As rideshare drivers, income and expenses is fairly easy. Uber and Lyft pay you, you track your expenses, like mileage, with a mileage tracking app like Stride, and at the end of the year, you use a tax prep software program like TurboTax to pull it all together.

But what happens when you’re planning your life after rideshare? What if you want to become a Dumpling delivery driver, a courier for DoorDash, a blogger, or make money in a variety of other ways?

It’s time for some serious, yet simple, accounting software. That’s why we’ve decided to review Freshbooks! RSG contributor Chonce Maddox-Rhea shares her Freshbooks review below and covers how she’s saved thousands of dollars using Freshbooks and how it can work for you.

In 2015, I was freelancing on the side and didn’t really organize my payments or expenses for that manner. When tax time rolled around, I was completely overwhelmed and confused. I started using Freshbooks in 2016 and have been using it ever since.

Using Freshbooks has saved me a lot of time and money over the years. The average bookkeeper charges $20 – $50 per hourly and some charge a minimum of $100 – $150 per month. It takes me less than an hour to use Freshbooks each month so it’s definitely been a crucial tool for me as an independent contractor all around.

I’ve saved anywhere from $1,000 to $7,200 in accountant fees by using Freshbooks – and you can too, depending on how much the average cost of accountants in your area is!

If you’re thinking of starting a rideshare or courier business (you can deliver food and items to people especially those who may not be able to get out as often), Freshbooks could be a great tool to help you send invoices and keep track of payments and expenses.

In this Freshbooks review, I’ll break down all the features of this tool so you can more bang for your buck if you decide to use it.

Quick links:

- Sign up with Freshbooks here

- Learn more about rideshare taxes

- Track your mileage with our favorite mileage app, Stride

This page contains references to codes and links that earn The Rideshare Guy a commission when used. Please see our affiliate policy here for more information.

What is Freshbooks?

What is Freshbooks?

Freshbooks is an all-in-one small business invoicing and accounting solution for freelancers, independent contractors, small business owners, and teams.

Let’s face it, when you’re just getting started with offering a freelance contract service, your main priority is likely related to doing the work and making money.

You shouldn’t have to be an accountant in order to make money flexibly as a contractor. This is why I like how Freshbooks makes it easy by providing a variety of features to help you get paid faster, manage your expenses, and more with very little effort.

I’ll go more into detail on Freshbooks’ features in this Freshbooks review, but I highlight some of the pros and cons:

Freshbooks Review: Pros and Cons

Pros:

- Easy to navigate (a little more user-friendly than Quickbooks)

- Affordable pricing options

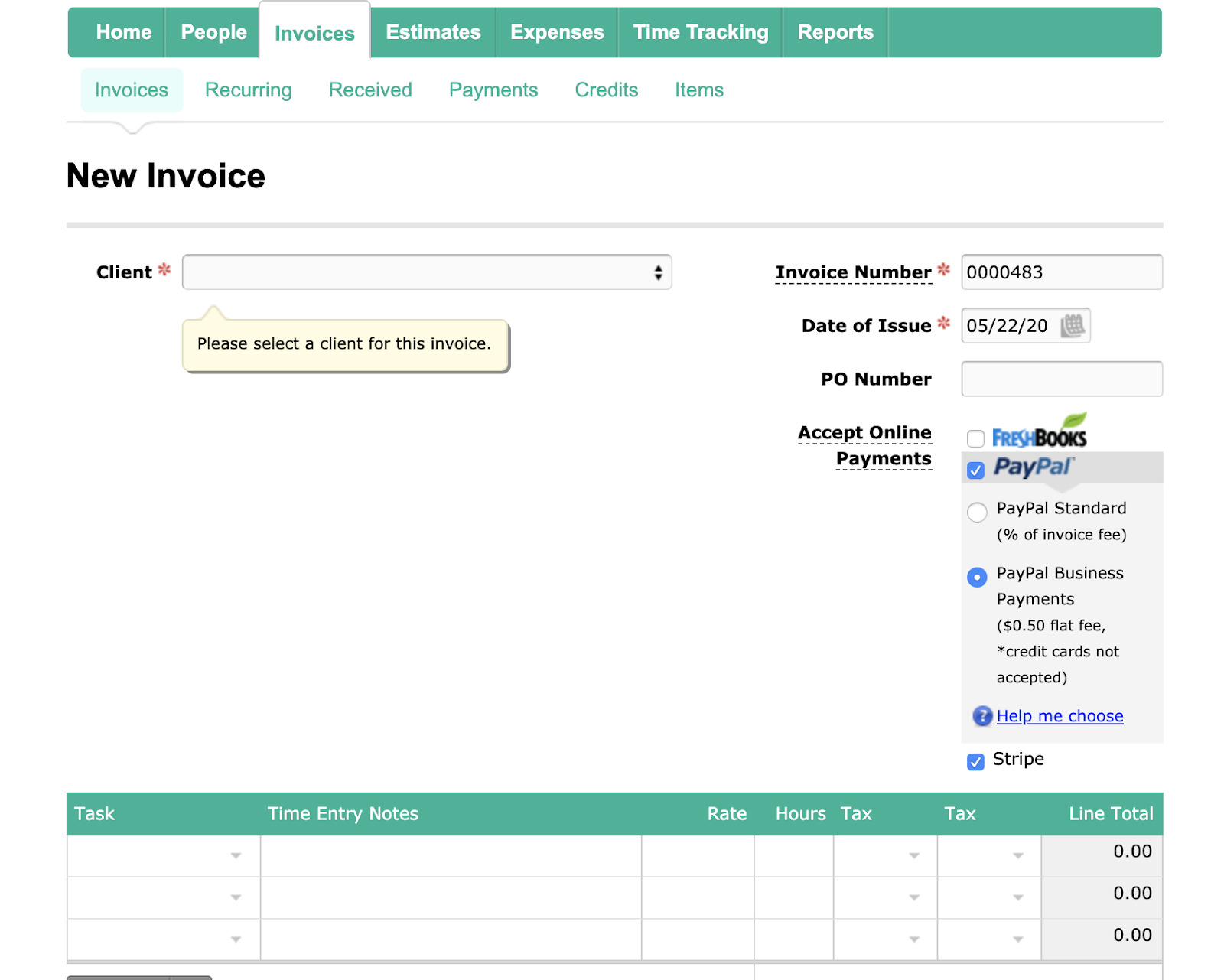

- Ability to accept payments via PayPal or credit or debit card payments through Stripe

- Save money on PayPal fees (Freshbooks only charges $0.50 per transaction when clients pay you via PayPal)

- No software to download (Freshbooks is completely web-based)

- Mobile app option

Cons:

- Not as easy to track mileage if you don’t have Mile IQ

- Not the best option for larger companies or businesses

How Does Freshbooks Work?

Freshbooks Features: Invoicing

Almost every Freshbooks review will point out how Freshbooks is well known for their invoicing features, which allows you to create professional looking invoices that can even be personalized with your name and a logo.

Invoices allow you to easily accept a variety of payments in the U.S. and get paid up to 11 days faster on average. Payments can be set up to go directly to your checking account or PayPal account. You can also:

- Add due dates to invoices

- Ask for a percentage of the payment upfront

- Offer a discount

- Automatically calculate taxes

- Set up recurring invoices if you need to bill clients regularly

- Set late fees to encourage clients to pay on-time

- Invoice from the Freshbooks mobile app on the go

Another feature that I liked about Freshbooks’ during my review is that you can see when a client views your invoice. Clients will also get automatic reminders to pay your invoices so you don’t have to worry about following up all the time.

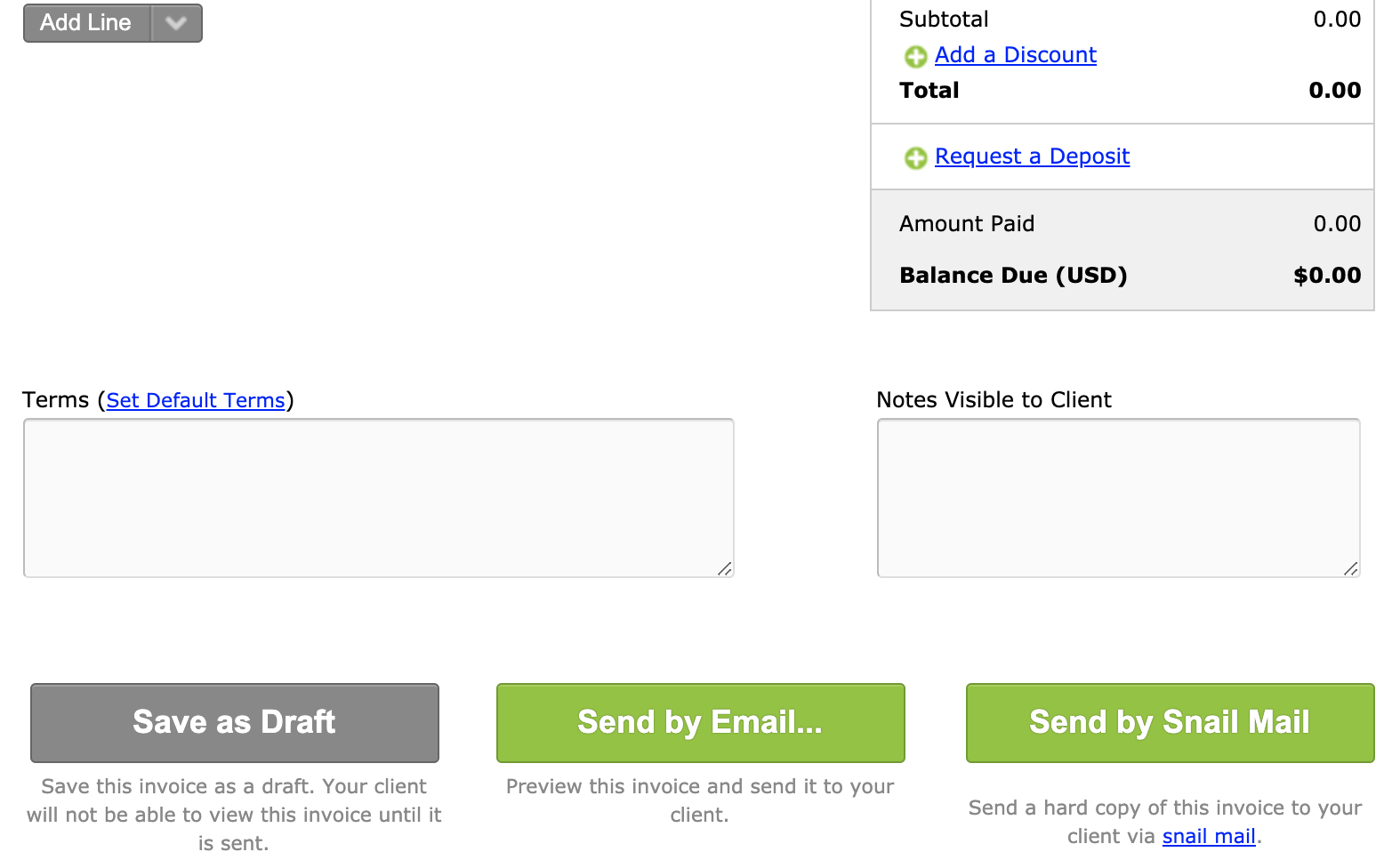

Start by creating new clients by adding their name, company, and email to send the invoice to. Then, click ‘create new invoice’ and fill in the fields.

You can pre-set specific tasks you’d like to bill for and also add notes and other terms.

You can pre-set specific tasks you’d like to bill for and also add notes and other terms.

Freshbooks Review: Tracking Mileage and Expenses

Freshbooks will automatically connect to your bank or you can track expenses manually.

Another feature that I like about this section is that you can choose to convert some expenses to an invoice.

This may come in handy if someone says you can get reimbursed for your expenses and you want to bill them for it quickly.

Time and Mileage Tracking

No Freshbooks review for rideshare drivers would be complete without talking about mileage tracking!

Track your time spent on certain tasks with Freshbooks, especially if you can bill for it later. As a rideshare or food delivery driver, you can track your mileage as well. There are a few ways to do this. The first option would be to add your mileage in manually under the expenses section.

Or, if you have MileIQ, it can integrate with Freshbooks to submit your miles so your mileage, income, and expenses can all be tracked in the same place.

With Mile IQ just follow these steps in the app:

- Click the green “Report” button on the bottom right of the drive pane

- Choose FreshBooks from the list of report options

- Add a one-time time account authorization with your FreshBooks account. Enter your subdomain (youraccount.freshbooks.com) and click “Authorize FreshBooks”

- Sign in to your FreshBooks account.

- Click the “Allow Access” button.

- You will now be able to submit drives and mileage reports to FreshBooks

Payments

Freshbooks allows you to accept credit card payments online so you won’t have to worry about the hassle of dealing with paper checks. That was one of the best features I found during this Freshbooks review.

This could come in handy if you’re considering starting your own private rideshare or delivery service. All your payments will be recorded in one place and you can track your income from month to month.

Reporting At Tax Time

Since you can track mostly all your income, expenses, and mileage in one place, Freshbooks is great for accounting and figuring out your taxes. You’ll get a complete record of all your financial accounts, transactions along with a profit-loss statement.

This makes it easy to upload your finances to any tax filing software you’re using or simply send it to your CPA. Not sure how to figure out your freelancer taxes? Take a look at our comprehensive rideshare taxes guide!

Third-Party App Integrations

During our review of Freshbooks we integrated it with a ton of other apps and programs including Stride, G Suite, PayPal and more. Other integrations include:

- Gusto (payroll)

- Stripe (accept payments – maybe for snack packs or other things you sell in your car or at farmers markets!)

- Boomr (time tracking app, perfect for freelance writers or other online jobs)

Mobile Apps

Freshbooks is convenient, and you can use it on the go. Just download the app for iOS or Android and you’ll be able to accept payments and send invoices.

Freshbooks vs. Quickbooks

Quickbooks is another tool you can use to track payments, mileage, and send invoices. Freshbooks and Quickbooks have similar features and price points, but Quickbooks does provide a few more advanced accounting tools and tax reporting integrations, and automations.

Not sure how Quickbooks works? Check out our guide: How to Set Up Quickbooks.

Some people who have switched from Quickbooks to Freshbooks say Freshbooks is much more user-friendly and easier to navigate.

Overall, our review of Freshbooks shows that it is designed for self-employed professionals and service-based contractors, while Quickbooks is catered more toward product-based small businesses.

Freshbooks vs. Xero

Xero is a leading alternative to both Freshbooks and Quickbooks. Xero is a little more affordable than Freshbooks but offers smaller plans so you’d be allowed fewer transactions with the most basic plan.

Xero provides some of the basic capabilities of Freshbooks that we reviewed but it also provides additional features for bank reconciliation, inventory, and purchase ordering which would be more suitable for someone with a product-based business.

However, if you’re mainly offering services as a contractor, Freshbooks provides plenty of features and capabilities to choose from.

Freshbooks Pricing

You can get started on Freshbooks for as little as $15 per month. Right now, all their packages are 60% off, which makes their lowest package just $6 per month.

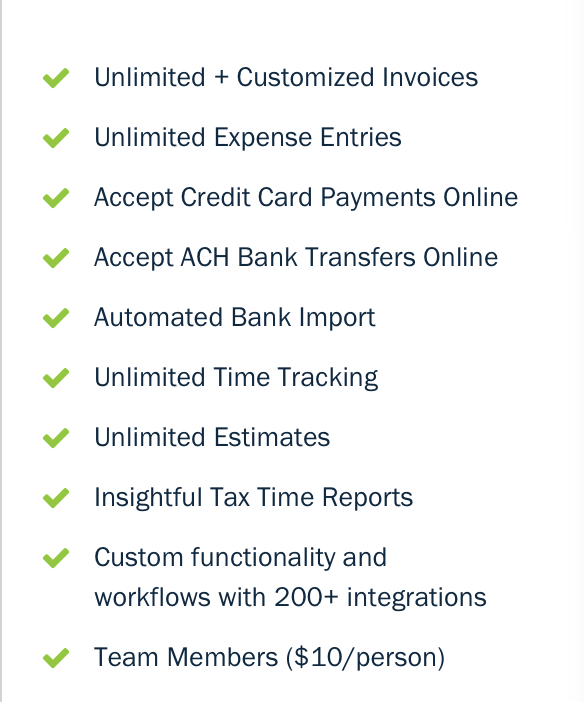

For the basic ‘Lite’ plan, you can bill up to 5 clients and send unlimited customized invoices. There’s also unlimited time tracking and tax-time reports. Here’s a summary of what you’d get:

The next plan tier is Plus, which is $25 per month and allows you to bill up to 50 clients.

The Premium plan starts at $50 per month and allows you to bill up to 500 clients.

As a small contractor, you will likely only need the Lite plan, which is the one I’ve been using since I started using Freshbooks.

If you don’t want to pay monthly, you can save 10% by paying annually. You can also try any of the plans for free for 30 days.

Summary: Our Freshbooks Review in 2020

During our Freshbooks review we found it to be a flexible tool that provides an easy way to send invoices, track expenses, and set up your own accounting all in one place. It’s budget-friendly and easy to use even if you’re not tech savvy.

Plus, I like that there’s an app version. Overall, I’ve been a happy Freshbooks customer for the last 4 years. It’s an excellent option for invoicing and accounting, especially if you decide to pursue some of the best gig jobs out there.

Readers, do you use online accounting software? If so, which one? If not, what questions do you have about Freshbooks? What is your review of Freshbooks?

-Chonce @ RSG

Quick links:

- Sign up with Freshbooks here

- Learn more about rideshare taxes

- Track your mileage with our favorite mileage app, Stride