-specific respondents did not differ too much – except for the number of undecideds.

Overall, the numbers between drivers nationwide and California-specific respondents did not differ too much – except for the number of undecideds.

If the ‘Against’ campaign was able to convince all Undecided respondents to vote against Prop 22, that would increase the percent ‘Against’ Prop 22 to 39.8% – not a victory, but much closer than 23.6%.

69% of California Drivers Want to Remain Independent Contractors

According to our results, out of California respondents, 68.8% said they wanted to remain independent contractors. Only 11.5% wanted to become employees, and 19.5% are undecided or said they didn’t know which classification they preferred.

This lines up fairly closely with the overall, nationwide responses we received. According to our poll results, nationwide 79% of respondents want to remain independent contractors, with 13% expressing the desire to become employees and 8% responding they weren’t sure/didn’t know.

This lines up fairly closely with the overall, nationwide responses we received. According to our poll results, nationwide 79% of respondents want to remain independent contractors, with 13% expressing the desire to become employees and 8% responding they weren’t sure/didn’t know.

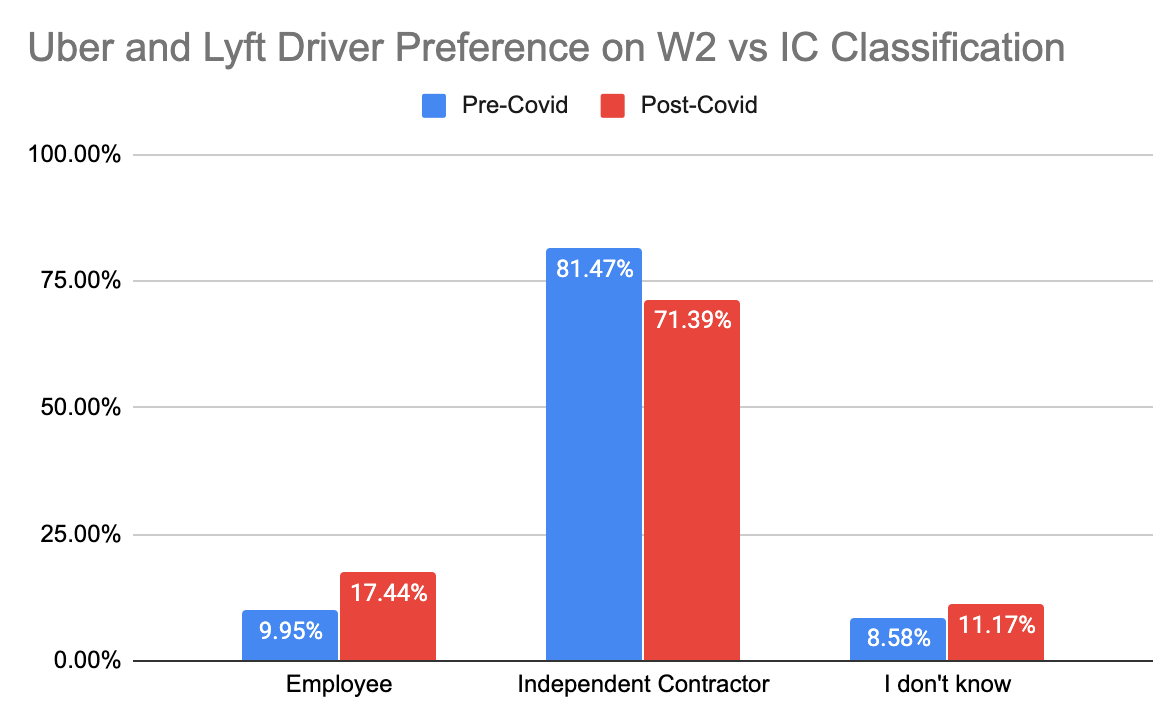

This is similar to numbers we saw earlier this year when we polled our driver pool. In May 2020, we sent a survey to our email list of 80,000 drivers and got responses back from 734 of them. Of those 734 drivers, 71% said they would prefer to remain independent contractors while 17.44% said they’d prefer to be employees and 11.17% were undecided.

Pre-COVID-19, when we sent out our annual 2019 survey, even more drivers were in favor of remaining independent contractors at 81.47%. From that survey, only 9.95% wanted to become employees while 8.58% were undecided. For that survey, we got responses back from nearly 1,000 drivers.

Nearly 13% of polled respondents said ‘flexibility’ was their number one reason for wanting to remain independent, by far the highest percentage of all the reasons provided. Other reasons for wishing to remain an IC included:

Nearly 13% of polled respondents said ‘flexibility’ was their number one reason for wanting to remain independent, by far the highest percentage of all the reasons provided. Other reasons for wishing to remain an IC included:

- Control / autonomy

- Independence / freedom

- Not wanting to be ‘micromanaged’ or otherwise treated like an employee with specific shifts, hours to work, etc.

What Drivers Are Saying

One driver who is against it said, “A vote no allows Uber, Lyft and DoorDash to become accountable to the state. If passed these companies will continue to rip drivers off.”

A driver who is for Prop 22 said, “Drivers have been liberated from working for employers, we want to continue to control our own destiny.”

Another driver pointed out: “There is nothing in AB5 that says Uber/Lyft must take flexibility away if drivers become employees.”

What is Uber Doing About This?

According to this article by San Francisco Chronicle reporter Carolyn Said, it looks like Uber will be or already is encouraging passengers to view a pro Prop 22 video. According to the article, ‘The next time you order a meal or ride from Uber, your app will showcase a TV-style commercial for Prop 22.’

In fact, Harry noticed this when he recently used the Uber app as a passenger:

Looks like Uber is now requiring riders to accept this notification in order to call for a ride! Have you seen this on your pax screen? Make sure to take our Prop 22 poll here! https://t.co/GFXuC1drbT pic.twitter.com/ZpKBRmclMN

— Harry Campbell (@TheRideshareGuy) September 28, 2020

Is it necessary at this point? Uber seems to think so, and many of the gig app companies want to keep the momentum up until the election in November. However, according to our poll results, Uber and Lyft may have little to worry about.

Viewer Response to Proposition 22

Senior RSG contributor Jay Cradeur shared his opinions on The Rideshare Guy YouTube channel about what he thinks about Prop 22 and how he plans to vote this November. Viewer response was swift! Below, Jay shares viewer and driver responses and explains more about Proposition 22: Jay’s Reaction To Lyft & Uber Drivers Comments About His Prop 22 Vote

What is Proposition 22?

Proposition 22 is a ballot measure made in response to the implementation of AB5, which outlined requirements for calling workers employees versus independent contractors. Take a look at the history of AB5 below:

AB5 doesn’t specifically call out rideshare and gig economy companies, but it does make it extremely difficult for those companies to argue their drivers and delivery people are independent contractors. Due to that, Uber, Lyft, Instacart, Postmates and DoorDash teamed together to fund Prop 22.

According to an article on CNET, “As of Aug. 28, the five gig economy companies had contributed more than $111 million to Proposition 22, according to California’s Fair Political Practices Commission, with Uber, Lyft and DoorDash the biggest backers.”

Prop 22 is aiming to call out those rideshare/gig companies and create a separate law that defines that they can call their workers independent contractors while providing some of the benefits of an employee.

If Prop 22 does not get voted in this November, Uber, Lyft and the others will be required to classify their drivers as employees under the law of AB5 according to a recent judge ruling.

Greg Ferenstein, a writer, researcher and educator, posted a handy voter guide about Prop 22 from the worker’s perspective. In a nutshell, he describes arguments both for and against Prop 22:

For:

- Uber driver surveys show that majority of gig workers want to remain independent contractors

- Forcing employee status will eliminate jobs and flexibility

- The proposition adds standards wage and benefit for independent contractors of drivers and couriers (although it’s important to note that the wage guarantees are NOT the same as a minimum wage since they only count engaged time)

Against:

- Gig workers will earn more as employees

- Gig workers will have better benefits as employees

- The proposition language makes it difficult for the state legislature to later amend the law

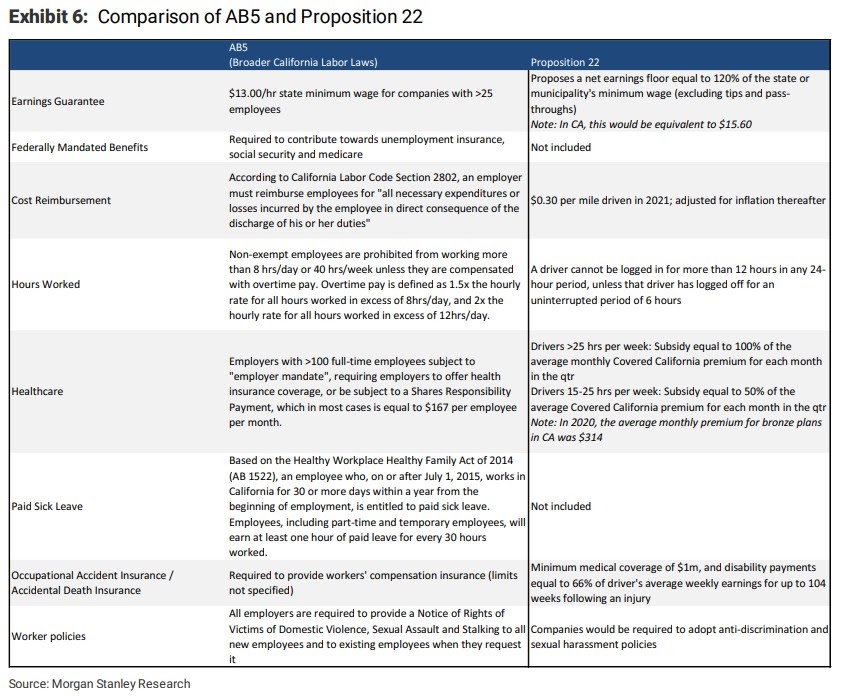

Wondering how AB5 and Proposition 22 differ from each other? This comparison from Morgan Stanley elucidates the differences:

What Polls Are Saying About Proposition 22

The LA Times published an article on Prop 22, linking a poll from the UC Berkeley Institute of Governmental Studies. The poll is close, with a high percentage of people (25%) who are undecided on how their vote will fall with Prop 22. However, despite how close it is, Prop 22 needs a vote of at least 50% in favor in order to pass.

The article states:

“With a built-in pool of union workers to conduct phone banks and knock on doors, organized labor in California can typically put up a good fight against campaigns with more money. But the pandemic has made it harder to gather union workers together to make hundreds or thousands of calls to potential voters and created new concerns about door-to-door contacts.”

It also stated that the poll showed:

“Opinions seemed to track with political leanings across California. Opposition is the highest in the Bay Area, where 42% of voters are against exempting app-based companies from having to treat their workers as employees. In Orange County, 46% of likely voters support the measure.”

As the Rideshare Guy Harry points out in this tweet, “Looks like there are 21 million registered voters in CA, so not sure what an appropriate sample size would be.”

Such a small sample. But I think that’s part of the problem – I assume only a very small % of population in CA knows what prop 22 is

— Charlie Zvibleman (@CharlieZvible) September 23, 2020

A poll of 5,900 is likely not going to give an entirely accurate outlook on voter’s opinions on Prop 22. As Charlie Zvibleman points out in a tweet on the same thread, for the most part, it’s likely that most of California voters do not know what Prop 22 is.

The Uphill Battle for ‘Yes’ on Prop 22

On The Road to Autonomy podcast, host Grayson Brulte focused on Prop 22 and had a conversation with Mike Murphy, a political strategist and co-host of Hacks on Taps.

Murphy said:

“This has been an interesting case study with Prop 22, which of course is the gig worker bill. [California] is a Democratic state. It’s almost a completely one party state now, which is never good from one party in my view, but particularly since I’m a conservative from the Democratic party. At least the non-Trump republican party would be better. The Labor Federation here, which is very powerful in the inside game in politics looked at all these workers and said why the hell aren’t they unionized?…So, AB5 started going. Because it’s a one-party state, if the Labor Union wants it, it’s got a lot of power.”

Murphy continued, “The challenge on 22 is, they have to get a ‘yes’ vote to blow up the law. Everybody in the initiative world knows vote ‘yes’ is harder to get than vote ‘no’. People like to vote ‘no’…vote ‘no’ campaigns are very persuasive.”

Overall, Murphy seems to believe that between Uber and Lyft (and others) throwing as much money at their initiative as they have paired with the effects of COVID-19, they might actually pull it off and pass Prop 22.

However, historically speaking, economic interest groups, such as those supporting Prop 22, that pour a lot of money into initiatives, often suggest to voters that the proposed legislation would not be in their (the voter’s) best interest, as explained in this policy paper by PPIC.

“Economic interests are less successful than citizen groups in passing initiatives. They devote few of their resources to support initiatives, and the initiatives they do support rarely pass. Gerber’s analysis of 31 ballot measures between 1988 and 1990 revealed that only 22 percent of initiatives backed by economic groups passed, in contrast to a 60 percent success rate for citizen-supported ballot measures.”

Why Does This Matter to Drivers Outside of California?

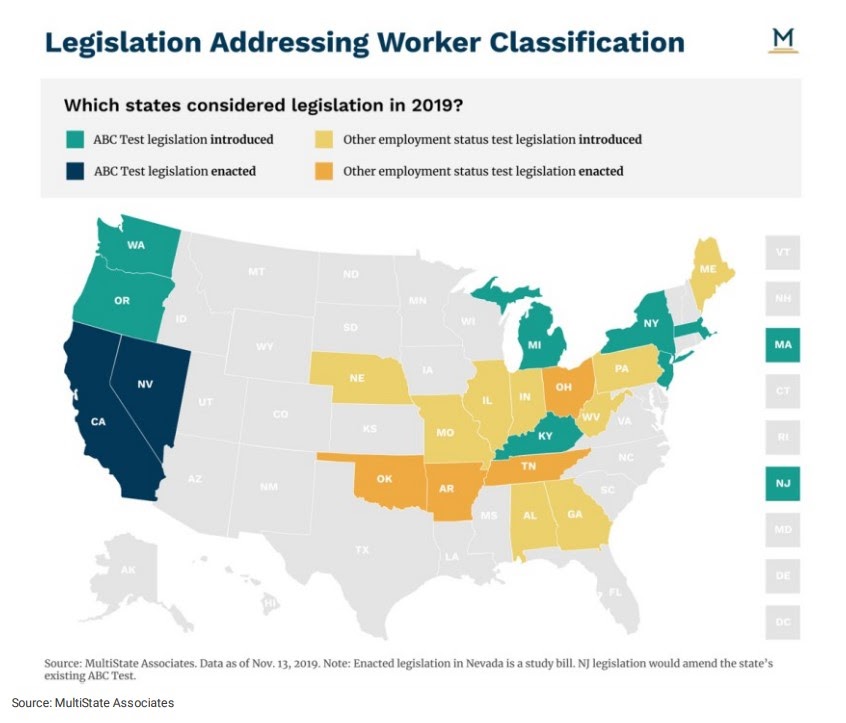

Other cities and states are considering similar legislation, which means laws or propositions like this could be coming to a city or state near you. Here are a few examples (there are more though):

- Massachusetts – In July 2020, Massachusetts filed a lawsuit against Uber and Lyft on the grounds of misclassification of drivers.

- New Jersey – In November 2019, New Jersey sued Uber for $659 million in unemployment and disability insurance taxes for misclassifying drivers as independent contractors. . In January 2020, New Jersey enacted five worker classification bills into law, increasing liability for companies misclassifying independent contractors. The state’s Department of Labor fined Uber $640 million in taxes and penalties as a result of alleged worker misclassification, although the company is challenging the decision.

- Texas – In June 2017, 19 drivers sued Uber on the grounds of being misclassified as independent contractors. We were unable to find an update on the status of this.

- New York – Governor Cuomo has created a Digital Marketplace Worker Classification Task Force to make recommendations for new gig labor laws

- Illinois – State Representative Guzzardi has announced his intent to introduce legislation similar to California’s AB5.

Many other local city councils and states are considering legislation. According to a report by Morgan Stanley in 2020, they believe the fate of California could set a precedent for other states. Take a look at the states considering or addressing worker classification below:

Basically, Morgan Stanley came to the conclusion that whatever happens regarding the outcome of Proposition 22 or AB5, it will create a blueprint for other states to follow.

It’s clear that the determination of the current issues in California could potentially open the doors for other states to follow suit.

Companies Behind the Prop 22 Ballot Initiative

Aside from Uber, Lyft, DoorDash, Instacart and Postmates, there are several organizations that support Prop 22.

Among those include the California-Hawaii State Conference NAACP, California State National Action Network, California Urban Partnership, California Chamber of Commerce, California Small Business Association, and a whole lot more here.

What Would Change if Proposition 22 Passes?

If Prop 22 passes this November, the biggest change is that drivers would start receiving benefits they had never received before, but not at the same level as employees.

Drivers would receive at least an amount equal to 120% of minimum wage for on app time plus 30 cents per mile compensation toward expenses. This would not limit how much money drivers can earn; this would just be the minimum. However, this would only be for active hours while they are driving a passenger, not all on-app time.

Drivers would also be given health care contributions equal to 100% of the average employer payment toward a Covered California plan. They would start earning this amount at 15 hours a week and reach the full benefit at 25 hours per week, from multiple platforms.

They would also receive occupational accident insurance (Uber already offers an injury protection plan though which is nearly identical), automobile accident and liability insurance and protection against discrimination and sexual harassment.

These are most benefits that drivers do not currently receive because they are independent contractors working for the gig companies. These benefits also vary a bit from those they would receive if Prop 22 did not pass and an employee model based on AB5 were to be enforced instead.

Arguments and Opposition to Prop 22

Those who oppose Prop 22 state that the proposed measure would continue to exploit workers for profit instead of allowing them the privileges and benefits as mandated by the law under AB5.

The opposition also states that Prop 22 would only require companies to pay drivers a minimum of $5.64 an hour, well under minimum wage, by only counting “engaged time” when drivers are actively online and working for the app companies.

The basis for their arguments against Prop 22 is mainly that Uber and Lyft are hiding the truth from voters about who benefits from the ballot measure; that the proposition only helps the companies, not the drivers. Which is very possible given the financial backing is mostly given by the gig app companies themselves. They clearly see something very profitable for themselves in the wording of Prop 22.

When Harry interviewed Nicole Moore of the drivers-centered group, Rideshare Drivers United, to talk about AB5, she pointed out a few things that are still relevant in our discussion of Prop 22. According to Moore, drivers are frustrated by a variety of issues when it comes to Uber and Lyft, like pay, the ability to contact Uber and Lyft, and protections for drivers. Moore said drivers don’t want to lose flexibility, they just want a ‘good standard of living.’

Who Has Financed the Campaigns For/Against the Proposition?

Total contributions in support of Prop 22 were at $111,157,335.82, as of August 21, 2020 reports, including $30.68 million from Lyft, Inc., $30.33 million from Uber Technologies, Inc., and $30.14 million from DoorDash, Inc. The opposition has raised only $1,981,590.62 in comparison, with the Transport Workers Union of America providing $500,000 of that.

The top five donors in support of Prop 22 are:

- Lyft, Inc.

- Uber Technologies, Inc.

- DoorDash, Inc.

- Maplebear Inc., DBA InstaCart

- Postmates Inc.

The top five donors in opposition to Prop 22 are:

- Transport Workers Union of America

- SEIU California State Council Issues Committee

- California Federation of Teachers COPE Prop/Ballot Committee

- Members’ Voice of the State Building and Construction Trades Council of California

- California State Council of Laborers Issues PAC

You can see more financial details on BallotPedia’s webpage about Prop 22.

How Does Prop 22 Relate to AB5?

In general, Prop 22 and AB5 are two sides of the same coin. They are mostly opposing forces; however, Prop 22 would likely not have come about if AB5 had not become a law.

AB5 mandates that employers classify their workers as employees as opposed to independent contractors if they cannot pass the A, B, C test:

- (A) that the worker is free from the control and direction of the hirer in connection with the performance of the work, both under the contract for the performance of such work and in fact.

- (B) that the worker performs work that is outside the usual course of the hiring entity’s business

- (C) that the worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed for the hiring entity.

Employers can only call workers independent contractors if all of the above are true.

AB5 does not come out and say specific language for gig workers and rideshare, which is one reason why companies have been able to avoid following it thus far.

Prop 22 is proposing a new law that has language specifically addressing rideshare and gig economy companies and how they can classify their workers in relation to AB5 legislation.

How Do Gig Workers Differ from Employees?

In a nutshell? Flexibility and lack of benefits.

Gig workers choose when they want to work. They have the ability to turn their app on when they are ready to start their day and turn it off to take a break or to be done working, even if it’s only 5 minutes after turning it on.

Gig workers are typically able to cash out their earnings to get paid immediately instead of waiting for the weekly paycheck to come through.

They are typically driving their own vehicles and therefore covering expenses that go along with owning a vehicle such as gas, maintenance, and even cleaning expenses.

Gig workers are also typically in charge of making sure they have the proper insurance needed for their jobs as well as covering their own health insurance. If they want a day off of work, they simply do not log into the app that day. There is no paid time off or sick pay if something keeps them from working.

Employees, on the other hand, would be more likely to be told or regulated when they can go online or have a limited number of hours allowed on the apps—limited in as far as not being allowed to work overtime. As it stands, gig workers are only allowed on one app for up to 12 hours in a row so they are forced off in order to get rest.

There’s nothing in the text of AB5 that would require drivers as employees to work scheduled shifts but the reality is that if drivers are paid more, receive guaranteed wages and benefits, it just isn’t realistic that they could still log on wherever or whenever. A few examples to point out:

- NYC’s Quasi Minimum Wage – NYC is the perfect case study for the potential downsides of an employee model. Drivers in NYC are guaranteed per mile and per minute rates that equate to a minimum wage determined by the city. This is great for drivers but it means that Uber and Lyft need their drivers to stay busy, otherwise they have to pay the difference. So they now require drivers to schedule blocks in advance and the priority is determined off seniority, rating, etc. Most drivers hate this new system but you can see how Uber and Lyft have to have some control over scheduling if they are required to pay a minimum wage. The question is, ‘is it worth it?’

- Delivery companies – Most delivery companies like Doordash and Instacart have predictable peak demand times so they require drivers to book shifts in advance. This has been the setup since day one so although there are some complaints, drivers are used to it and it highlights the challenge in going from the current Uber ‘log in whenever you want’ model to a more rigid ‘scheduling system’. Even though, it aligns interests, it’s hard to take away the flexibility that drivers once had.

Employees are also afforded certain benefits under the law depending on if they are part-time or full-time workers. Benefits may include health insurance or coverage; paid time off or sick pay; and other such benefits.

Ultimately, there are a lot of unknowns when it comes to what will happen if drivers become employees. Most likely though, drivers will lose some flexibility, there will be less drivers, but those remaining on average will make more.

Why Do Gig Companies Support Proposition 22?

One big reason that gig companies like Uber and Lyft support Prop 22 is because of money. Obviously businesses need to do what’s best for their bottom line and “hiring” all of their current independent contractors as employees is not feasible.

The CEO of Uber, Dara Khosrowshahi admitted during Harry’s interview that “There are going to be trade offs. I think that people are going to opt-in to their own preferences.” You can watch Harry’s interview with the Uber CEO here:

“What we will absolutely commit to is to be transparent about your earning expectations,” said Khosrowshahi during the interview.

In the past transparency has been an issue, where drivers don’t know what their potential earnings could be. Uber’s CEO wants to be more transparent moving forward when it comes to earnings and those expectations.

Changing drivers to becoming employees would take a complete overhaul of their business structure as it stands now, and there likely wouldn’t be room for everyone in the event of a transition.

Khosrowshahi also mentioned in a recent article, “Uber’s response would be to limit the number of drivers allowed on its platform and to raise prices for customers after it eventually relaunches in the state. He predicted that upwards of 80 percent of those drivers who only log onto the app for 5-10 a week would no longer be able to earn on the platform.”

That is a huge impact in the negative direction if Prop 22 does not pass and AB5 is enforced in its current state.

On Lyft’s website, after threatening to close their doors if made to follow AB5 in August 2020, the Co-founders John Zimmer and Logan Green stated, “Our goal is still to give you benefits that do not limit your independence or choice of work.”

They also stated that the progress of being able to continue services for now is just temporary and that in order to maintain operations, “it’s up to the voters to decide the future of rideshare in California in November with Prop 22.”

California Contributors Respond to Prop 22

We asked Harry and a couple of our other contributors in California what they thought about Prop 22:

Harry is a no on Prop 22, stating that:

“I’ve been against AB5 from the get go, because the majority of drivers want to remain independent contractors. And I think it’s more important to do what’s best for the largest number of drivers.

But when it comes to Prop 22, I’m also a no because I don’t think it goes far enough. Uber and Lyft have their backs up against the wall right now and their ‘compromise’ is a joke. Their ‘minimum wage’ only includes on app time so it doesn’t align incentives between drivers and the companies. So if the companies flood the app with drivers and you don’t get any rides, the minimum wage is useless. And there’s no bargaining or structural aspect that prevents them from giving drivers benefits and then just lowering rates in the future.”

One of our senior contributors, Jay Cradeur, has some specific thoughts concerning Prop 22:

“I don’t like surrendering my future to Uber or Lyft. In the past 4 years, they have consistently cut rates, bonuses and surge. Prop 22 gives Uber and Lyft what they want and that, in my experience, is good for Uber and Lyft but BAD for drivers. I would rather roll the dice and see what Uber and Lyft look like with drivers as employees. I honestly don’t know which is better for drivers, but given Uber and Lyft’s enthusiasm for Prop 22, that must mean more money for them and less money for drivers.”

Another California driver and fellow Senior Contributor Gabe Ets-Hokin has another take. He’s definitely against Prop 22, but also doesn’t believe that an employee model is the way to go. Instead he offers a suggestion:

“The main thing I want people to understand is that AB5 is not really a law. All it does is codify existing law. It doesn’t create anything. It doesn’t order Uber and Lyft to hire drivers as employees. All it does is say this is what an employee is and this is what an independent contractor is…The solution is for Uber and Lyft to adjust their business model so that we’re independent contractors. I could tell them how to do it in 5 minutes. It’s easy.”

Whether you’re a California driver or not, what do you think about this proposition? Let us know in the comments below and we’ll add it here.

Our RSG YouTube contributor, Cecily, has said regarding AB5/Uber and Lyft’s threat to leave California that it may be time for a complete change. Whether that’s a new rideshare company or a fundamental change in how Uber/Lyft interact with their drivers, it’s important that Uber and Lyft listen to drivers, instead of spending millions to force them to accept Proposition 22.

Our Position

Prop 22 is a means to an end, to put it bluntly. It’s there to define what hasn’t been defined properly and to close a hole so lawmakers cannot go after the gig companies taking advantage of the ambiguity of the language in AB5.

Does that mean it won’t work? Does that mean it’s bad or good for the drivers? Honestly, no one has a crystal ball to read the future, but neither seem to really keep the drivers wants and needs at the top of the importance column.

As an outsider (not in California), I think Prop 22 has more merit and looks after the drivers more than AB5 does (though AB5 does not specify that companies cannot allow flexibility to their employees, which is something the majority of drivers want to maintain). But, I do like Gabe’s take on how it would all actually be solved quite easily if Uber and Lyft shifted their business model to reflect drivers as true independent contractors as defined by law. Our survey data shows that most drivers want to remain Independent Contractors but the big caveat is that they want to be actually independent – and as any driver can tell you, Uber does not make that easy.

As far as implementing AB5 goes, if the CEO of Uber is already stating that he can’t hire every independent contractor as an employee, that’s a big problem.

What’s even more concerning is the sheer number of drivers who would be permanently off the platforms—up to 80% according to Khosrowshahi. I wouldn’t want to roll the dice and see if I was magically one of the 20% allowed to remain on the platform.

There is also the possibility that California will start to look more and more like New York City. In New York City, drivers are paid a minimum wage, but it’s not all ‘high earnings and driving when you want’. If there are too many drivers on the platform in an area that doesn’t have enough demand, some drivers are kicked off and not allowed to earn anything until the tides shift or until they move to a busier area of the city.

No matter the outcome in November, I’m not looking forward to seeing what’s in store for rideshare drivers. I hope for the best.

Drivers, what do you think about Proposition 22? Do you support it or not?

-Paula @ RSG